Short-term technical outlook on EUR/GBP

click to enlarge charts

Key Levels (1 to 3 days)

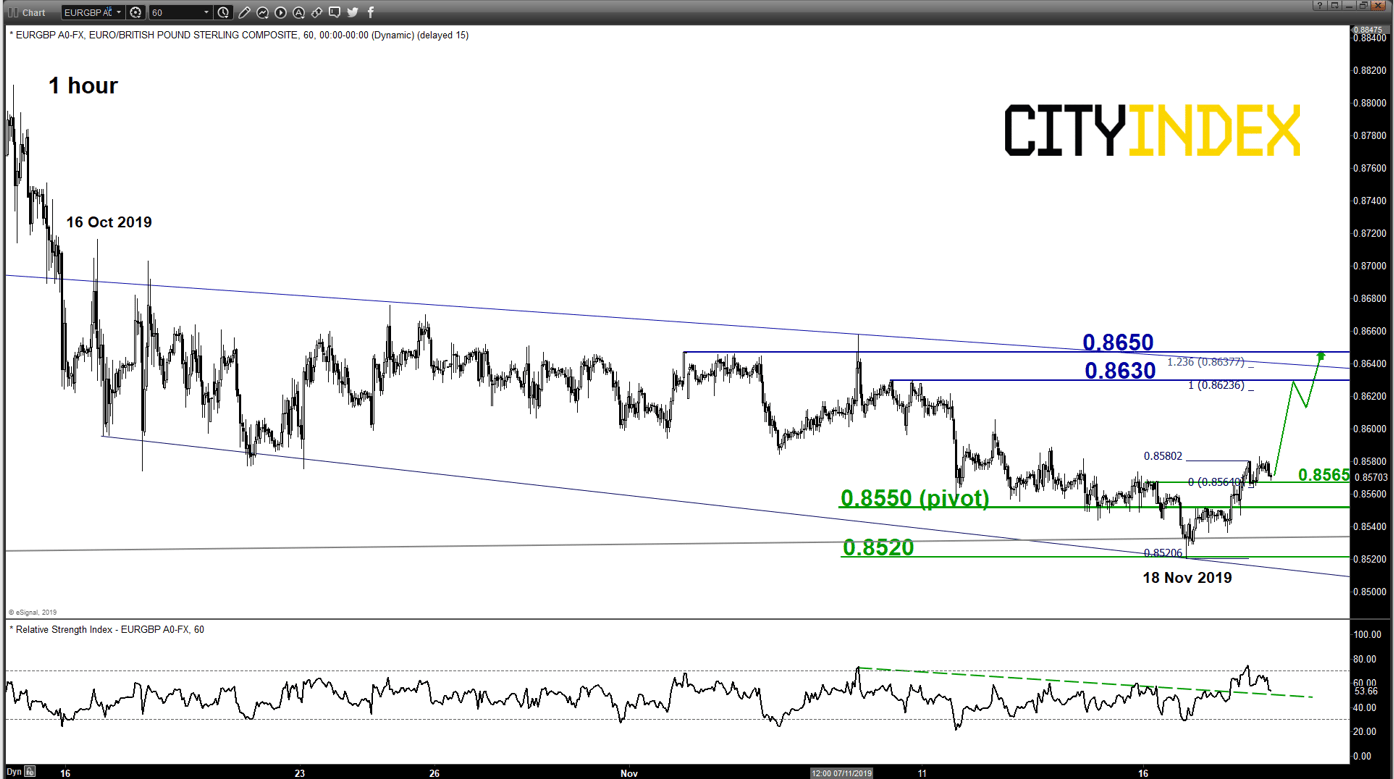

Intermediate support: 0.8565

Pivot (key support): 0.8550

Resistances 0.8630 & 0.8650

Next support: 0.8520

Directional Bias (1 to 3 days)

Bullish bias above 0.8550 key short-term pivotal support for a further potential push up to target the next intermediate resistances at 0.8630 and 0.8650.

However, a break below 0.8550 negates the bullish tone for slide back to retest the major support at 0.8520.

Key elements

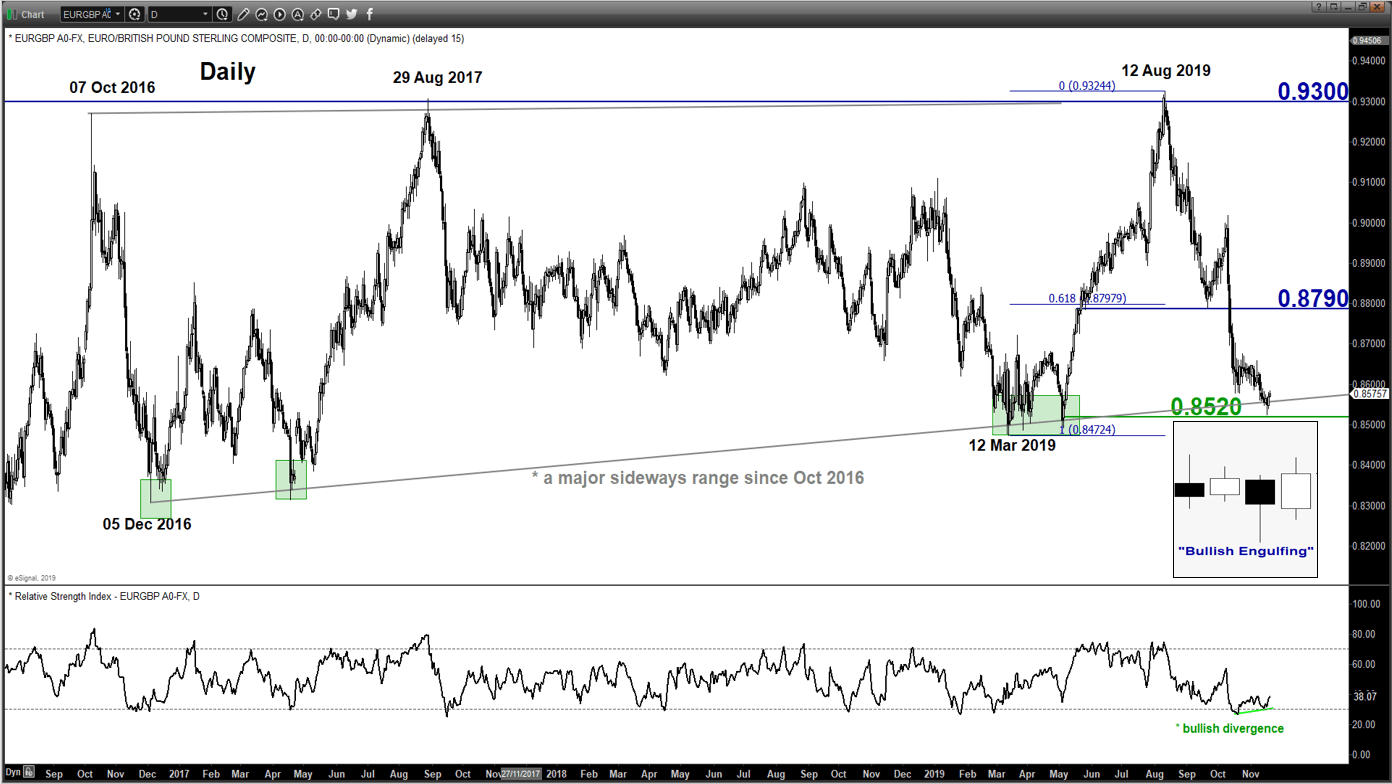

- The 800 pips decline from the 12 Aug 2019 swing high area of 0.9300 has stalled at 3-year/major sideways range configuration support in place since 05 Dec 2016 low.

- In addition, positive signals have been detected on the 0.8520 major range support where the price action of the EUR/GBP cross pair has formed a daily “Bullish Engulfing” candlestick pattern coupled with a bullish divergence signal seen in the daily RSI oscillator at its oversold region. These observations suggest that the momentum of the 3-month down move has started to wane and price action may see a medium-term bullish reversal at this juncture.

- The next significant intermediate resistances are at 0.8630 and 0.8650 which is defined by the minor range resistance from 16 Oct 2019 high and the 1.00/1.236 Fibonacci expansion of the recent push up from 18 Nov 2019 low.

Charts are from eSignal

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM