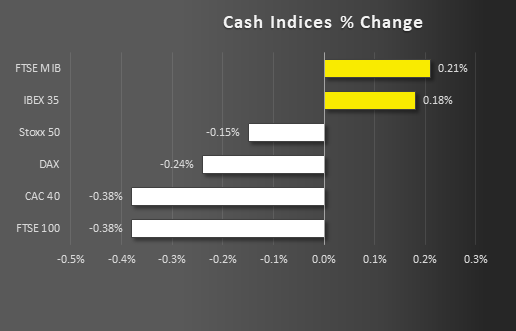

Stock market snapshot as of [30/4/2019 2:26 PM]

- Northern-hemisphere stock market sessions are moderating the impact of disappointing Chinese manufacturing data considerably, with help from firm earnings and rebounding oil prices

- Saudi Arabia’s signal that it might—in effect—pretend it hadn’t heard last week’s demand from U.S. President Donald Trump for lower prices, sends WTI contracts up 2%

- The regional STOXX gauge remains soft, though the largest country indices are only mildly lower

- Wall Street futures are mixed, with Nasdaq pinned in the red by Alphabet’s surprise revenue miss overnight. Dow futures are some 40-odd points higher; S&P contract down 2 points

Corporate News

- BP continues the oil theme after its earnings clearly beat the performance of Exxon and Chevron, which reported last week. Strong cash flow and a contained fall in refining margins enabled the UK producer’s shares to rise 1.8% just now

- The U.S. technology sector is the main source of downside pressure after a sharp ‘after-hours’ reversal of Alphabet shares in reaction to quarterly results

- Alphabet’s surprising revenue miss dragged the stock 7% off Monday’s new record high. Still, with Google’s weakening advertising sales growth looking like a function of rising competition from Amazon, Facebook and others, the net impact on the stock market may be buffered

Upcoming corporate highlights

AMC: after market close

Upcoming economic highlights

Latest market news

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM