Europe Points Higher After Fed’s Historic Shift

As the dust settles on the Federal Reserve’s historic policy shift the mood in the market is upbeat. European bourses and US futures are pointing to a stronger start after a mixed finish on Wall Street overnight. Whilst the Dow & the S&P ended in positive territory, the Nasdaq closed in the red.

Asia also saw a mixed show, with the Japanese Nikkei and the yen slumping on news that Shinzo Abe will resign on health reasons.

As the dust settles on the Federal Reserve’s historic policy shift the mood in the market is upbeat. European bourses and US futures are pointing to a stronger start after a mixed finish on Wall Street overnight. Whilst the Dow & the S&P ended in positive territory, the Nasdaq closed in the red.

Asia also saw a mixed show, with the Japanese Nikkei and the yen slumping on news that Shinzo Abe will resign on health reasons.

Fed softens approach to inflation

Jerome Powell, Chair of the world’s most powerful central bank announced a shift in policy framework, paving the way for years of more pro-growth policies.

The Fed will adopt a softer approach to inflation, allowing inflation to over run the 2% target for some time in order to boost employment and to compensate for the extended periods of time that it has run below target.

His comments weren’t unexpected. However, they still managed to create a stir in the financial markets sending the S&P to yet another all time high and dragging the US Dollar to a 27 month low versus a basket of currencies.

Jerome Powell, Chair of the world’s most powerful central bank announced a shift in policy framework, paving the way for years of more pro-growth policies.

The Fed will adopt a softer approach to inflation, allowing inflation to over run the 2% target for some time in order to boost employment and to compensate for the extended periods of time that it has run below target.

His comments weren’t unexpected. However, they still managed to create a stir in the financial markets sending the S&P to yet another all time high and dragging the US Dollar to a 27 month low versus a basket of currencies.

BoE Andrew Bailey up next

Today it is the turn of Bank of England Governor Andrew Bailey to take to the virtual stage at Jackson Hole. Investors will be looking for further clarity around negative interest rates. Earlier this month Andrew Bailey said that negative rates were in the BoE’s toolbox. However, he also said there are no plans yet to use them.

The question is whether the BoE sticks to its preferred avenue and just adds additional stimulus to bridge the fallout from the withdrawal of the Government’s job retention scheme, whilst keeping interest rates at or above 0. Or whether this will be when the central bank looks towards using negative rates?

Today it is the turn of Bank of England Governor Andrew Bailey to take to the virtual stage at Jackson Hole. Investors will be looking for further clarity around negative interest rates. Earlier this month Andrew Bailey said that negative rates were in the BoE’s toolbox. However, he also said there are no plans yet to use them.

The question is whether the BoE sticks to its preferred avenue and just adds additional stimulus to bridge the fallout from the withdrawal of the Government’s job retention scheme, whilst keeping interest rates at or above 0. Or whether this will be when the central bank looks towards using negative rates?

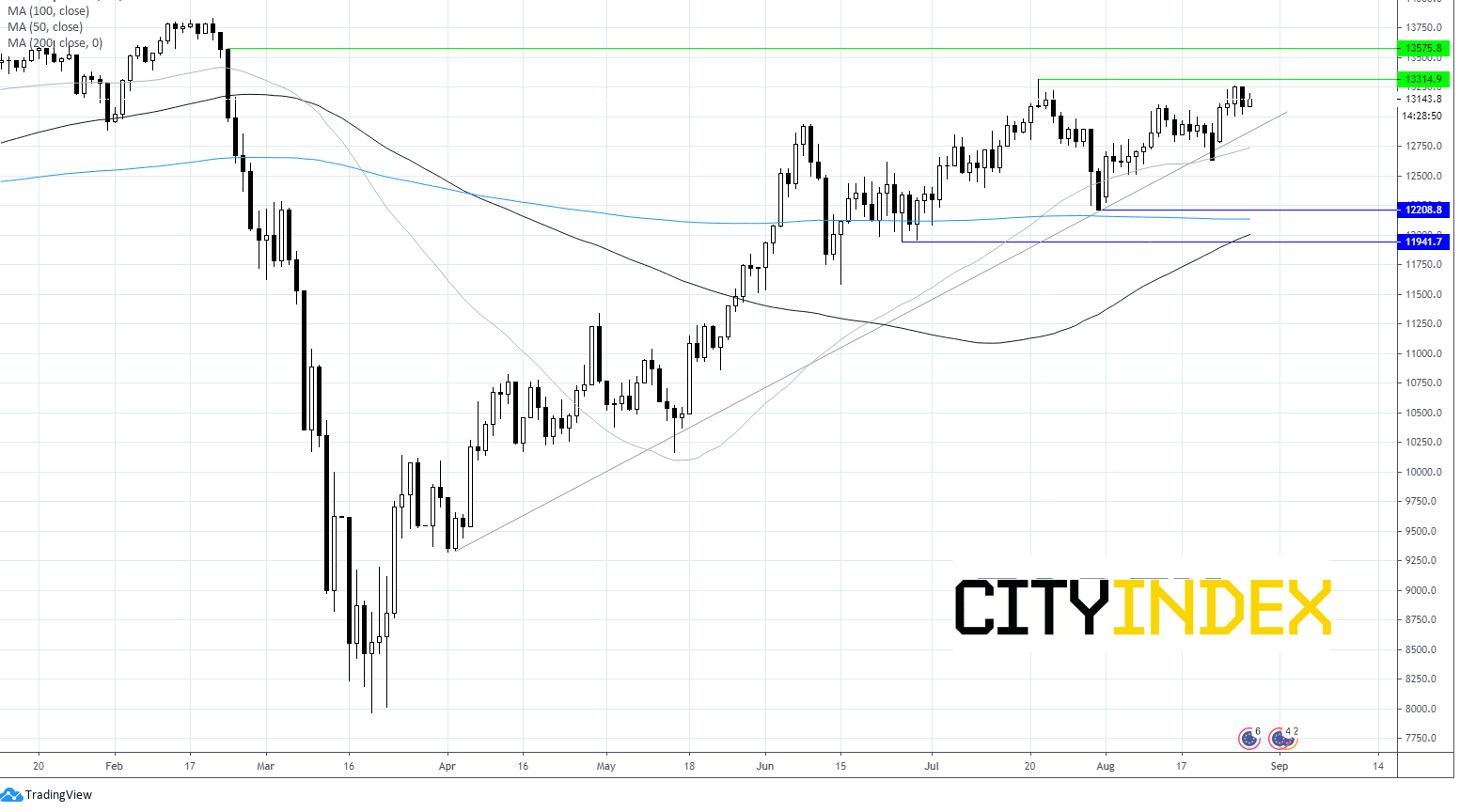

German consumer confidence slips

German consumer confidence unexpectedly fell -1.8 in September against expectations of +1.2. Recent data from Germany has been broadly upbeat and pointing to Germany being on the road to economic recovery. Furthermore, the German government has extended the German job retention scheme beyond March 21 in a supportive mood. Still that fact that morale has fallen as coronavirus cases rise highlight concerns surrounding a second wave.

The Dax is looking to open higher, although trailing the FTSE, whilst the Euro is benefiting from the weaker USD.

Eurozone consumer confidence is keenly awaited.

German consumer confidence unexpectedly fell -1.8 in September against expectations of +1.2. Recent data from Germany has been broadly upbeat and pointing to Germany being on the road to economic recovery. Furthermore, the German government has extended the German job retention scheme beyond March 21 in a supportive mood. Still that fact that morale has fallen as coronavirus cases rise highlight concerns surrounding a second wave.

The Dax is looking to open higher, although trailing the FTSE, whilst the Euro is benefiting from the weaker USD.

Eurozone consumer confidence is keenly awaited.

Dax Chart

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM