Stock market snapshot as of [10/6/2019 3:02 PM]

- Whether the ‘Mexican standoff’ was real or fake, as insinuated by many high-profile commentators, the market reaction shows unalloyed relief

- European, emerging-market and U.S. exchanges are following the strong lead of Hong Kong’s Hang Seng, (+2.3%), China’s CSI 300, Korea’s KOSPI and Japan’s Nikkei (all up 1% and a bit). Sovereign bonds, gold and yen safe havens are on the retreat

- U.S. 10-, 5- and 2-year Treasurys are caught in the downdraft against ‘low-risk’ assets, helping the benchmark yield pull away from last week’s almost two-year low of 2.05% to stand around 2.12%

- Mexico’s peso is leading EMFX, but a swell is catching certain other currencies in that category too, whilst the dollar is also rising. A pointed exception is the yuan

- China’s currency is continuing to soften in an atypical move given the ‘risk-on’ context. Traders continue to challenge renminbi rates after the PBOC governor last week denied the existence of a widely perceived 7-yuan line in the sand

- Inevitably, markets will have to re-think Monday’s assiduously milked cheer at some point soon; next weekend’s meeting of G20 leaders, including U.S. President Trump and China’s President Xi may be an inflection point

- With pivotal indices like the S&P 500 trading fairly neutral relative to chart technical indications like 14- or even 30-day RSI, investors may well err on the side of an underlying tailwind till later in the week

Corporate News

- In Europe, investors are particularly snapping up banks, the objectively hardest hit sector of the year, for reasons not exclusively linked to tariffs and trade. This gives the return of positive sentiment a non-specific and broad character that may become more discriminate in coming sessions

- China-focused HSBC leads European heavyweights, with Lloyds Banking Group, Barclays, Spain’s Santander and France’s BNP Paribas also notable gainers

- Mining and steel stocks are also among the best performers in another tie to China

- However, as if to underscore that trade disputes remain almost totally unresolved; technology hardware and chip shares are underperforming in Europe

- Bank shares are also near the front on Wall Street, though leaders there also have a broadly industrial flavour, including transportation, as UPS and FedEx firmly rebound

- U.S. techs aren’t tardy. Shares in hardware, software, web groups and more enjoy the tailwind. Weather-beaten FANG stocks, Twitter and TripAdvisor also attract strong buying interest

- Raytheon shares are only rising modestly though. Deal-partner United Technologies’ are actually slipping. The moves may highlight scepticism about the merits or even viability of their deal…not just the doubts voiced by U.S. President Trump. Washington scrutiny looks almost inevitable given that the $100bn-plus tie-up will create the U.S. Department of Defense’s biggest single contractor after Lockheed

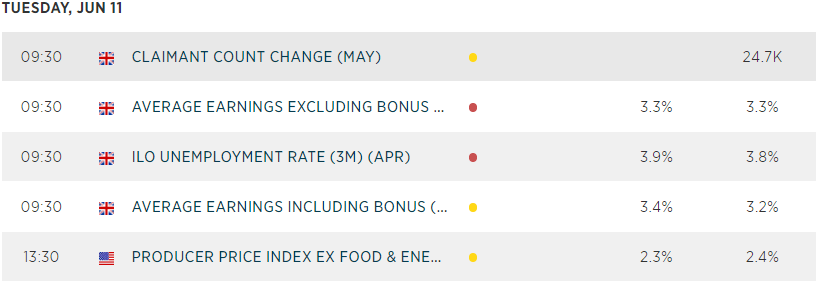

Upcoming economic highlights

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM