Stock market snapshot as of [29/5/2019 2:06 PM]

- There are major questions about the effectiveness and sustainability of a possible move by Beijing to restrict rare earth exports, as claimed by China’s state-controlled Global Times newspaper

- Nonetheless, European stock markets are flirting with March lows as the broad STOXX gauge drops as much as 1.5%

- Read why 'Rare earths should be on your radar screen' by City Index's Chief Technical Strategist, Asia, Kelvin Wong

- That investors are taking no chances demonstrates that a higher level of underlying risk aversion now prevails than earlier in the year

- Technical chart aspects in U.S. indices are also keeping investors nerves elevated. With S&P 500 mini futures trading down about a tenth of a percentage point at 2785 a short while ago, the S&P 500 is poised to open under the ‘psychological' level of 2800, where support has been frequently observed since late-March

- Loss of the pivotal price and approach to the closely-eyed 200-day moving average around 2775 promise to keep the market on tenterhooks and volatility on the boil

Corporate News

- Shares of China-dependent raw materials producers and those of technology hardware firms, which tend to have intricate global supply chains, continue to underperform. STOXX’s Mining & Metals sub-index was down 2.5% just now, among the weakest industrial sectors

- The IT index was close behind, with a 2.2% fall, as Tech Hardware, semiconductors and software components all contribute to the downside

- The mining and metals sector has another centre of gravity in steel giant ArcelorMittal which has tumbled as much as 7.3% to print a 25% year-to-date loss. The group will cut European production as it scrambles to tackle falling global demand and rising regional imports

- Satellite TV group ProSiebenSat.1 Media is among a handful of blue-chip bright spots as it joins a wave of broadcasters defending against Netflix incursion by consolidating. Silvio Berlusconi-controlled Mediaset has bought an almost 10% stake

- U.S. consumer shares are again in the spotlight as Michael Kors owner Capri heads 7% lower and Abercrombie & Fitch faces a 16% drop after disappointing quarterly releases

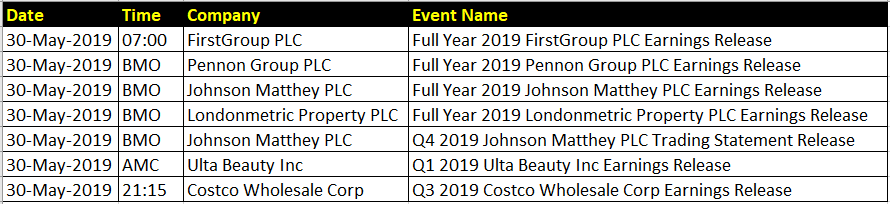

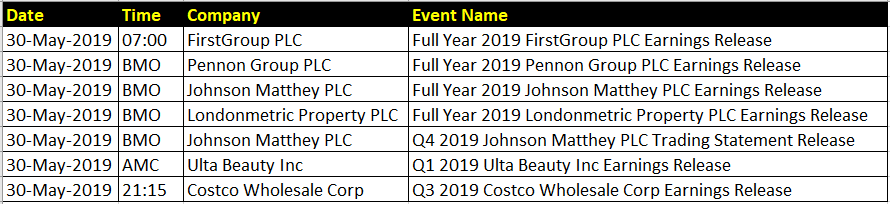

Upcoming corporate highlights

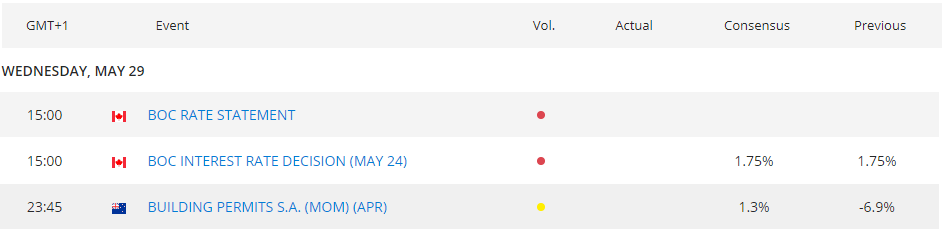

Upcoming economic highlights

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM