A stellar US jobs report saw Wall Street bound higher with the Nasdaq reaching another all time high and the S&P reaching its highest closing level since early June. The positivity spilled over into Asia where stocks are trading at 4-month highs, buoyed also by China’s service sector growing at the fastest pace in over a decade in June.

The Caixin/Markit service sector PMI soared in June to 58.4, the highest reading since April 2010, up from May’s 55 as the world’s second largest economy continues to recover from its lockdown paralyses earlier this year.

The data suggests that the Chinese recovery is becoming more broader based as life slowly returns to normal. Services accounts for around 60% of the economy and half urban jobs.

After 4.8 million new jobs having been created stateside in June and following upbeat Chinese data, European bourses are pointing to a slightly stronger start on Friday, although liquidity could be thin today given the US long weekend in observance of Independence Day.

US covid cases dampen optimism

Caution remains despite increasing signs of a strong economic rebound, due to rising US coronavirus cases. The number of new daily cases crossed 50,000 for the first time reaching 51,200 in the last 24 hours a sign that the crisis is spiralling out of control. The economic recovery that was cheered in the previous session could soon be reversed as reopening plans are paused and in some cases rolled back.

Caution remains despite increasing signs of a strong economic rebound, due to rising US coronavirus cases. The number of new daily cases crossed 50,000 for the first time reaching 51,200 in the last 24 hours a sign that the crisis is spiralling out of control. The economic recovery that was cheered in the previous session could soon be reversed as reopening plans are paused and in some cases rolled back.

UK hospitality sector to reopen this weekend

Here in the UK preparations are being made for the reopening of the hospitality sector with pubs and restaurants ready to throw open their doors to the public after three months of lock down. Travel bridges are also expected to be announced today coming into effect next week. Whilst these are steps that will hep boost economic activity in the UK there are concerns that the government is moving too quickly.

Here in the UK preparations are being made for the reopening of the hospitality sector with pubs and restaurants ready to throw open their doors to the public after three months of lock down. Travel bridges are also expected to be announced today coming into effect next week. Whilst these are steps that will hep boost economic activity in the UK there are concerns that the government is moving too quickly.

The further easing of lockdown measures come as scores of high street retailers announce job cuts and store closures. Whilst GFK consumer confidence shows that morale in the UK is at its highest level since April, there is still a long way to go until it returns to pre-coronavirus levels.

Today UK service pmi data today is expected to confirm the preliminary reading of 47.3, revealing that the contraction in the sector is slowing.

Today UK service pmi data today is expected to confirm the preliminary reading of 47.3, revealing that the contraction in the sector is slowing.

Pound slips as Brexit talks end early

The Pound is slipping versus the US Dollar after Brexit talks ended a day early. The break down of negotiations shows just how much distance remains between the two sides. Michel Barnier confirmed in a statement that serious divergences remained, however he still believed that a deal could be reached, which has prevented the Pound from falling further. Talks will resume in London next week as planned.

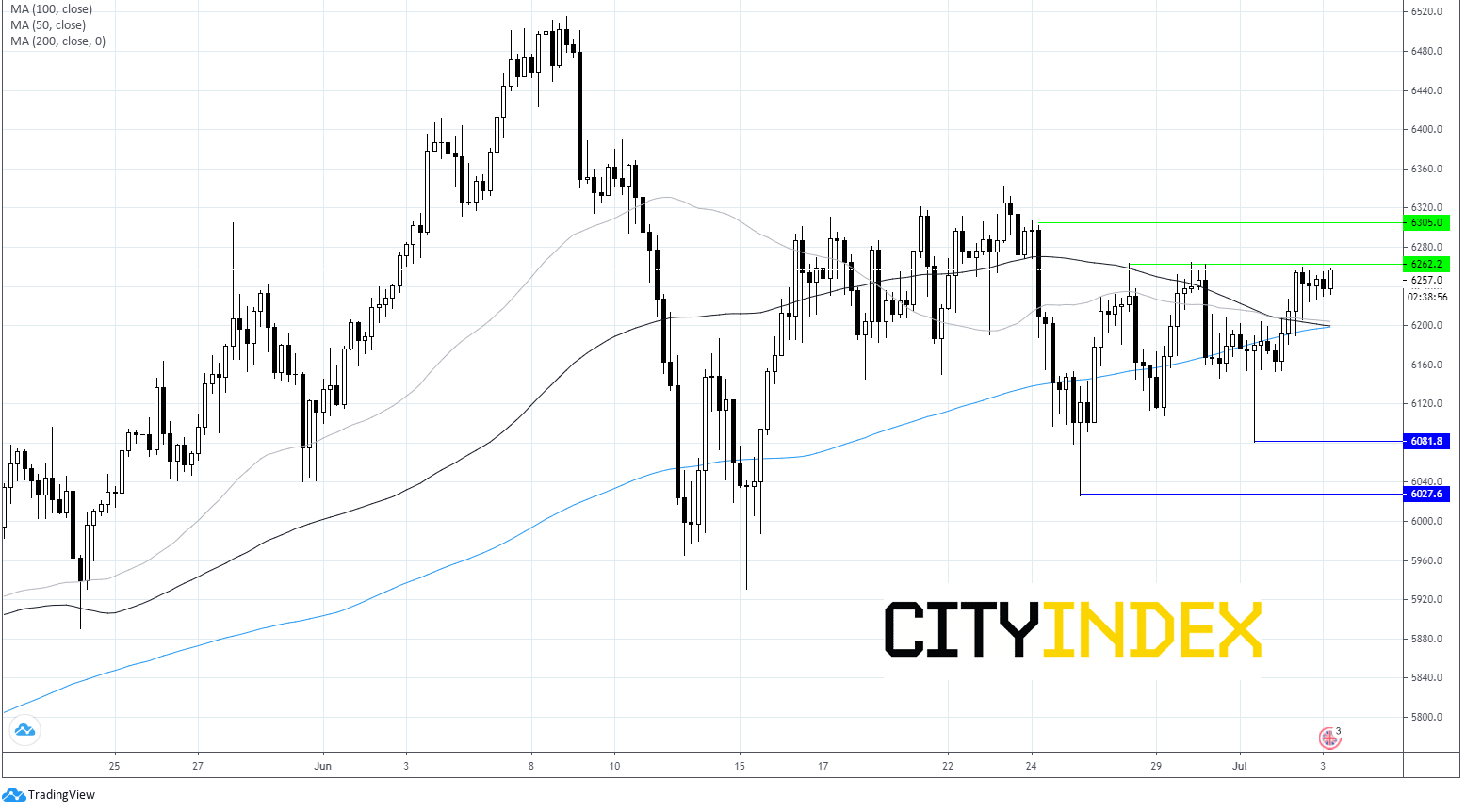

FTSE Chart

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM