Stock market snapshot as of [5/6/2019 2:16 PM]

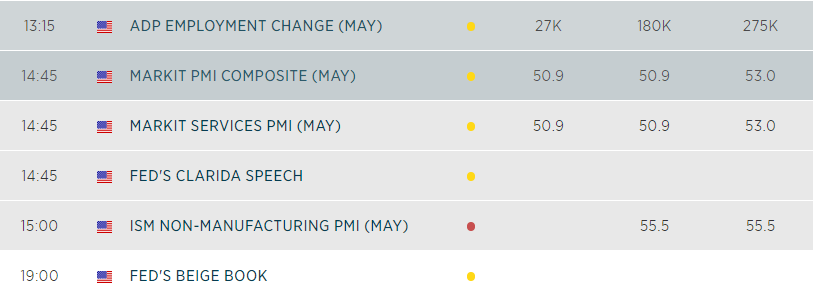

- It almost turned out to be a set of economic data that the market is most ambivalent to—ADP Inc.’s de facto private version of the U.S monthly employment figures, that would give rallying stock markets a wake-up call. The gauge showed 185,000 new were jobs were created in May vs. expectations for 275,000

- But wait a minute. Consensus for non-farm payrolls is tracking around 180,000-190,000. The mismatch could therefore represent one of the frequent dislocations between the official readings and the unofficial. Market reaction suggests investors applied a hefty discount to ADP’s signal. A strong print from the ISM’s Employment PMI on Tuesday also undercuts the view of a negative outcome from Friday’s NFPs

- Furthermore, the ISM’s more pivotal Non-Manufacturing PMI – just out— which also includes a jobs component, is always treated as a better proof of the pudding.

- The main index has just printed at 56.9 compared to 55.4 expected and 55.5 in April. The jobs index hit a two-year high. As such, expectations for a solid payrolls report have survived the typical curtain raisers. That’s another point in favour of the stock market bounce continuing

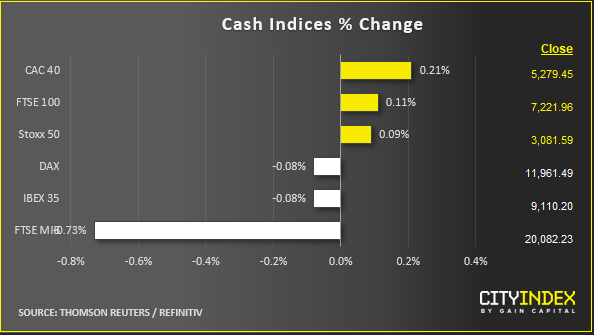

- European shares and U.S. indices did dip when the ADP data were released but they retook some losses after the ISM readings

- The latter releases provide the first real test of sentiment that has been buttressed by Federal Reserve Chairman Powell’s pledge to act “as appropriate”

- Italy remains a standout underperformer after the EU went ahead with disciplinary procedures; though after a year of warnings, it was no longer a surprise and reaction looks contained

Corporate News

- Italian banks are nevertheless bearing the brunt as usual

- European techs manage to retain their bargain-hunt bid as the outlook for the impact from Washington’s aggressive trade strategy is reassessed in light of a possibly more accommodative policy environment

- Salesforce is the mega-cap focus after beating EPS views; the stock is up 3%

- GameStop leads the glaring decliners after the retailer missed revenue expectations and suspended its dividend. The stock is tanking by around 30%

Upcoming economic highlights