Stock market snapshot as of [7/6/2019 4:31 PM]

- In one of the surest signs yet that markets and the economy are ending one era and (re)entering another, bad news is good news once again

- For the second time in three months, non-farm payrolls missed badly, coming in at 75,000 in May against 175,000 forecast, according to a consensus compiled by Bloomberg. Earnings growth also dipped vs. expectations, rising 0.2% month-to-month instead of 0.3% foreseen; payrolls over the prior two months were revised down by 75,000

- It’s worth noting that forecasts had been sliding all week as data points that typically accompany the official figures disappointed. The fact that the headline print was lower still, shows the extent to which the swing caught markets off-side

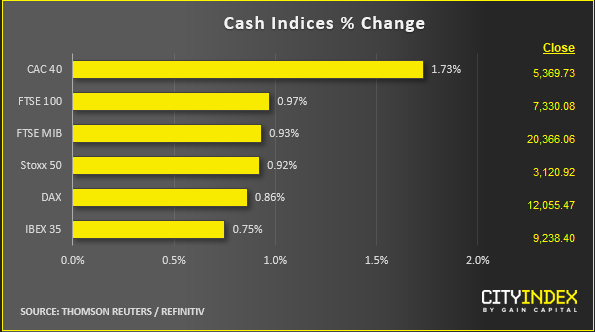

- Yet after a fairly brief dip in risk appetite, several large global indices are set for their best one-day rise of the month so far

- Friday’s U.S. jobs figures are juxtaposed against the heads of three major central banks this week reaffirming a willingness to act (or act again, in the RBA's case)

- As such, investors now expect any confirmed economic downturn to be salved by easing

Corporate News

- Signs abound that reinvigorated sentiment is super-charging bullish stock-specific news

- Beyond Meat stars again after full-year net revenue guidance crushed Wall Street views; the recently listed group surges around 30%

- Another market newcomer, Zoom Video leaps 20% after also topping investors’ annual expectations

- One of the earliest Amazon victims, Barnes & Noble (which owns Britain’s Waterstones) rises 11% as it seals a deal to be bought by private equity group Elliott

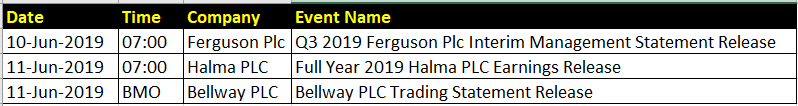

Upcoming corporate highlights

BMO: before market open

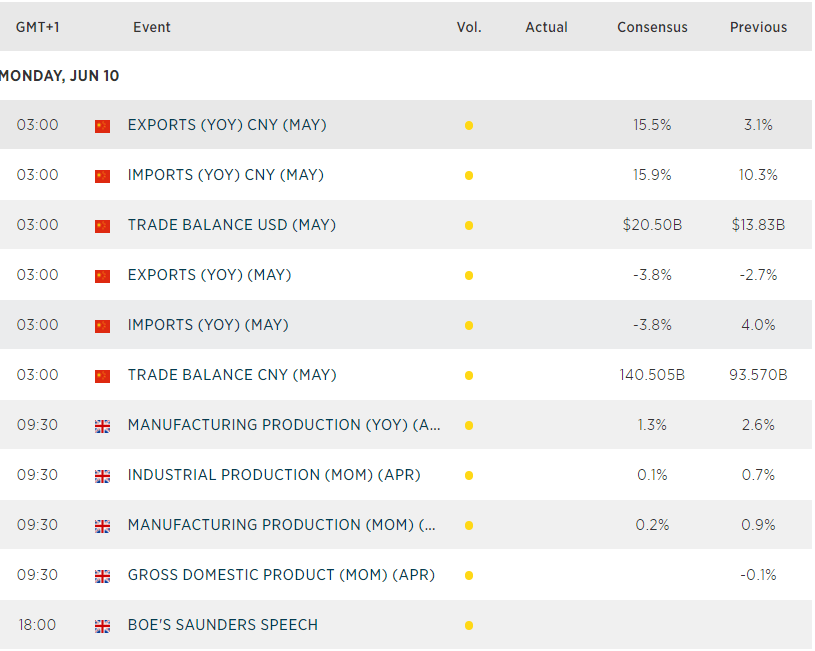

Upcoming economic highlights

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM