The Pound is under performing its major peers, slipping below 1.41 versus the US Dollar, whilst EUR/GBP hold over 0.86. Sterling failed to capitalize on earlier gains following the upbeat jobs report.

Unemployment falls

The UK jobs market appears to be regaining its poise. In the three months to April, unemployment in the UK ticked lower to 4.7%, in line with forecasts and down from 4.8% in March. Whilst this is undoubtedly a move in the right direction, there are still some clouds on the horizon. Unemployment is expected to pick up in Autumn when the furlough scheme comes to an end.

The data also showed a record jump in workers on the payroll in May compared to April. 197,000 more jobs were added over the month as hospitality and entertainment companies scrambled to hire staff ahead of the easing of pandemic restrictions and indoor re-opening. Indoor hospitality restarted on 17th May.

Headwinds remain

Boris Johnson pushed back the full lifting of restrictions for another month, which means that the hospitality sector is certainly not out of the woods yet. The delay of the re-opening continues to drag on demand for the Pound.

Brexit tensions also continue to weigh on the Pound.

Attention will turn to BoE Andrew Bailey who is due to speak shortly.

UK CPI data is due tomorrow. Expectations are for CPI to rise to 1.8% YoY in May.

The Euro is finding its feet again after the dovish ECB meeting. German inflation data cane in as expected 2.4% YoY. Weakness in US treasury bonds pulling on the USD, supporting the Euro.

Where next for EUR/GBP?

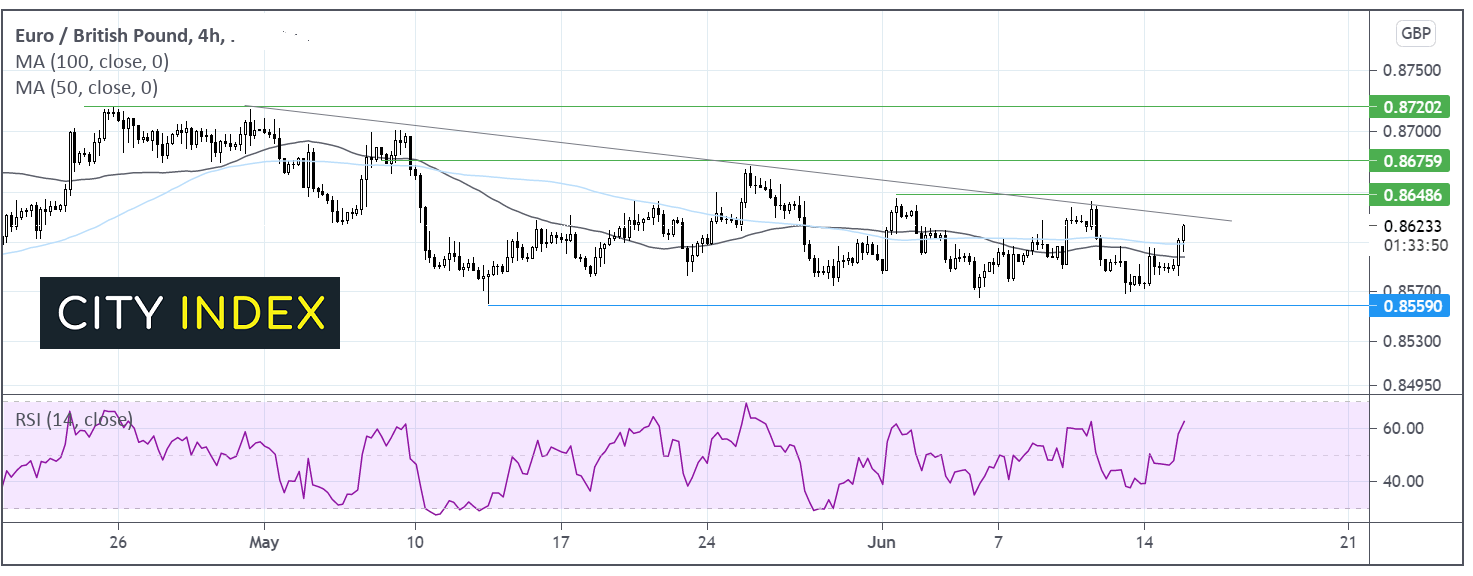

EURGBP has been trending lower since late April. It trades below its 6 week descending trendline. The pair has rebounded off 0.8570 and has climbed above its 50 sma and 100 sma on the 4 hour chart.

The RSI is pointing higher and supportive of further gains whilst it remains out of overbout territory.

Immediate resistance can be seen at 0.8630 the ascending trendline resistance. A break above here could open the door to 0.8650. Beyond this level buyers could gain traction.

On the flip side, support can be seen around 0.86 the 50 & 100 sma and round number. A move below here see the sellers target 0.8560 the May low for a deeper selloff.

Learn more about trading forex

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.