Stock market snapshot as of [25/4/2019 2:53 PM]

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

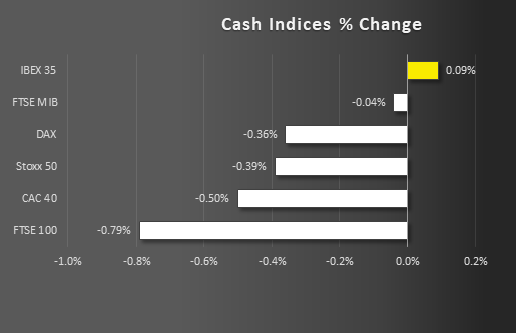

- European shares are extending a malaise linked to earnings and signs that Beijing largesse may soon be curtailed

- Major indices fail to pick up the baton despite bumper overnight earnings from Microsoft and Facebook

Corporate News

- The tech slump on this side of the Atlantic can mostly be pegged on Nokia’s disappointing quarter. It’s shares trade 8% lower

- Contrast that with near-blockbuster earnings from Microsoft and Facebook, reaffirming U.S. tech sector resilience ahead of Amazon and Alphabet reports tonight and Monday

- Still, a divide is appearing between ‘value’ and ‘growth’ shares, as 3M Co posts a weak outlook similar to Caterpillar’s, on Wednesday. The office equipment group’s shares fall 6%

- The Nasdaq 100 rises 0.7% whilst the Dow falls 0.8

Upcoming corporate highlights

|

Date |

Time |

Company |

Event Name |

|

25-Apr-2019 |

AMC |

Starbucks Corp |

Q2 2019 Starbucks Corp Earnings Release |

|

25-Apr-2019 |

AMC |

Amazon.com Inc |

Q1 2019 Amazon.com Inc Earnings Release |

|

25-Apr-2019 |

AMC |

Ford Motor Co |

Q1 2019 Ford Motor Co Earnings Release |

|

25-Apr-2019 |

AMC |

Mattel Inc |

Q1 2019 Mattel Inc Earnings Release |

|

25-Apr-2019 |

AMC |

Intel Corp |

Q1 2019 Intel Corp Earnings Release |

|

26-Apr-2019 |

AMC |

Juniper Networks Inc |

Q1 2019 Juniper Networks Inc Earnings Release |

|

26-Apr-2019 |

13:00 |

Exxon Mobil Corp |

Q1 2019 Exxon Mobil Corp Earnings Release |

AMC: after market close

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM