A ferocious sell off in US tech stocks spilled over into the broader market, dragging US indices sharply lower on Thursday. Asian markets saw the worst performance in two weeks overnight and European bourses are headed for a softer open.

The Nasdaq has roared higher recently striking record high after record high as big tech such as Apple, Netflix, Amazon, Alphabet and Tesla have seen demand soar. These stocks have not only benefited from the acceleration of reliance on tech which covid has brought with it; they have also adopted an almost safe haven like status. Whilst these stocks are no strangers to talk of overvaluation, investors could be taking heed. The large-scale sell-off in tech stocks saw the Nasdaq plunge 5% and S&P drop -3.5%.

The brutal sell off in tech didn’t have the characteristics of a risk off event, given the performance of safe havens gold and USD, which both traded lower. So, this is looking more like a decent bout of profit taking. And who can blame them after such an impressive rally?

Still the sheer size of the selloff has unnerved traders across Asia and is carrying over into Europe, with bourses looking to kick the session off lower ahead of the US non-farm payroll.

Still the sheer size of the selloff has unnerved traders across Asia and is carrying over into Europe, with bourses looking to kick the session off lower ahead of the US non-farm payroll.

NFP to disappoint?

Expectations are for 1.4 million jobs to have been created in August, down from 1.76 million in July. The unemployment rate is also expected to slip into single digit falling to 9.8%, down from 10.2%. Average earnings growth is due to slow slightly to 4.5%, from 4.8% suggesting that more lower income earners are returning to the workforce.

The key lead indicators for the NFP report haven’t been encouraging. The employment component of the ISM manufacturing and non-manufacturing reports showed continued contraction, albeit at a slower pace. The closely correlated ADP report also fell short of expectation, suggesting a disappointing headline figure could be on the cards. However, in such unprecedented times anything is possible.

Expectations are for 1.4 million jobs to have been created in August, down from 1.76 million in July. The unemployment rate is also expected to slip into single digit falling to 9.8%, down from 10.2%. Average earnings growth is due to slow slightly to 4.5%, from 4.8% suggesting that more lower income earners are returning to the workforce.

The key lead indicators for the NFP report haven’t been encouraging. The employment component of the ISM manufacturing and non-manufacturing reports showed continued contraction, albeit at a slower pace. The closely correlated ADP report also fell short of expectation, suggesting a disappointing headline figure could be on the cards. However, in such unprecedented times anything is possible.

Europe’s rebound slowing

Meanwhile, the economic recovery in Europe could be showing signs of losing steam. The Spanish French and Italian service sector PMI’s revealed that activity contracted in August. Retail sales across the bloc also unexpectedly fell -1.3% month on month in July. Adding to the downbeat news German factory orders, which were expected to increase an impressive 5% month on, grew 2.8%, following from a 27% increase in June.

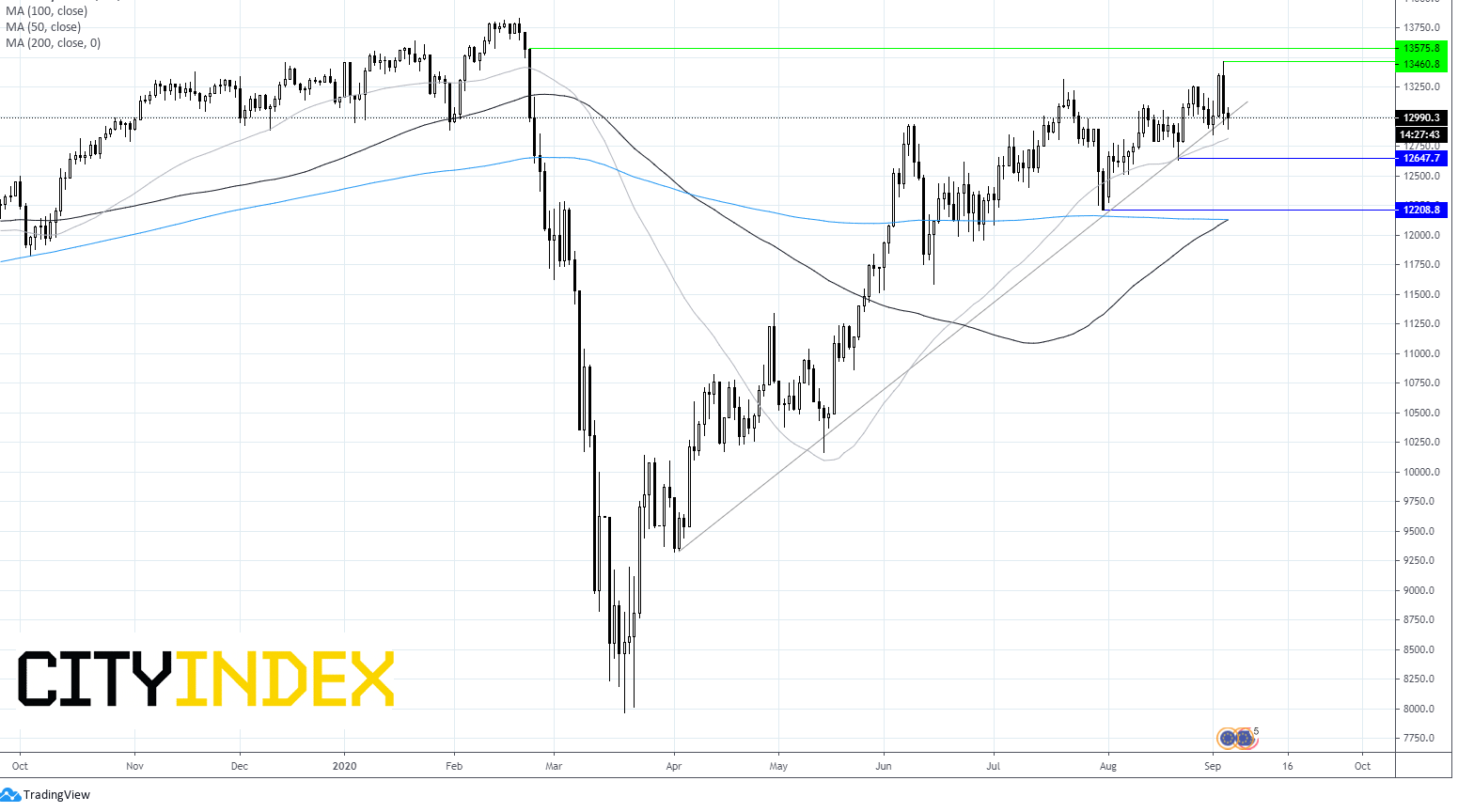

Dax chart

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM