In an otherwise quiet session, the star of the show overnight was GBP which at one point was trading +1% higher after Nigel Farage announced that the Brexit Party would not run candidates in any of the 317 seats won by the Conservative Party in the 2017 election.

This in theory means it will be “easier” for Boris Johnsons Conservative Party to retain the seats it already holds as it won’t split the pro-Brexit vote. However, as we have learned over the past three years, nothing is ever straight forward when it comes to Brexit.

Complicating the issue for Prime Minister Boris Johnson, the Brexit Party will continue to run candidates in the seats won by Labour. To get the majority Boris Johnson needs to provide the platform to stand up to the EU during the transition period, the Conservatives still need to win some of the seats currently held by the Labour Party.

My preferred way of trading GBP has traditionally been via the EURGBP cross-rate rather than via the jet fuelled exchange rate that is GBPUSD. I must admit until recently I had taken all GBP currency rates off my screen after being on the wrong side of a number of Brexit headlines in the very early days.

With UK General Election exactly one month away and with it a likely Brexit resolution, below are the key points for EURGBP.

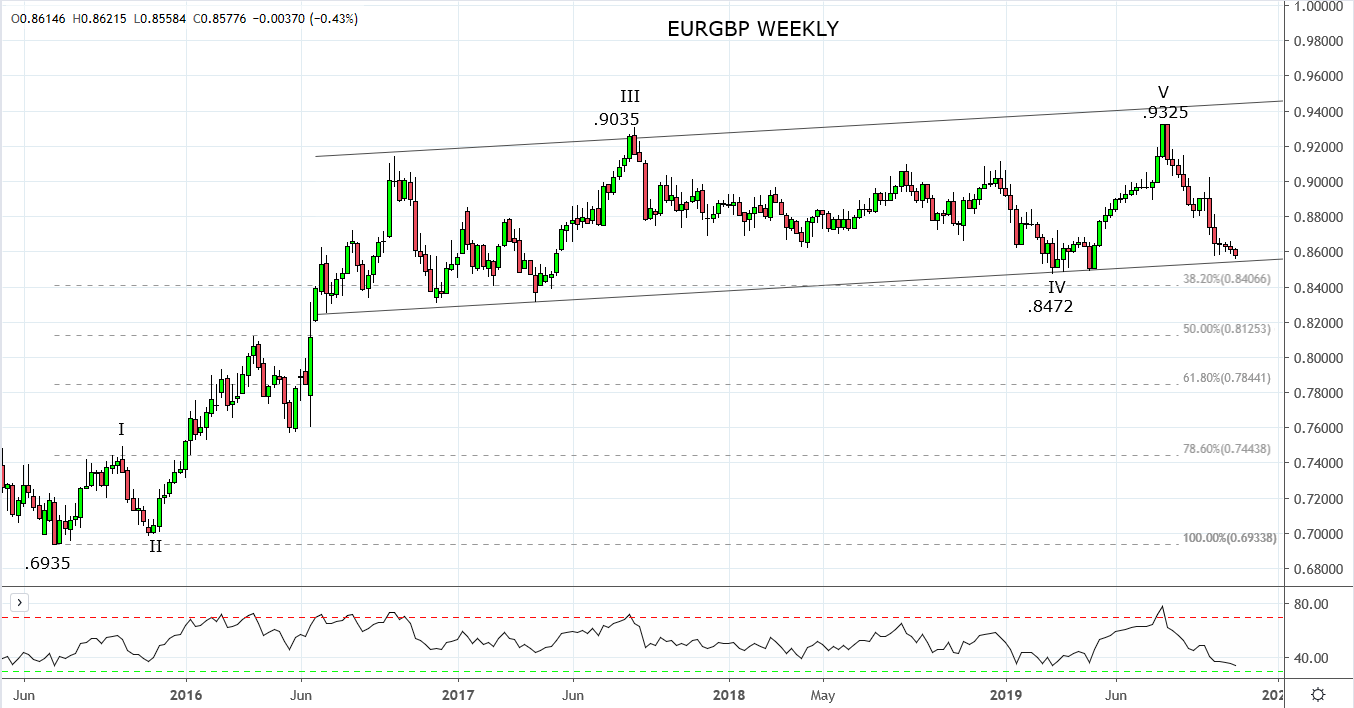

As can viewed on the weekly chart below, EURGBP completed a five-wave multiyear advance from the 2015 .6935 low at the .9325 high of August 2019. The subsequent decline from the .9325 high has resulted in EURGBP falling back towards trend channel support .8540 area. Not far below here is the year to date low at .8472. It is reasonable to expect these levels might hold if tested over the next month.

However, should the .8540/.8470 support region break, allow for EURGBP to fall towards the support offered by the 50% Fibonacci retracement at .8130/25 which coincidentally is just above the .8117 high the cross traded to just before the Brexit referendum in June 2016

Source Tradingview. The figures stated areas of the 12th of November 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.