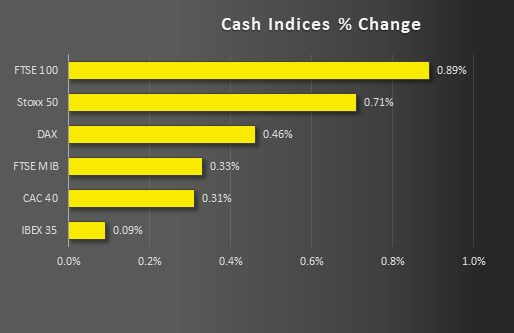

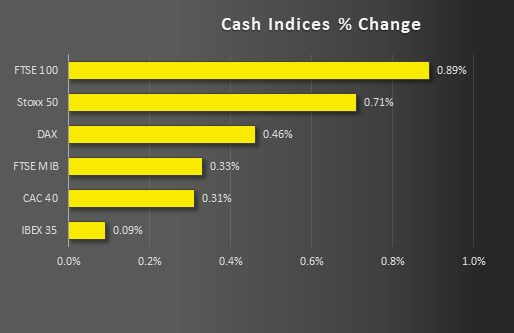

Stock market snapshot as of [3/5/2019 2:42 PM]

- A non-farm payrolls beat was just in time to give Europe’s stock market rebound from a shaky week added momentum

- Payrolls climbed to 263,000 against an 185,000-consensus compiled by Reuters, with a new 49-year jobless rate low; eclipsing softer than forecast wage growth

- Europe’s broad STOXX 600 index extends Friday gains that had initially been largely based on resilient showings by two large banks that lifted their sector

- U.S. shares look similarly buttressed, with futures pointing to the best start of the week, rising 0.5%-0.8%

Corporate News

- HSBC’s Q1 results were in many ways the best in Europe’s bank reporting season with resurgent revenues, profits and core capital on the back of a solid performance in Asia, even if other regions were patchy. The stock has mostly traded about 2.5% higher

- France’s Société Générale rose almost 4% at one point after a surprise improvement in its regulated capital position raised hopes that it could soon mandate higher cash returns to shareholders

- Shares of Beyond Meat, a U.S. food producer, will be one early focus after a textbook ‘pop’ on Thursday, its first day of trading, left the stock 163% above IPO price

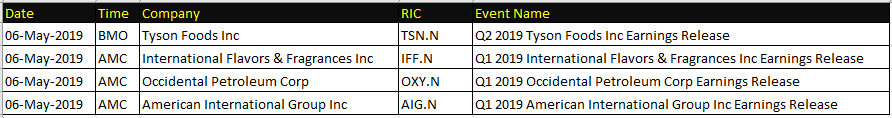

Upcoming corporate highlights

BMO: before market open AMC: after market close

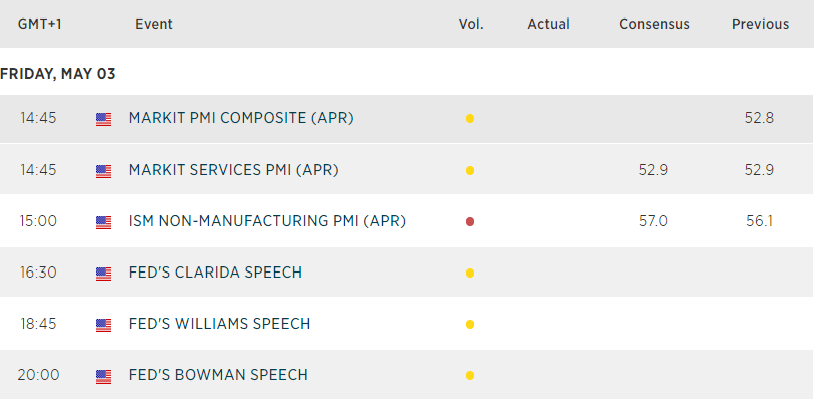

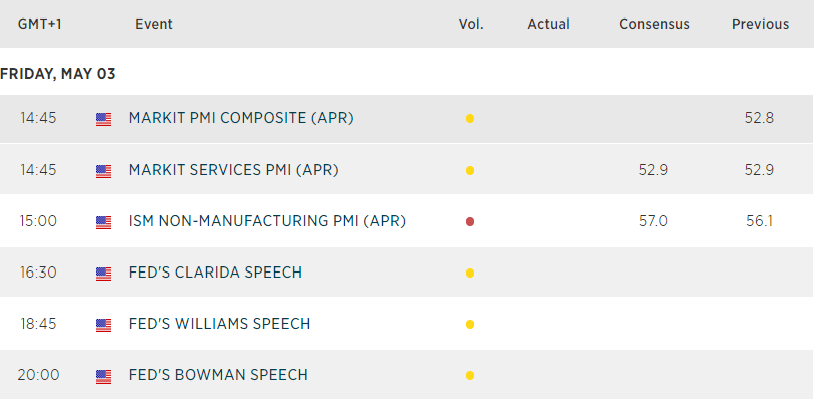

Upcoming economic highlights

Latest market news

Today 08:15 AM

Today 05:45 AM