Despite the S&P reaching an all time high and the Dow and Nasdaq closing in positive territory, the upbeat mood has not transferred into Europe. European bourses are looking towards a softer start, with the Dax set to outperform its peers whilst the FTSE prepares to lag after a stellar previous session.

The FTSE surged 2% on Wednesday on stimulus hopes after data revealed that the UK economy experienced its deepest contraction since records began. Optimism surrounding vaccines, infections plateauing and encouraging US inflation data reinforced confidence in the broader markets resulting in bourses across the board booking a positive finish.

Inflation US vs Germany

Data wise, US inflation saw a better than forecast 0.6% mom increase in July. Core CPI was also +0.6% in its largest increase since 1991. Delving deeper into these figures, the jump in inflation was primarily down to motor vehicles and apparels whilst food prices eased after climbing during the pandemic. This level of inflation is unlikely to be sustained but it certainly can’t be ignored as it points to an encouraging recovery.

Data wise, US inflation saw a better than forecast 0.6% mom increase in July. Core CPI was also +0.6% in its largest increase since 1991. Delving deeper into these figures, the jump in inflation was primarily down to motor vehicles and apparels whilst food prices eased after climbing during the pandemic. This level of inflation is unlikely to be sustained but it certainly can’t be ignored as it points to an encouraging recovery.

The strong jump in US inflation is in sharp contrast to German inflation data. Germany experienced deflation as prices declined -0.5% mom in July and fell -0.1% on an annual basis.

Looking ahead US initial jobless claims will be in focus. Expectations are for 1.12 million Americans to have signed up for unemployment benefits. This is only down marginally from last week’s 1.18 million, as the recovery in the US labour market appears to be stalling.

Still no sign of US stimulus

Perhaps more concerning are the 16 million jobless Americans who are longing for the next stimulus package to be passed in Congress as the stalemate continues between the Democrats and Republicans. Failure for a deal to be reached could undermine the US economic recovery. Whilst the two sides are expected to eventually cross the line, timing is everything. The longer it takes the more damage to the economy. The US Dollar is back under pressure after two straight days of gains.

Perhaps more concerning are the 16 million jobless Americans who are longing for the next stimulus package to be passed in Congress as the stalemate continues between the Democrats and Republicans. Failure for a deal to be reached could undermine the US economic recovery. Whilst the two sides are expected to eventually cross the line, timing is everything. The longer it takes the more damage to the economy. The US Dollar is back under pressure after two straight days of gains.

Oil eases

After rallying 2.5% in the previous session and hitting a 5-month high, the price of oil is easing on Thursday, although it is still managing to hold onto the lion share of yesterday’s gains. Data this week has shown that oil inventories are falling, additionally US fuel demand data is also rising, hitting the highest level since March. The figures support the view that fuel demand is returning despite the ongoing pandemic. With supply and demand fundamentals offering support the price of oil could start gaining altitude if the markets start to expect a shortage in oil in the coming quarters.

After rallying 2.5% in the previous session and hitting a 5-month high, the price of oil is easing on Thursday, although it is still managing to hold onto the lion share of yesterday’s gains. Data this week has shown that oil inventories are falling, additionally US fuel demand data is also rising, hitting the highest level since March. The figures support the view that fuel demand is returning despite the ongoing pandemic. With supply and demand fundamentals offering support the price of oil could start gaining altitude if the markets start to expect a shortage in oil in the coming quarters.

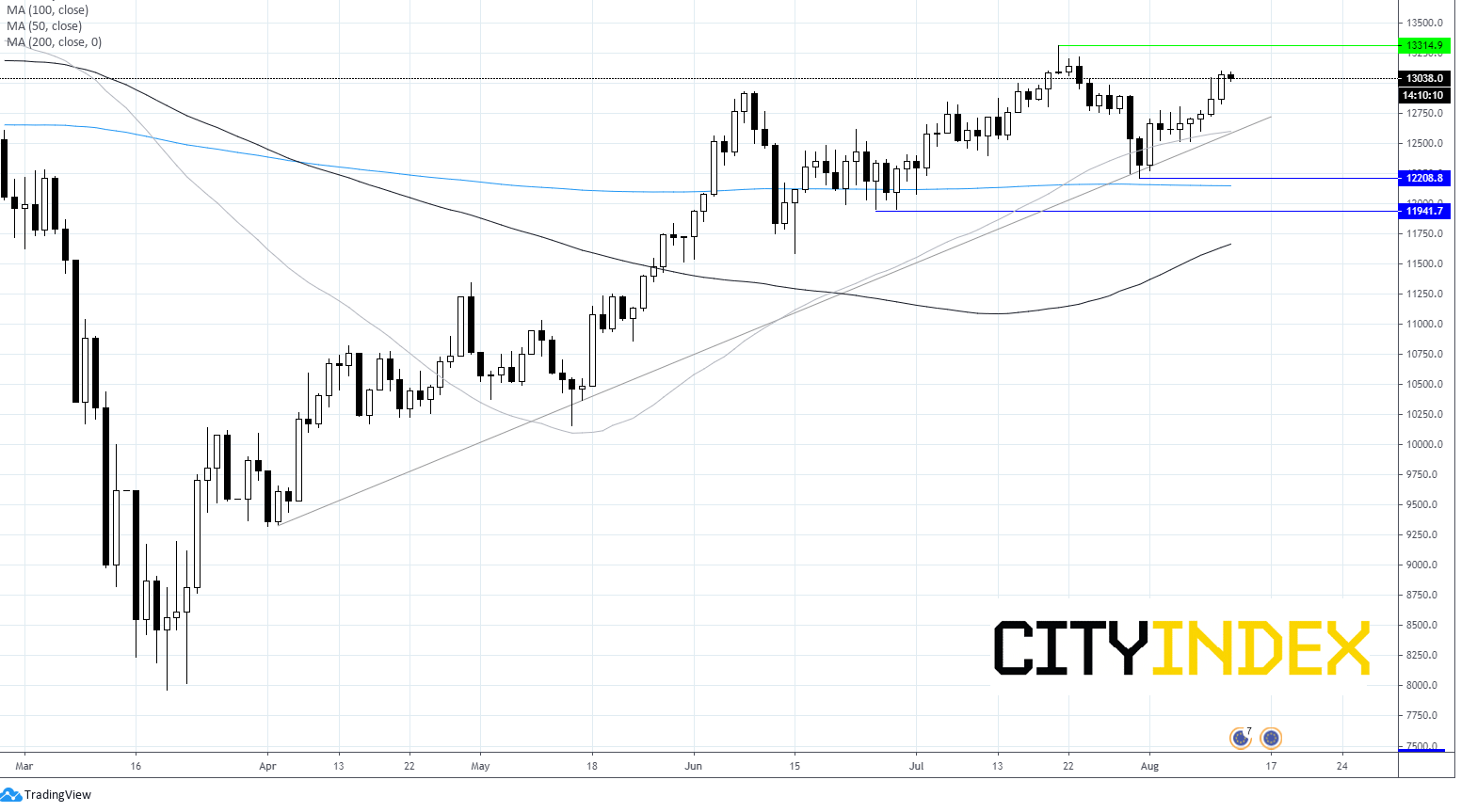

Dax chart

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM