Imports, however, are painting a more concerning picture. Import numbers were disappointing falling 2% from a year earlier, suggesting that domestic demand in the world’s second largest economy is still soft.

Concerns over the health of the economic recovery in the Eurozone and particularly Germany have started to increase. The latest German industrial production figures fuelled those concerns further. Output increased just 1.2% mom in July. This was well short of the 4.7% forecast and down significantly from June’s 9.3%. The data comes after German Factory orders pointed to the recovery losing momentum. The Dax is shrugging off the data whist EURUSD trades mildly lower.

The Pound is losing ground across the board as Brexit concerns return with vigour amid a ramping up of pressure by Boris Johnson. Ahead of the 8th round of trade talks the British government dropped a series of political bombshells across the channel, potentially threatening the chances of a trade deal ever happening. Government plans to introduce domestic legislation which partially overrides the Brexit divorce deal could throw a serious spanner in the works. The threat of such legislation is being used as leverage to get a free trade deal done by 15th October, a new date set by Boris Johnson.

Failure to agree a deal will see the UK end the transition period on unfavourable WTO terms, putting trade worth $1 trillion dollars between the two sides into uncertainty.

Oil skids on demand concerns

Oil has plunged at the stat of the new week trading -1,8% lower whilst slipping through the key $40 per barrel level to trade at 39.50. WTI had skidded to a 2-month low of 38.55. Oil prices dived as Saudi Arabia made the deepest price cuts for supply to Asia in 5 months and as concerns rose over the recovery in demand.

Supply is abundant, the US driving season is coming to an end, jet fuel demand in on the floor and China is slowing purchases. With covid cases still rising globally and fears of a second wave as we head towards winter, there seems little reason to be bullish on oil demand.

China, which had been underpinning prices with recorded purchases of oil, slowed these purchases in August adding to the pain for oil prices.

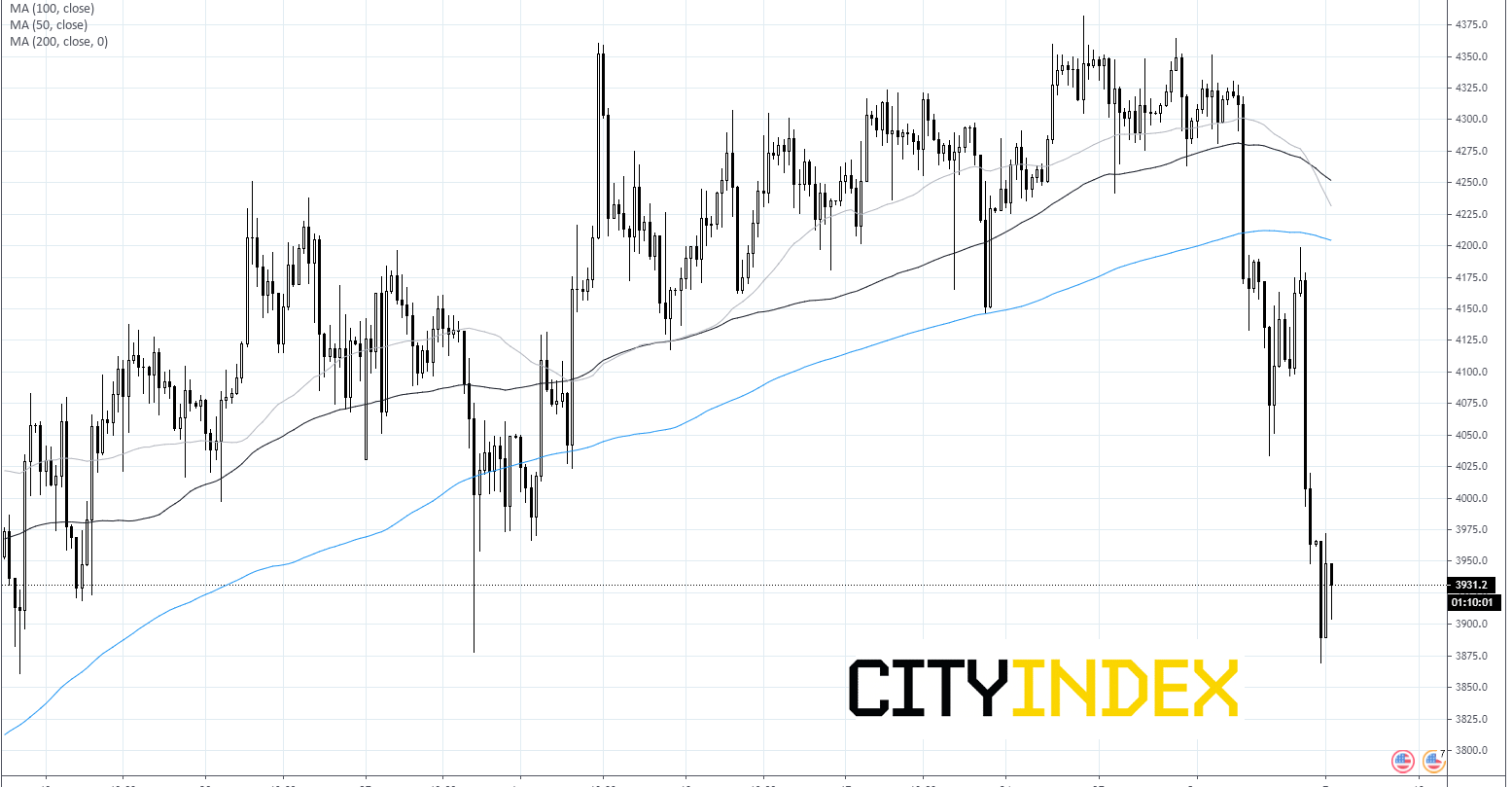

WTI Chart