That said there are still many unknowns, perhaps too many to justify the return to a bull markets for many bourses across the globe. The true scale of the economic impact of the coronavirus is still unknown. Whilst people returning to work and economies reopening is a good thing, there is a good chance that the rally will start to stall over the coming weeks, as investors are faced with the stark reality of the hard data whilst also waiting to see if the gradual reopening are working.. Investors face the same conundrum as governments; will the reopening prove successful or lead back to a second wave of infections?

US GDP & Fed

Attention will now shift towards UD GDP and Federal Reserve FOMC announcement. Of the two events, the GDP has more market moving potential. The Fed are not expected to move on rates. Recently, if the Fed wants to move, it doesn’t wait for the monthly meeting.

Q1 US GDP, will shed some light on how badly the coronavirus crisis hit the US economy. There were only two full weeks of lock down included in Q1. A worse than forecast GDP reading will stoke fear in the markets that the Q2 numbers will be even worse.

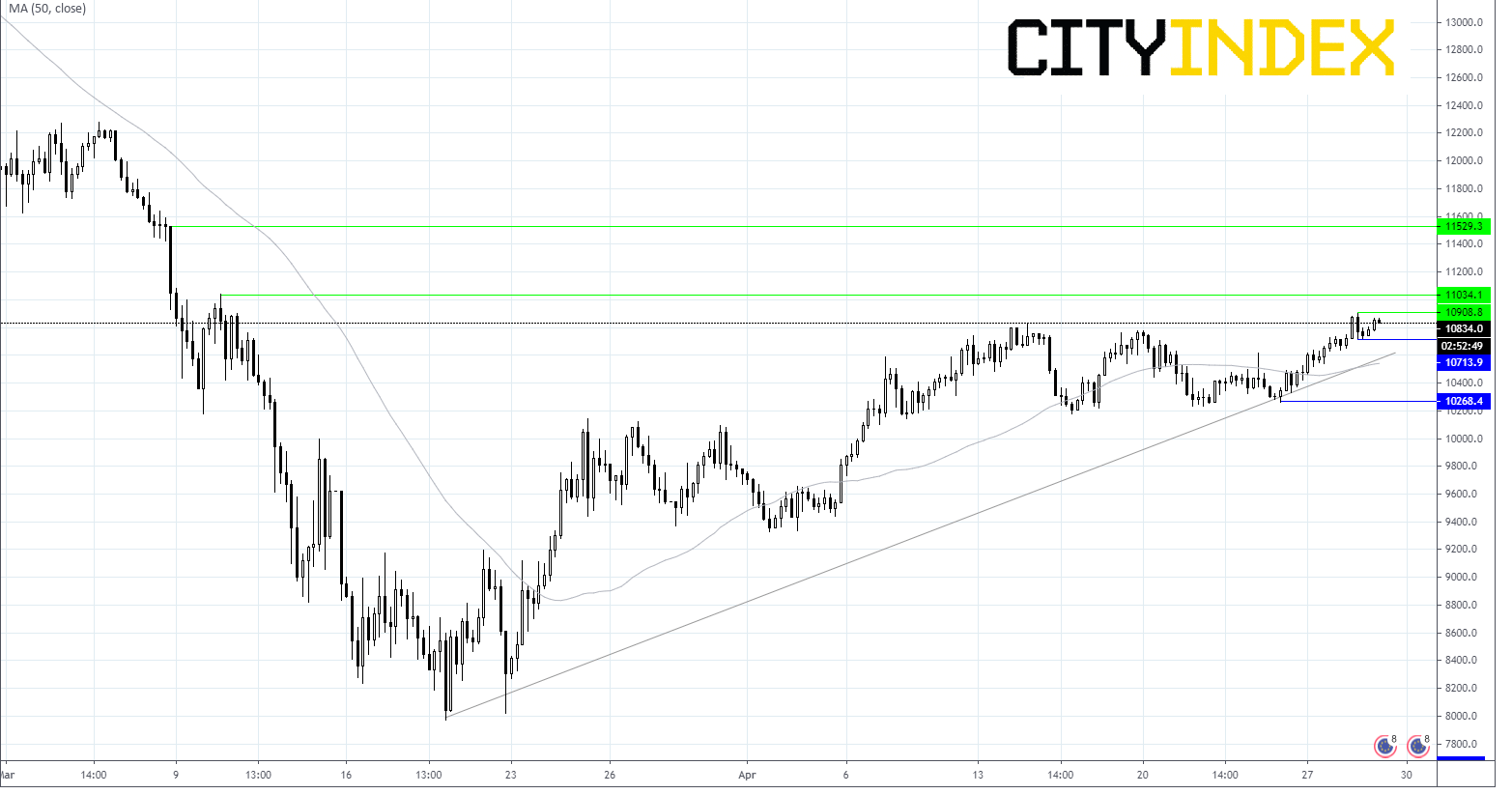

Dax levels

Dax remains in an uptrend, supported by a trend line from March low. Immediate resistance can be seen at 10901 (yesterday’s high) prior to 11034 (high 10th March)

Immediate resistance is seen at 10719 (low yesterday) prior to 10595 (trend line support).