EUR/JPY Offers Volatility, Without Much USD Correlation

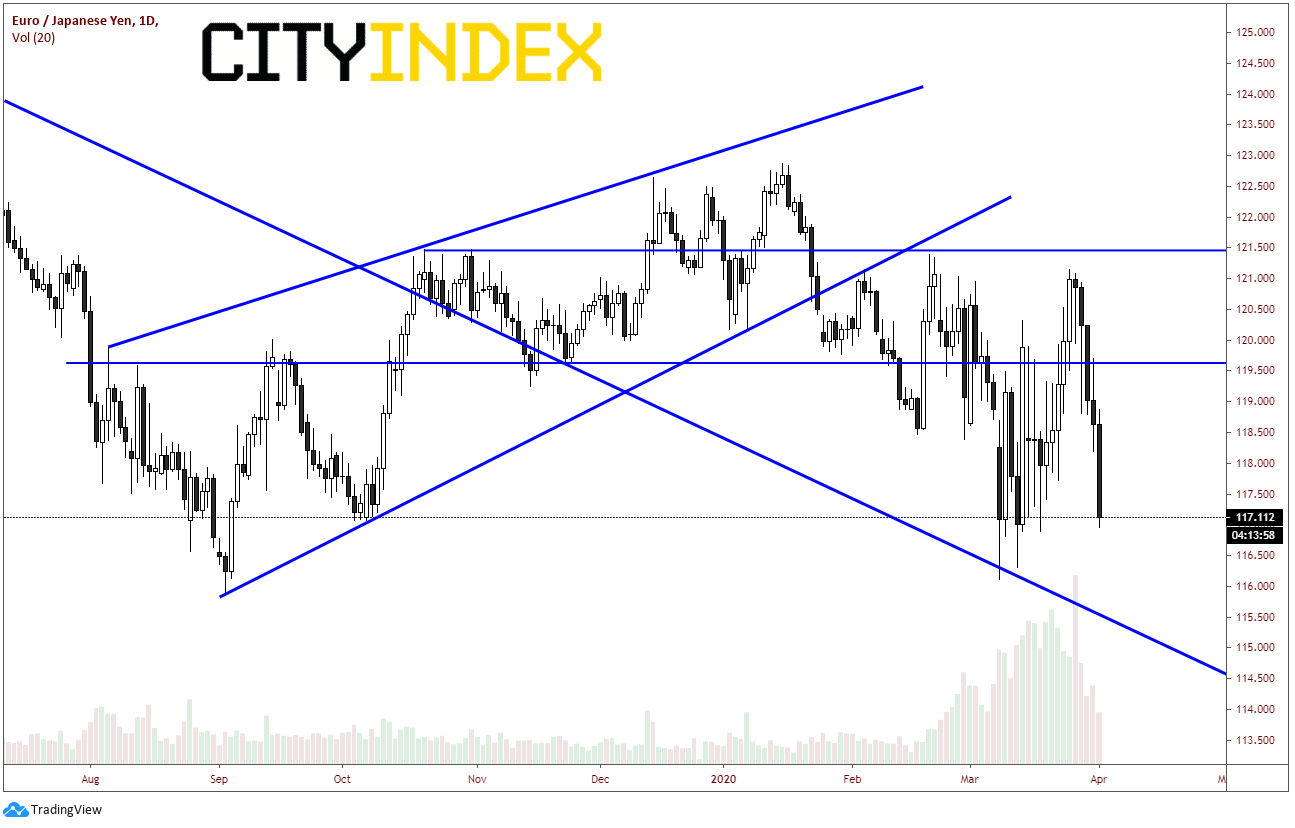

Since February 20th, when the S&P 500 began selling off from its all-time highs, EUR/JPY has been trading in a volatile trading range between 116.12 and 121.40. However, over the last 4 trading days, the pair has traded lower from 121.08 to today’s lows near 116.96, down almost 1.5% today alone. Support doesn’t come in until 85/100 pips lower near 116.00, which is near the long-term downward sloping tending and they March 9th lows.

Source: Tradingview, City Index

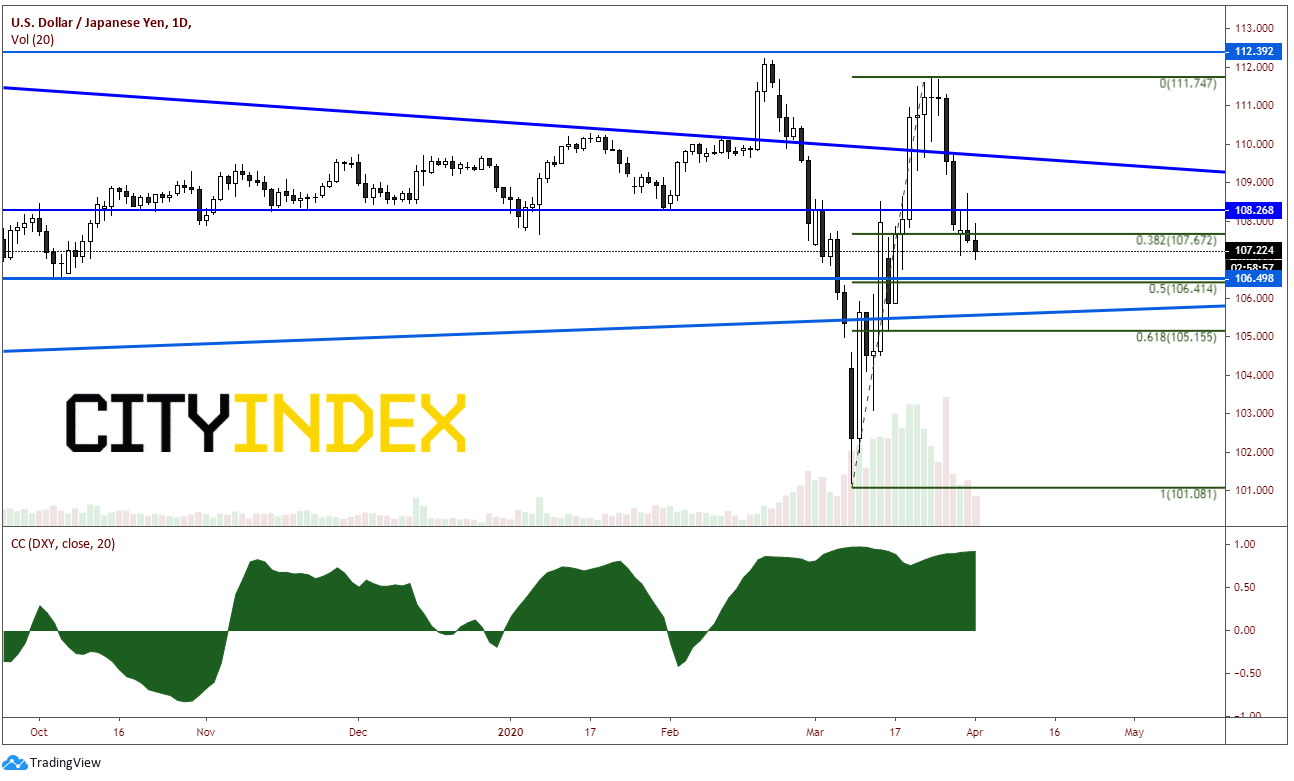

One reason for the move lower is because of USD/JPY, which has sold off from a recent high of 111.71 to today's lows of 107.00, while stalling between the 38.2% Fibonacci retracement level from the march 9th lows to the March 24th highs. As of late, the pair has a high positive correlation with the DXY at +0.92. A correlation coefficient of +1.00 means the pair move perfectly together in the same direction. Currently, there is a close correlation. Support is below at the 50% retracement level and horizontal support near 106.50.

Source: Tradingview, City Index

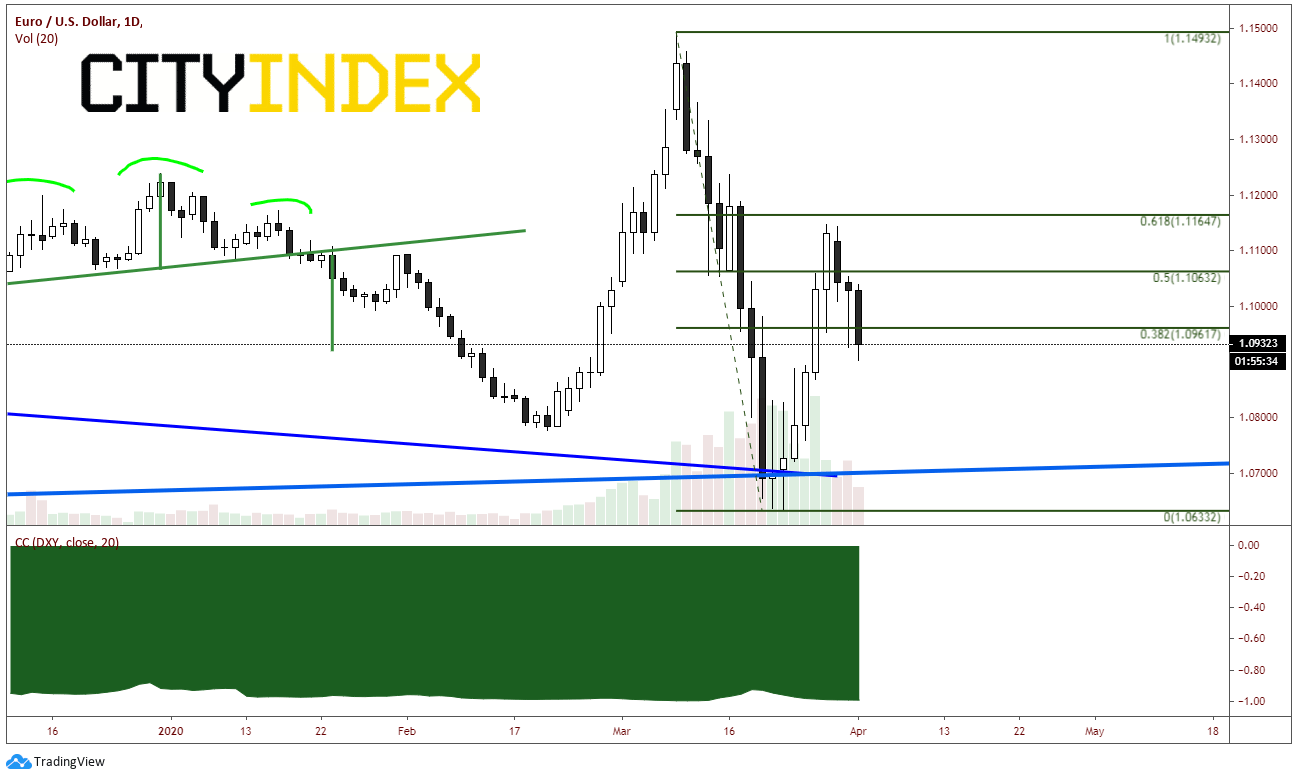

The other reason the EUR/JPY is moving lower is because of EUR/USD side of the equation. The pair has been moving lower since Monday’s open. The EUR/USD traded up to the 61.8% Fibonacci retracement level from the highs on March 9th to the lows on March 23rd before turning lower. Support is at today’s lows near 1.0900. Notice how highly negatively correlated the EUR/USD is with the DXY. The current reading is -0.99. A correlation coefficient of -1.00 means the 2 assets are perfectly negatively correlated. This is sure pretty close!

Source: Tradingview, City Index

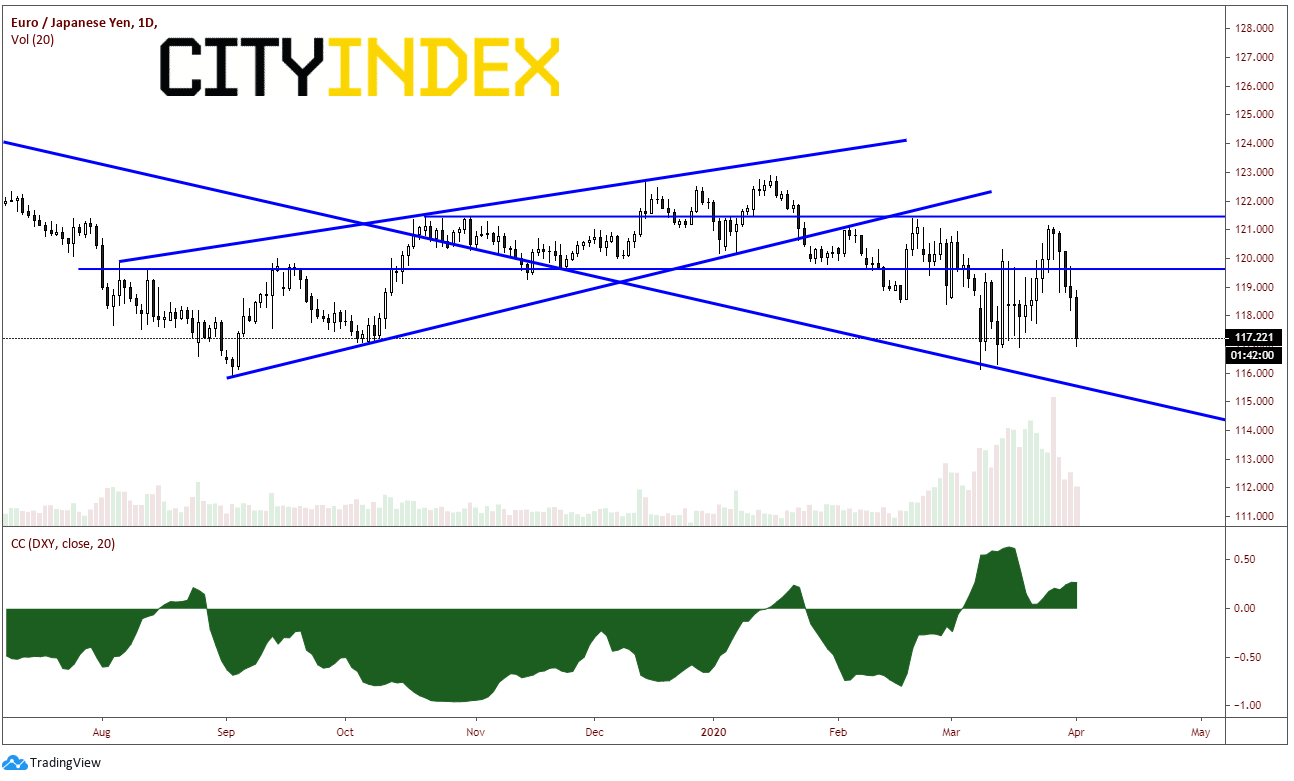

With the EUR lower vs the USD, and JPY higher vs the USD (USD/JPY lower), it makes sense that the EUR/JPY would be much lower, especially with the high correlations that EUR/USD and USD/JPY have with the US Dollar. However, when we take a look at the correlation of the EUR/JPY to the DXY, the correlation coefficient is only +0.27! There is only a mild correlation to the DXY.

Source: Tradingview, City Index

Here’s the point:

With initial claims tomorrow and Non-Farm Payrolls on Friday, the US Dollar currency pairs may continue to be volatile over the next few days. If you are looking for a currency pair to trade, but don’t want exposure to the US Dollar, EUR/JPY is a pair to consider.