The closely watched UK service sector Purchasing Managers Index will be in focus in the European session. Analysts are expecting the PMI to confirm 56.6, whereby the level 50 separates expansion from contraction, as the sector continues to rebound from its April nadir. The service sector is the sector which was most affected by the lockdown measures and is also the dominant sector in the UK economy. A strong reading could help lift sentiment and push GBP/USD back above $1.31 as the UK economic recovery gains momentum. However, this is set to change as the government starts to withdraw support from the job retention scheme over the coming months.

In the US session the ADP payroll and ISM non-manufacturing could guide investors with what to expect on Friday’s non-farm payroll. Both the ADP payroll and the non-manufacturing PMI are expected to show a slowdown from last month’s solid numbers. Too much of a slow down could unnerve investors amid fears that the resurgence in covid cases is hampering the economic recovery.

Gold is on fire. The precious metal’s scorching rally has continued with prices pushing through the key psychological level $2000 to a record high of $2030 per ounce, as bond yields hit new lows and the US Dollar experiences another steep sell off.

With Congress promising to work round the clock to reach a deal on a new rescue package by the end of the week and comments from the President of the Federal Reserve Bank of San Francisco that the US economy will need more support than initially thought– the stimulus taps are firmly switched on with no signs of them being turned off anytime soon.

With the global economic recovery expected to be more drawn out than initially expected and the US Dollar losing value, investors are increasingly turning to non-yielding gold to store wealth. Given that high fiscal spending and extremely accommodative monetary policy are expected to be in place for years, there is a good chance that gold has higher to go.

Whilst the commodity Gold is an obvious way to tap into the gold rally, Gold miners have also been experiencing a boom of late.

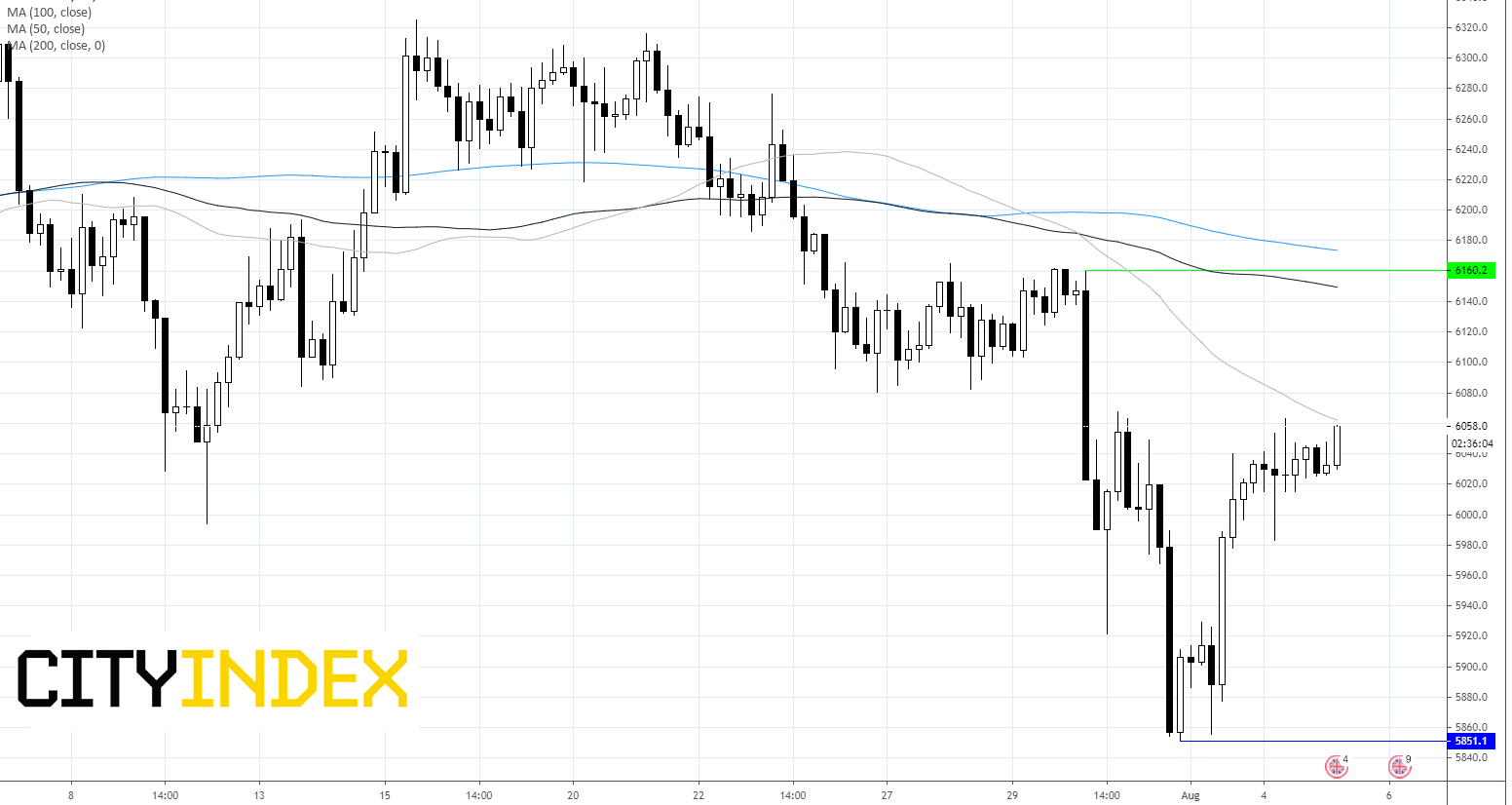

FTSE Chart