European bourses are pointing to a mildly positive start after hopes of more US stimulus and upbeat US earnings overnight are overshadowing rising Western tensions with China.

Geopolitical tensions continue to keep any gains in check as the orders the Chinese consulate in Houston to shut by Friday on spying accusations, whilst China plans to follow suit in the tit for tat moves which will see the US consulate in Wuhan closed.

The overriding fear here is that Trump will call off the Phase one trade deal as tensions with China escalate. Despite the tensions, the US Dollar continues to hover close to its all-time low with its eyes on the stimulus prize, inflation hedge gold also remains close to 2011 highs at $1870.

German consumer confidence jumps

The Euro is continuing its run higher as it enjoys its popularity boost brought about by the EU Recovery Fund. Data showed that consumer confidence in Germany jumped to -0.3, up from -9.4 in July and smashing expectations of -5. The surge in consumer sentiment is giving investors yet another reason to buy into the Euro. Data is the region surprising to the upside, flare ups in covid cases are being brought quickly under control and both the fiscal and monetary stimulus taps are turned on. What’s not to like?

US jobless claims improvements set to stall

Looking ahead US jobless claims will be in focus. Expectations are for claims to remain unchanged, stalling at 1.3 million. Continuing claims are expected to edge slightly lower to 17.067 million, down from 17.3 million. Whilst jobless claims have been steadily improving, the fear is rising that the numbers could soon start to deteriorate again as parts of the US sunbelt start to re impose lockdown measures to bring the rising coronavirus numbers under control. The US reported another 70,000 new daily cases on Wednesday.

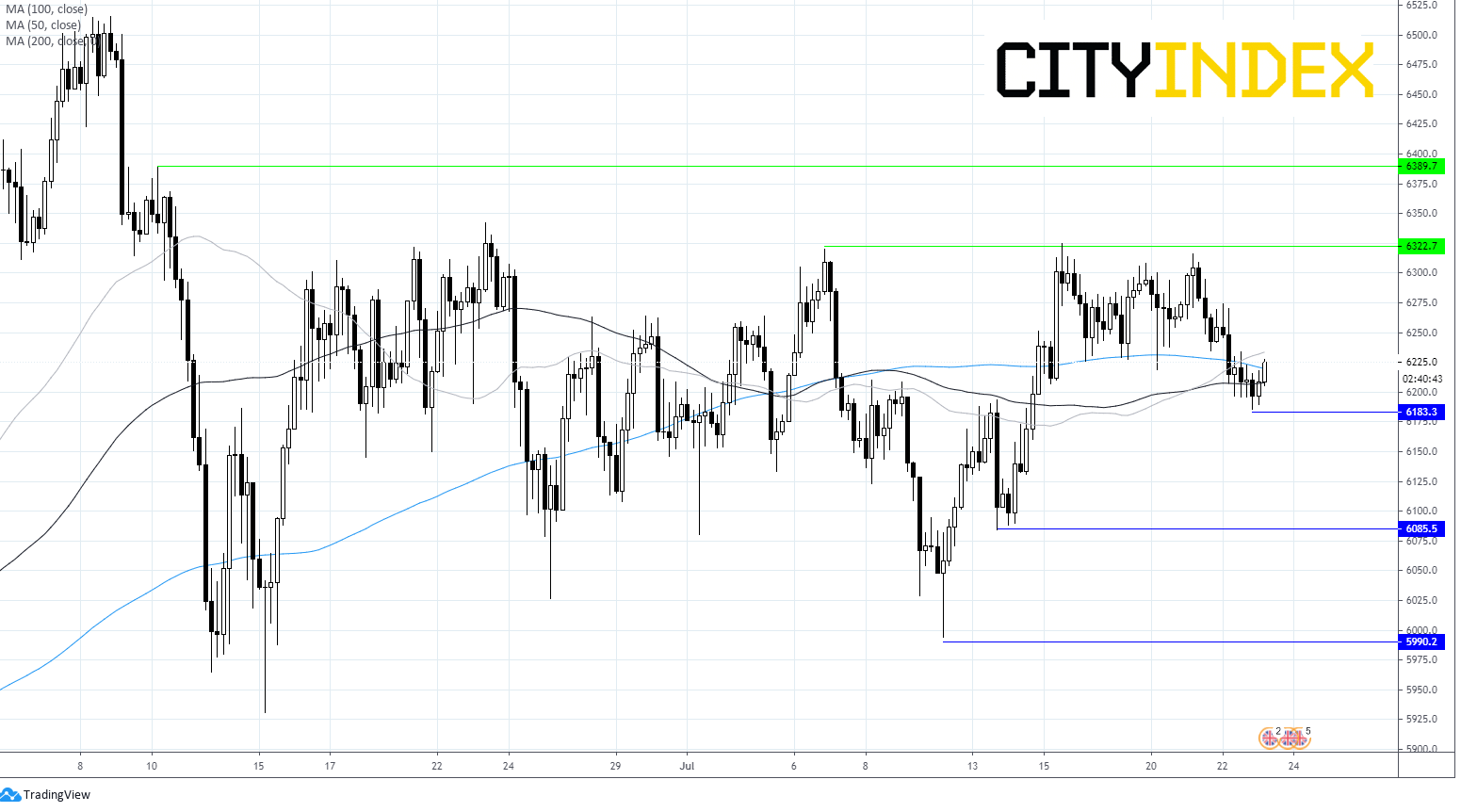

FTSE Chart