Pound traders are staying focused on the Conservative leadership race. Boris Johnson yesterday, firmly reiterated his plan to remove the UK from the EU deal or no deal. The only reason the pound didn’t fall further was thanks to the rising opposition that Boris is encountering. Suggestions are circulating that 12 or so Conservative MP’s will join a vote of no confidence in the scenario of a no deal Brexit. Given that the new Prime Minister will only have a working majority of 3, a general election could be on the cards as soon as September.

What we are seeing is that whilst the figurehead at the helm might change as Theresa May is replaced, the undercurrents in Westminster are the same. With the political fog so dense and a low possibility of clearing there is little motivation for investors to buy into the pound, even a weak pound. With such elevated levels of political uncertainty, the pound is expected to keep its cautious tone.

The fact that the pound is skidding lower despite the BoE saying that it may need to raise interest rates reflects investor scepticism towards the central banks’ position. Given the broader global headwinds and dovish shifts from other central banks, a rate cut is looking more likely than any rate hike.

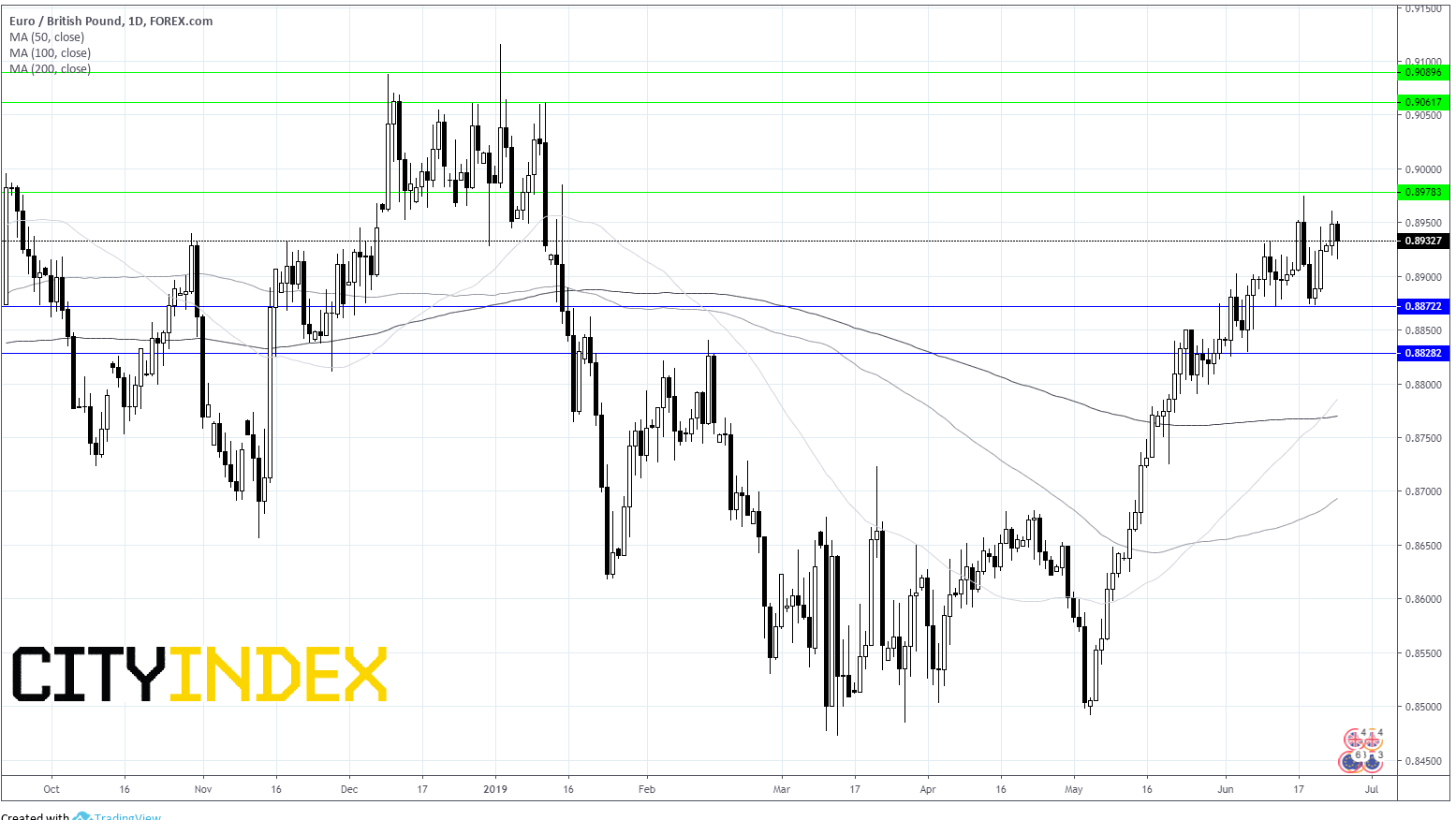

EUR/GBP Levels to watch;

Whilst the pound is stronger today, EUR/GBP remains above its 50, 100 & 200 ma on 4 hour chart. A break above 0.8974 would open the door to 0.9062 and finally 0.9092. On the other hand, the next support is located at 0.8872, followed by 0.8826.