European bourses have started stronger on Wednesday, as the mood in the market appears to be improving despite the price of oil continuing to decline. The FTSE which shed just shy of 3% in the previous session opened 0.8% higher. An additional $484 billion rescue package stateside and a boom in Netflix subscriber numbers are doing their bit to boost sentiment, as is upbeat news on vaccine trials in the UK.

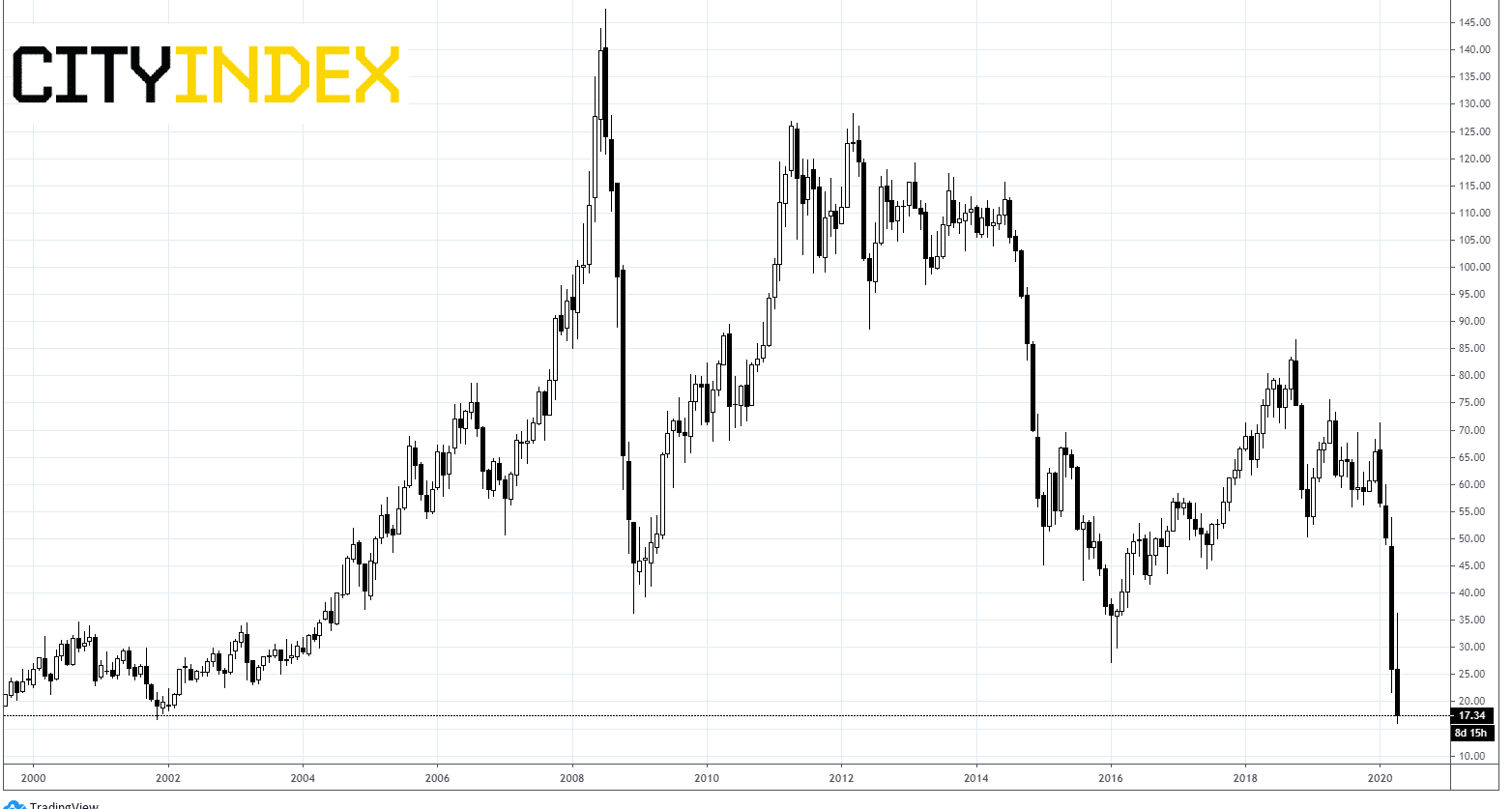

Brent hits 18 year low

Oil is crashing for a second session, hitting levels not seen for two decades, fuelled by anemic demand and the swelling global oil glut. Overnight Brent dropped by almost 18% hitting $15.98 a level last seen in mid-1999. The fall in Brent comes following a plunge in the price of WTI earlier this week which saw WTI futures trade in negative territory for the first time ever. The pickup in demand as Asia comes out of lock down is slower than expected. This will almost certainly be replicated across the globe.

The steep losses in the oil markets could suggest that the economic hit from coronavirus will be far worse than initially anticipated by investors. Energy stocks unsurprisingly were under pressure in the previous and we can expect them to remain depressed with oil at these levels.

Gold prices are on the rise as investors seek out their safe haven properties. Gold futures jumped by 1.1% overnight taking the precious metal above the $1700 level. We are seeing the precious metal restore its inverse relationship with stocks. Gold is starting to shine, which is not that surprising given the ongoing turmoil in the financial markets, interest rates on the floor and amid the huge levels of fiscal and monetary stimulus unleashed to cushion the impact of coronavirus. A move towards $2000 is completely conceivable.

UK inflation drops to 1.5% yoy

The pound is attempting to claw back some its losses after diving over 1% in the previous session. Fears that Boris Johnson could be adopting a more dovish approach to ending the UK lock down unnerved investors. These fears were then fanned by BoE governor Andrew Bailey warning of easing the lock down too soon.

On the UK data docket, CPI is showed inflation increased at 1.5% yoy in March, down from 1.7% as petrol prices fell and consumption of non-essential items plunged. Traders have shrugged off the in line data, preferring activity data recently.