European bourses are pointing to a weaker start as fears of rising coronavirus cases drag on sentiment. Although low volumes suggest weak conviction.

Germany has seen its R rate jump to 2.88 in just four days, up from, 1.79. A number over 1 indicates that the spread of the virus is increasing as lockdown measures are eased. Even though the number of cases in Germany is low, the rise is unnerving. The markets will be watching developments closely here. Germany has been relatively successfully in keeping deaths low and reducing the spread quickly in the first wave, investors will need to this second wave nipped in the bud to boost optimism that a second wave won’t be as devastating the first.

Meanwhile, in the US states such as California and Florida are still seeing the number of cases rise. Apple announced that it will be shutting 11 stores owing to rising cases in some states adding to investor woes. On a positive, the recent outbreak in Beijing appears to be fading.

UK to reduce social distancing rules

What is becoming increasingly clear is that any covid-19 recovery will be far from a straight line. Hopes of a V-shaped recovery to be tested further this week as the UK is set to reduce its social distancing rules down to one meter in an attempt to boost the prospects of survival for shops, bars and restaurants as they reopen. Chancellor Rishi Sunak has also hinted towards a reduction in VAT to get the UK spending again.

What is becoming increasingly clear is that any covid-19 recovery will be far from a straight line. Hopes of a V-shaped recovery to be tested further this week as the UK is set to reduce its social distancing rules down to one meter in an attempt to boost the prospects of survival for shops, bars and restaurants as they reopen. Chancellor Rishi Sunak has also hinted towards a reduction in VAT to get the UK spending again.

Spain reopens for tourism

Spain has removed its state of emergency, reopening its borders to allow summer tourism to restart. The next few weeks will be crucial as investors keep a close eye on coronavirus cases to see whether this big step forward will also mean a big increase in cases.

Whilst localised flare ups in coronavirus cases are likely to happen, the speed and effectiveness of dealing with them will be paramount.

Whilst localised flare ups in coronavirus cases are likely to happen, the speed and effectiveness of dealing with them will be paramount.

Survey data in focus

Today, the UK economic calendar is fairly empty with CBI business trends in focus. European consumer confidence could also attract some attention. This data should provide a sense of how quickly sentiment is recovering as economies reopen. This is key for a recovery in domestic demand. Expectations are for a slow increase in confidence in June to -15, up from -18.8

Looking ahead a barrage of PMI data from UK, Eurozone and the US will provide further clues as to the health of the economic recovery.

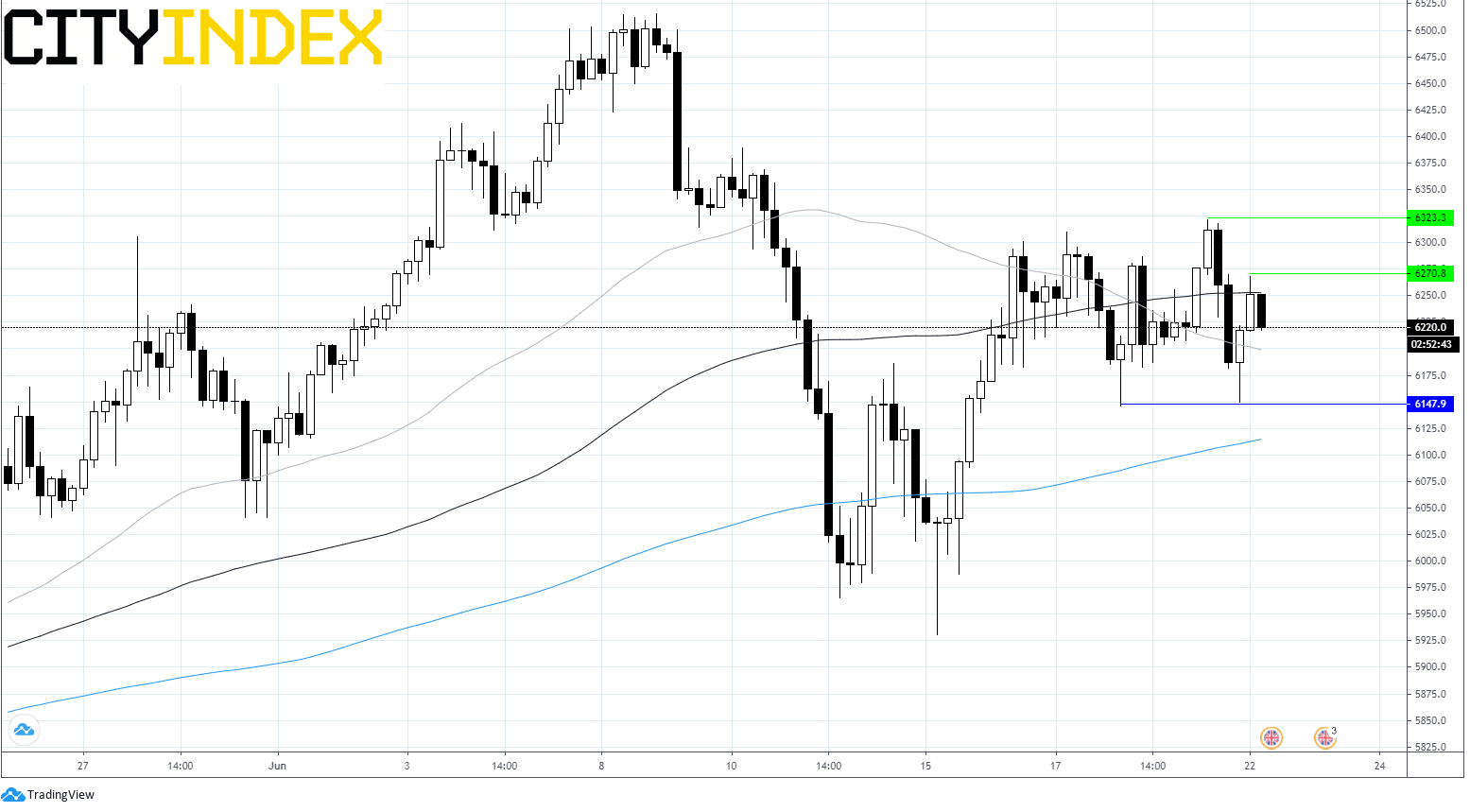

FTSE Chart

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM