Stock market snapshot as of [1/5/2019 2:40 PM]

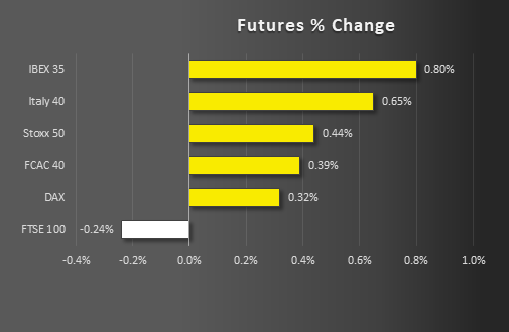

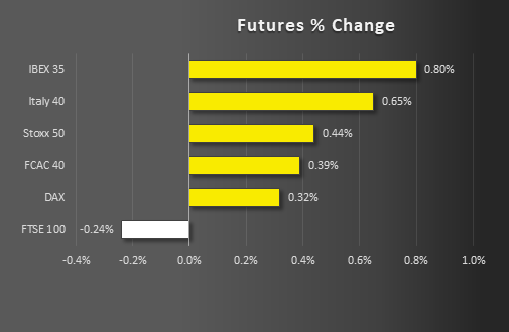

- With few exceptions, European stock markets are closed for labour holidays though participants remain interested enough to bid futures firmly higher

- Investors here are partly responding to another stellar set of U.S. technology sector earnings

- A huge beat by ADP’s unofficial curtain-raiser before Friday’s U.S. payrolls—275,000 when 175,000 were forecast—is another positive for markets to look forward to when they return on Thursday

- Wall Street is getting a similar boost, with Apple helping Nasdaq indices recover from Alphabet-induced declines, and the Dow to narrow the lag to the broader market’s gains

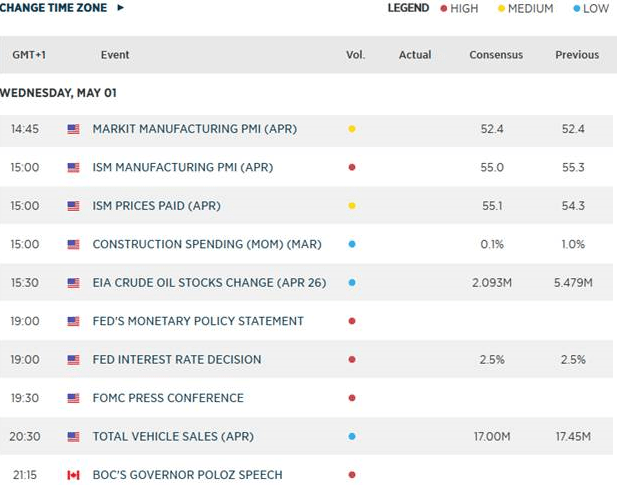

- The main event ahead is the Federal Reserve’s policy statement and press conference. Markets clearly expect the Fed to remain ‘patient’. This would maintain a benign back drop for risk appetite

Corporate News

- Apple’s surprise projection of a muscular rebound in third quarter revenues is in focus, particularly after Q2 sales and profits also beat Wall Street’s view

- With Apple shares rising sharply, despite a more than 40% ascent into Tuesday’s close, investors appear to be anticipating signs of a stabilisation in iPhone sales

- Earnings beats from Big Pharma groups Merck and Pfizer help repair Dow Jones Industrial Average underpinnings and of the 'value' side of the street in general

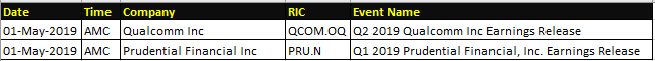

Upcoming corporate highlights

AMC: after market close

Upcoming economic highlights

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM