EUR/GBP: Two Potential Scenarios to Trade This Week

Yesterday, we took a technical look at EUR/USD, concluding the pair’s ever-tightening range around 1.0900 was approaching a potential breaking point in near future. Today, we wanted to key in on the second most-traded euro cross, EUR/GBP.

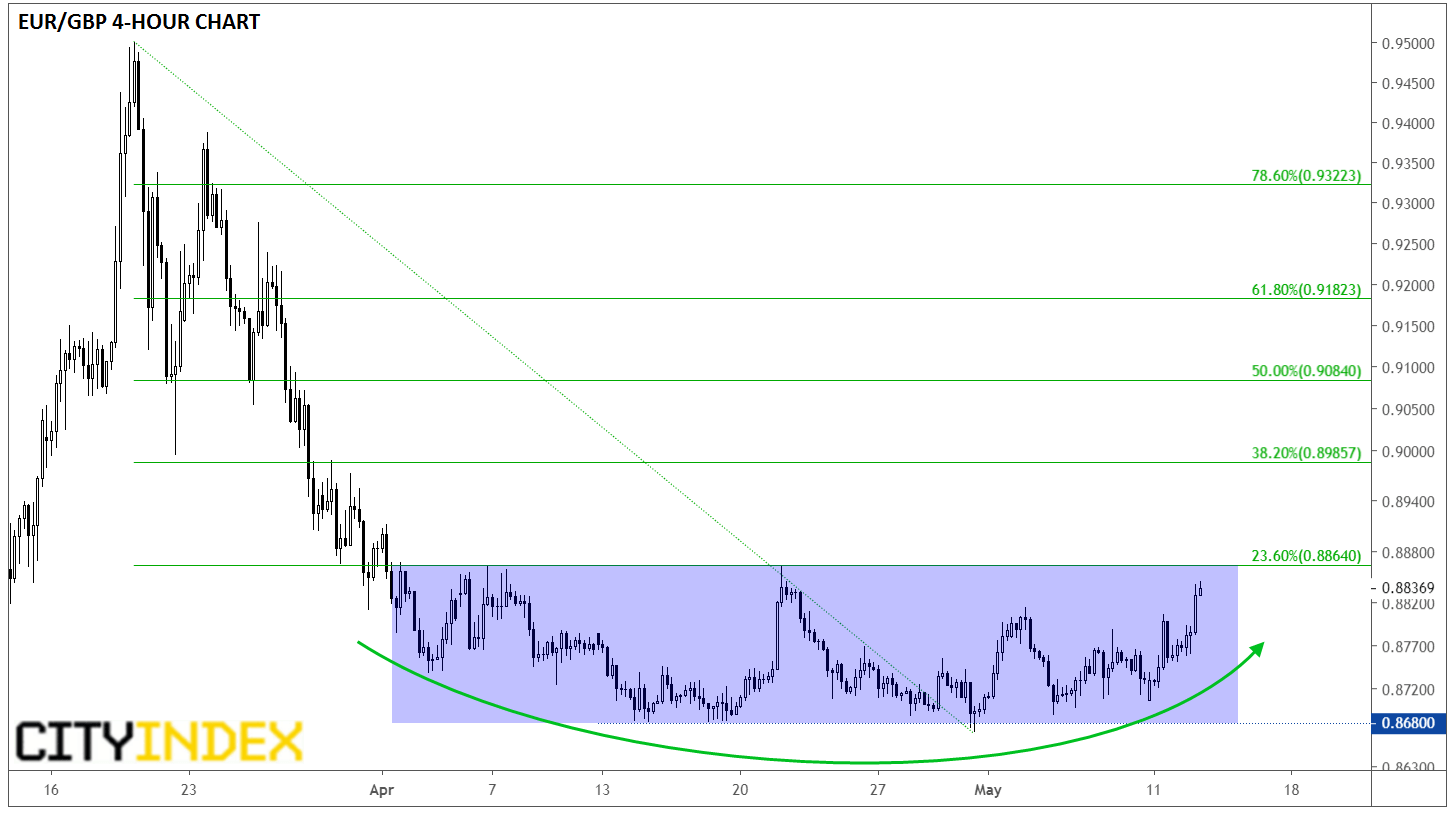

Like EUR/USD, EUR/GBP has spent the last six weeks constrained to a relatively tight range, in this case between support at 0.8680 and resistance up at 0.8860. As the chart below shows, that resistance level represents the 23.6% Fibonacci retracement of the entire mid-March to late-April drop:

Source: TradingView, GAIN Capital

As it stands, there are two interpretations of the recent sideways price action – one bullish and one (potentially) bearish:

1) It’s merely rangebound trade, reflecting consolidation and balance between buyers and sellers. Under this interpretation, rates may be more likely to break lower, in line with the previous trend.

2) The pair is forming a “rounded bottom” pattern, showing a shift from selling to buying pressure and potentially opening the door for a near-term rally toward at least the 38.2% Fibonacci retracement near 0.9000.

Of course, readers are welcome to layer on their preferred technical indicators to help handicap which scenario is more likely, but the next tradable breakout may ultimately hinge on this week’s economic data. The UK is scheduled to release its preliminary estimate of Q1 GDP tomorrow at 7:00 GMT, followed by a webinar presentation from new BOE Governor Andrew Bailey on Thursday at 11:30 GMT and the release of German Q1 GDP at 7:00 GMT on Friday.

If these data points show more optimism around opening the economy on one side of the English Channel or another, that may be the catalyst to finally take EUR/GBP out of its established range!