European bourse hobbled into the close on Tuesday. Meanwhile Wall Street opted for a different route with both the S&P and the Nasdaq pushing to fresh record closes - again.

With US coronavirus numbers improving, US – China trade relations hitting a better note and the prospect of further stimulus, US stocks are clearly the flavour of the month, far outperforming their European peers.

With US coronavirus numbers improving, US – China trade relations hitting a better note and the prospect of further stimulus, US stocks are clearly the flavour of the month, far outperforming their European peers.

Second wave fears are becoming more real in Europe as a number of countries, particularly tourist destinations, such as Spain and France are seeing a strong rise in covid cases. Governments, however, are showing reluctance to slap nationwide lock downs into place just yet, but investor concerns are growing.

Vaccine optimism is being broadly brushed off today. News that Cambridge University is set to receive funding from the British government is doing little to boost sentiment.

Vaccine optimism is being broadly brushed off today. News that Cambridge University is set to receive funding from the British government is doing little to boost sentiment.

Jackson Hole symposium

Trading is expected to remain muted as investors wait patiently for this week’s highlight – the virtual Jackson Hole central bankers’ summit and more specifically Federal Reserve Jerome Powell’s key-note speech, tomorrow, the first day of the symposium. Investors are waiting anxiously for any hints over the direction of monetary policy.

Federal Reserve Chair Jerome Powell is expected to reaffirm continued support for the US economy and pledge to do whatever it takes to see the economy through this the coronavirus crisis. This of course offers a solid backdrop for further gains in the US equity markets.

Trading is expected to remain muted as investors wait patiently for this week’s highlight – the virtual Jackson Hole central bankers’ summit and more specifically Federal Reserve Jerome Powell’s key-note speech, tomorrow, the first day of the symposium. Investors are waiting anxiously for any hints over the direction of monetary policy.

Federal Reserve Chair Jerome Powell is expected to reaffirm continued support for the US economy and pledge to do whatever it takes to see the economy through this the coronavirus crisis. This of course offers a solid backdrop for further gains in the US equity markets.

US durable goods

The economic calendar in the UK and Europe is very quiet today. US durable goods orders will be under the spotlight. Expectations are for a 2% increase in July (ex transportation), down from 3.3% in the previous month.

US data has been a mixed bag of late. US consumer confidence plummeted to a new post pandemic low in August as concerns over coronavirus induced job losses hit morale. Consumer spending could take a hit over the coming months on the back of the decline in confidence. Meanwhile the US housing market continues to impress with new homes sales jumping 13.9% to the highest level in over a decade, despite the number of American’s out of work running into the tens of millions.

The economic calendar in the UK and Europe is very quiet today. US durable goods orders will be under the spotlight. Expectations are for a 2% increase in July (ex transportation), down from 3.3% in the previous month.

US data has been a mixed bag of late. US consumer confidence plummeted to a new post pandemic low in August as concerns over coronavirus induced job losses hit morale. Consumer spending could take a hit over the coming months on the back of the decline in confidence. Meanwhile the US housing market continues to impress with new homes sales jumping 13.9% to the highest level in over a decade, despite the number of American’s out of work running into the tens of millions.

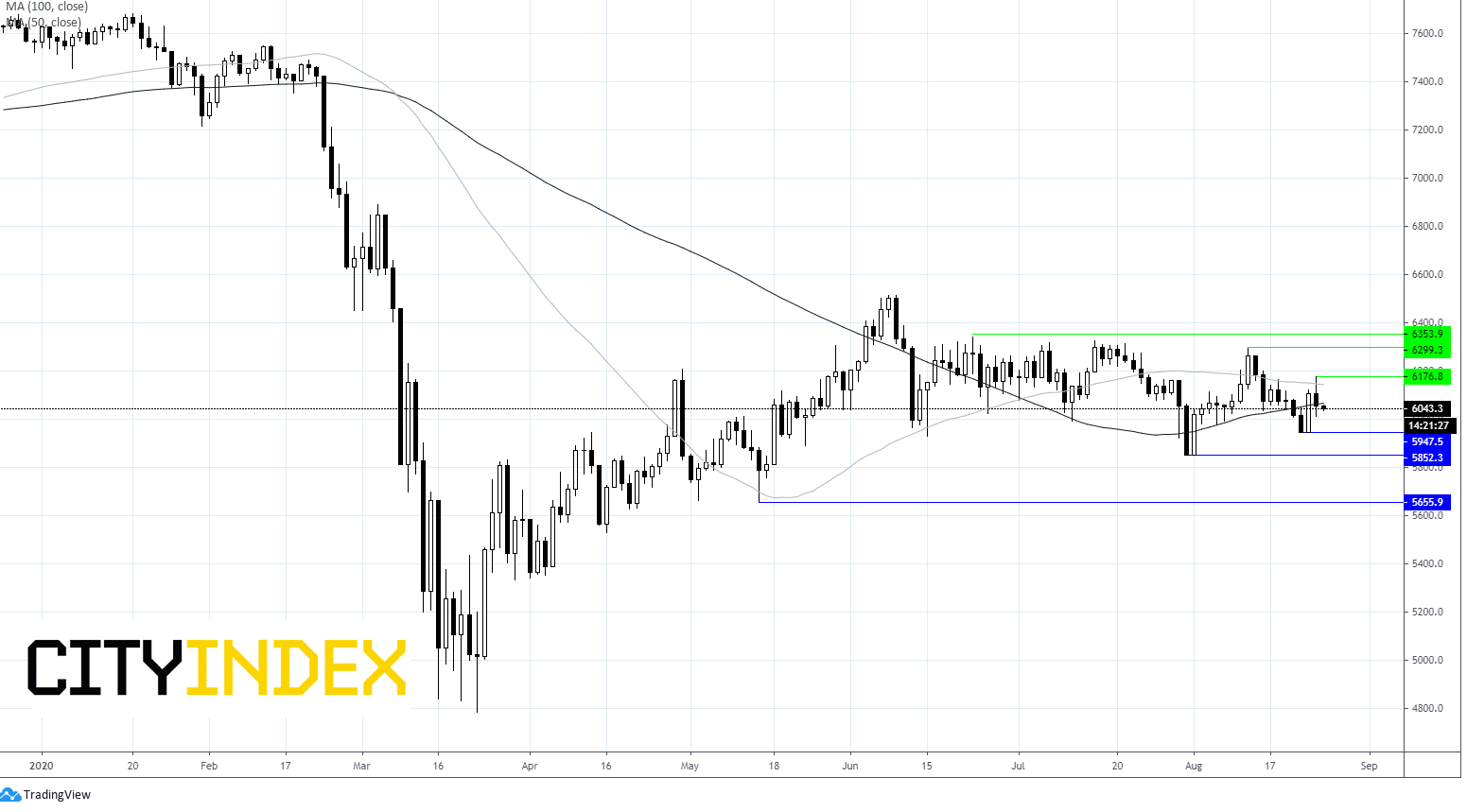

FTSE Chart

The chart shows that the recovery in the FTSE has clearly stalled. The index is trading in a familiar range between. It is currently testing its 50 and 100 daily moving average. A move above 6300 could indicate a fresh uptrend, whilst a move below 5950 could see more bears jump in.

Latest market news

Yesterday 08:33 AM