European bourses are heading lower on the open as vaccine optimism which has driven the rally across the first part of the week fizzles and the covid trade is back in play. Weaker than forecast UK GDP adds to the downbeat mood.

Here in Europe covid figures continue to deteriorate pointing to a very challenging winter before any vaccine will be widely available. The UK reached a grim milestone of 50,000 covid deaths, whilst Italy hit 1 million cases, the third country in Europe to pass the milestone after France and Spain. Calls for a national lockdown in Italy are growing whilst Germany’s Angela Merkel warns that the second wave could be more deadly than the first. Furthermore, Sweden, which avoided a lockdown in the first wave is imposing a partial lockdown in a bid to stem the spread of covid. And that’s just Europe. New daily covid cases in the US are topping 130,000 a day, the question is when will a new lockdown be brought in, if at all?

Rising covid cases and tighter and more widespread lockdown restrictions are prompting a risk off trade sending riskier assets such as stocks lower, whilst safe haven such as the US Dollar & Gold are back in favour.

UK Record GDP Rebound

UK GDP data revealed that the UK economy staged a record recovery in the third quarter surging 15.5% in the July to September period. This came after a record -19.8% GDP collapse in Q2 during the lockdown period. As the economy reopened, businesses flung open their doors and the economy rebounded, although it did so a slightly weaker rate than the 15.8% expected.

Whilst the economy has grown for an impressive 5 straight months, it is still -8.2% smaller than in February.

UK GDP data revealed that the UK economy staged a record recovery in the third quarter surging 15.5% in the July to September period. This came after a record -19.8% GDP collapse in Q2 during the lockdown period. As the economy reopened, businesses flung open their doors and the economy rebounded, although it did so a slightly weaker rate than the 15.8% expected.

Whilst the economy has grown for an impressive 5 straight months, it is still -8.2% smaller than in February.

Slowing growth in September

The MoM September GDP sheds more light on the picture, increasing 1.1%, down from 2.2% in August and also short of the 1.5% expected. This shows us that the UK economy was starting to slow even before lockdown 2.0 as pent up demand eased and the Chancellor’s Eat Out to Help Out scheme came to an end.

Between record redundancies and signs of growth slowing in September, the outlook for the UK economy was showing signs of weakness even before lockdown 2.0 came into play. This most doesn’t bode well for the coming months as conditions deteriorate further.

GBP/USD is trading -0.3% lower only extending losses slighty following the data. FTSE futures are pointing to losses 0.7% on the open.

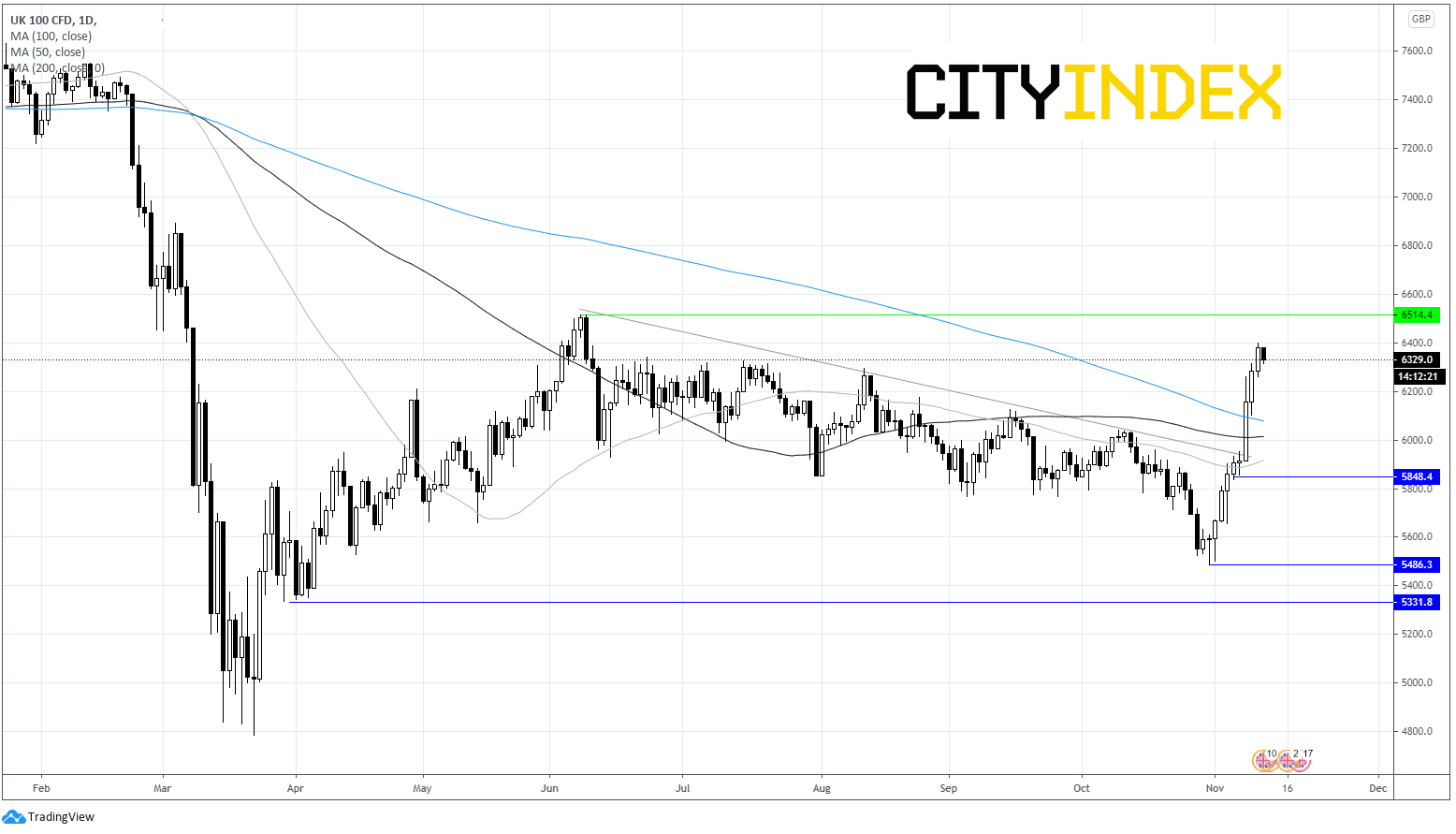

FTSE Chart

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM