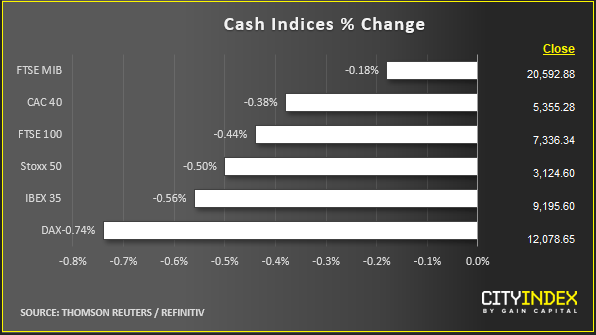

Stock market snapshot as of [14/6/2019 3:02 PM]

- Thursday’s oil-fuelled froth has dissipated into the end of the week. With so much uncertainty afoot, this isn’t a weekend to head into long

- Washington is now naming Iran as directly responsible for yesterday’s tanker attacks near the Gulf of Oman. Energy shares continue to get a lift off the back of still-buoyed crude-oil prices

- But perceptions that the risk of military conflict has increased have pushed investors to get real

- It’s notable that European shares remain largely weaker and U.S. indices opened to the downside despite a batch of promising U.S. economic data out ahead of Wall Street’s start

- Core Retail Sales beat forecasts and the last two months were revised higher, likely calling for upward reassessments of quarterly growth

- U.S Industrial and factory production was also firm/better than forecast

- A wary investor reaction to good economic news again points to an equity market focused on gauging the likelihood of Fed easing. Friday’s data push that possibility back a little

Corporate News

- The rise of utilities shares in Europe leaves little doubt of investors’ tilt with respect to risk appetite/aversion on Friday

- A firm consumer services sector is largely led by FTSE 100-listed Compass Group, the catering services and supply firm. Its shares rise 1% after it agreed a EUR475m acquisition, its biggest in about two decades, sparking hopes of exponential growth

- Some weight on the global chip sector can be attributed to Broadcom’s revenue downgrade after Thursday’s close. It cited a “broad-based slowdown…driven by geopolitical uncertainties” that reversed earlier expectations that profits would rise. The stock traded 6.7% lower a little earlier

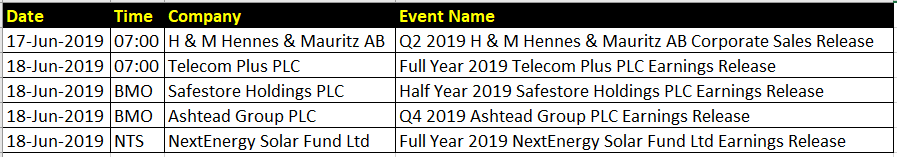

Upcoming corporate highlights

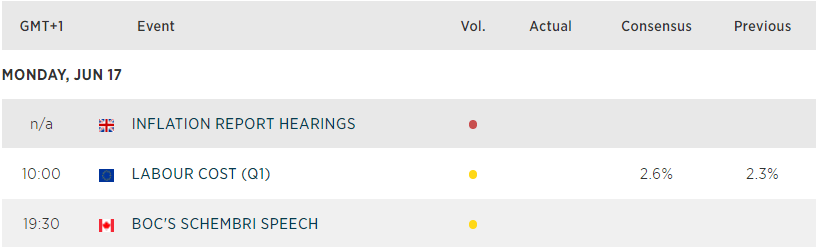

Upcoming economic highlights

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM