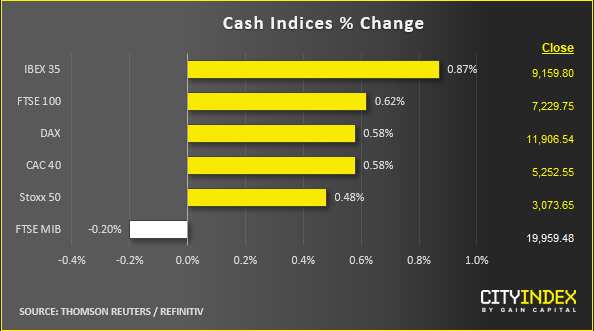

Stock market snapshot as of [30/5/2019 3:29 PM]

- The European stock market bounce was going so well before more ructions in Italy opened a fresh seam of negative sentiment

- Italy’s FTSE MIB has duly swung into the red and was down 0.3% at last look. It comes as Deputy Prime Minister Matteo Salvini resumes the Northern League’s antipathy with the European Union. He’s insisting he’d rather end the coalition government than backtrack on a plan to cut taxes for most Italians. That would probably move Rome even further away from EU fiscal prescriptions

- Most other large EU stock markets are off highs though still positive. It’s due to a combination of profit taking, oil shares tracking bullish inventory data and bank stocks

- Investors anticipate favourable details about the ECB’s new short-term lending programme when the central bank meets next week

- U.S. stock markets have opened firm, partly tracking a rebound in Treasury yields, with profit taking also seeping into that key safe-haven market after an eye-catching ramp of late, in step with dwindling risk appetite

- A firm print by the second assessment of U.S. GDP is also helping underpin U.S. shares. Year-on-year growth printed at 3.1% compared to a consensus compiled by Bloomberg of 3%

- As well, the weak core inflation component is being interpreted as likely to keep Fed policy on the backfoot – a de facto positive for risk assets

Corporate News

- U.S. car shares are among the sectors leading from the front. In itself, that tends to back the profit realisation thesis for the more optimistic look of Wall Street on Thursday

- Note MSCI’s global auto makers index is down about 2% since the beginning of the year

- Dollar General beats first-quarter estimates enabling shares of the discount retailer to surge 7%

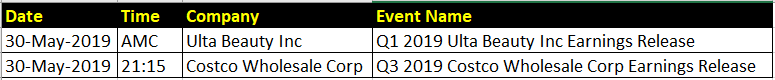

Upcoming corporate highlights

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM