Stock market snapshot as of [14/5/2019 2:45 PM]

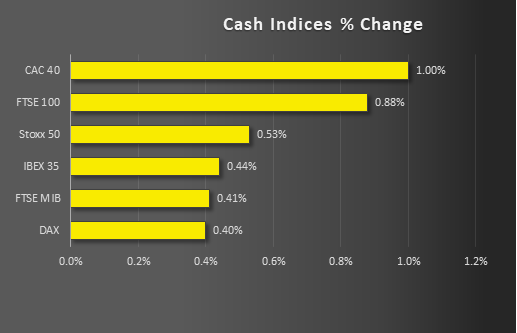

- Volatile gyrations require markets to go up as well as down; Tuesday brings the upswing

- Nobody believes tariff turmoil is done; it would be difficult to do so given Washington’s signal that a further barrage of new 25% duties on $300bn of Chinese goods is in the works

- Partly on a perceived discount following recent selling; partly on residual optimism about potentially “very successful” talks in the near term, risk appetite is making what is likely to be a relatively short-lived reappearance

- Treasuries stabilise, the dollar advances; removing some of the chill from the safe-haven yen’s recent rally; oil remains buoyed by further murky incidents involving Saudi Arabian oil assets

- Bitcoin rises to $8,000, extending a winning streak to the longest since 2013, and remaining as decoupled from conventional news flow as ever

Corporate News

- Resurgent upside momentum also drowns out the reality of further unsatisfactory earnings from European heavyweights. Even after reporting its second consecutive multibillion euro annual loss, missing revenue forecasts and slashing its dividend 40%, Vodafone shares managed to advance almost 5%. But they only erased Monday’s slump of a similar magnitude temporarily, eventually trading 3% lower. The hope is that reduced pay outs will leave more cash available for 5G, retaining market share, though flawless execution will be needed

- Possible U.S. standout stocks include AbbVie, after Boehringer Ingelheim agreed to pay royalties to the larger group for licensing arthritis drug HUMIRA

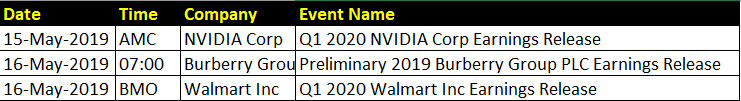

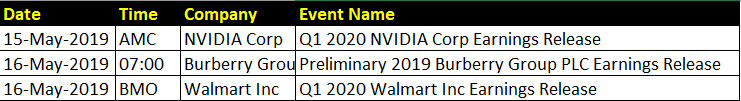

Upcoming corporate highlights

BMO: before market open AMC: after market close

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM