Short-term technical outlook on EUR/GBP

click to enlarge charts

Key Levels (1 to 3 days)

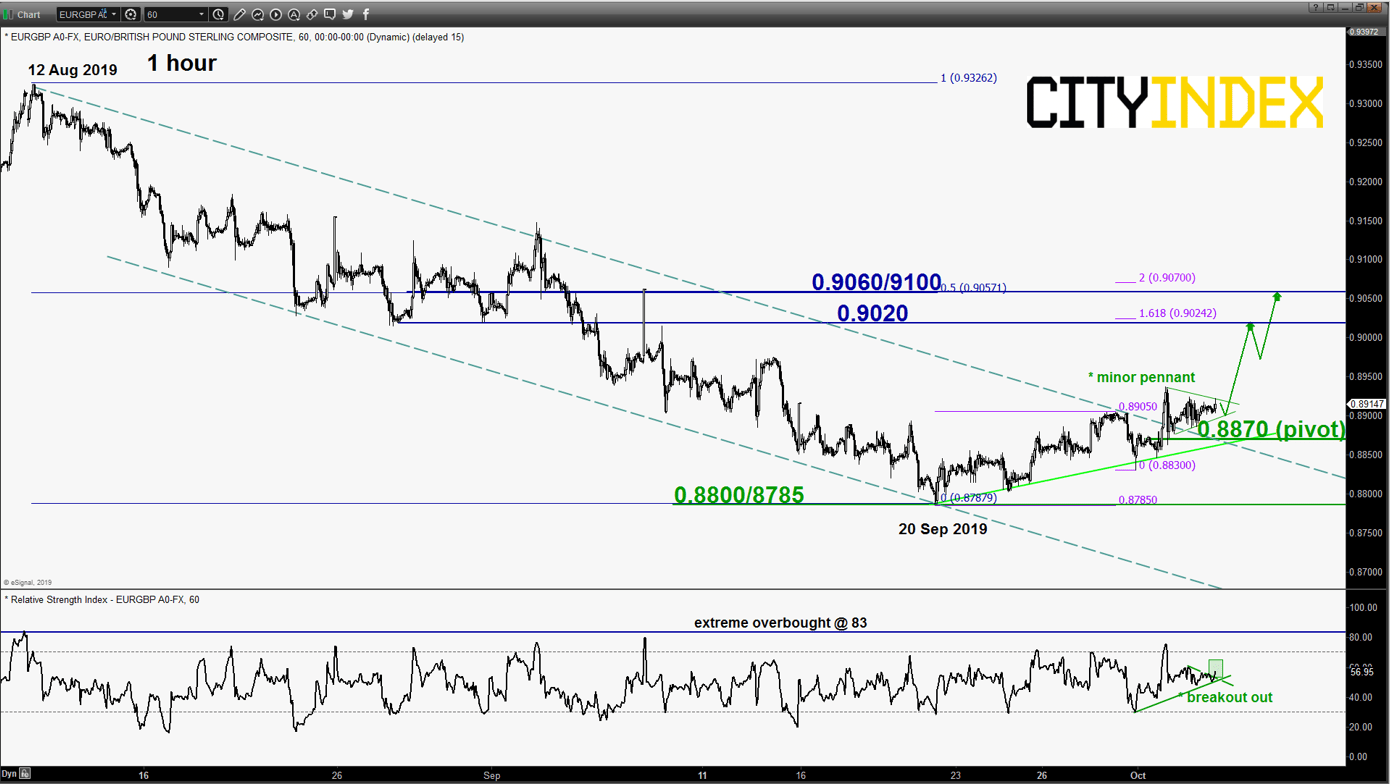

Pivot (key support): 0.8870

Resistances: 0.9020 & 0.9060/9100

Next support: 0.8800/8785

Directional Bias (1 to 3 days)

Bullish bias in any dips above the 0.8870 short-term pivotal support for a further potential push up to target the next intermediate resistances at 0.9020 and 0.9060/9100

On the other hand, a break with an hourly close below 0.8870 negates the bullish tone for a slide back to retest the 0.8800/8785 key medium-term support.

Key elements

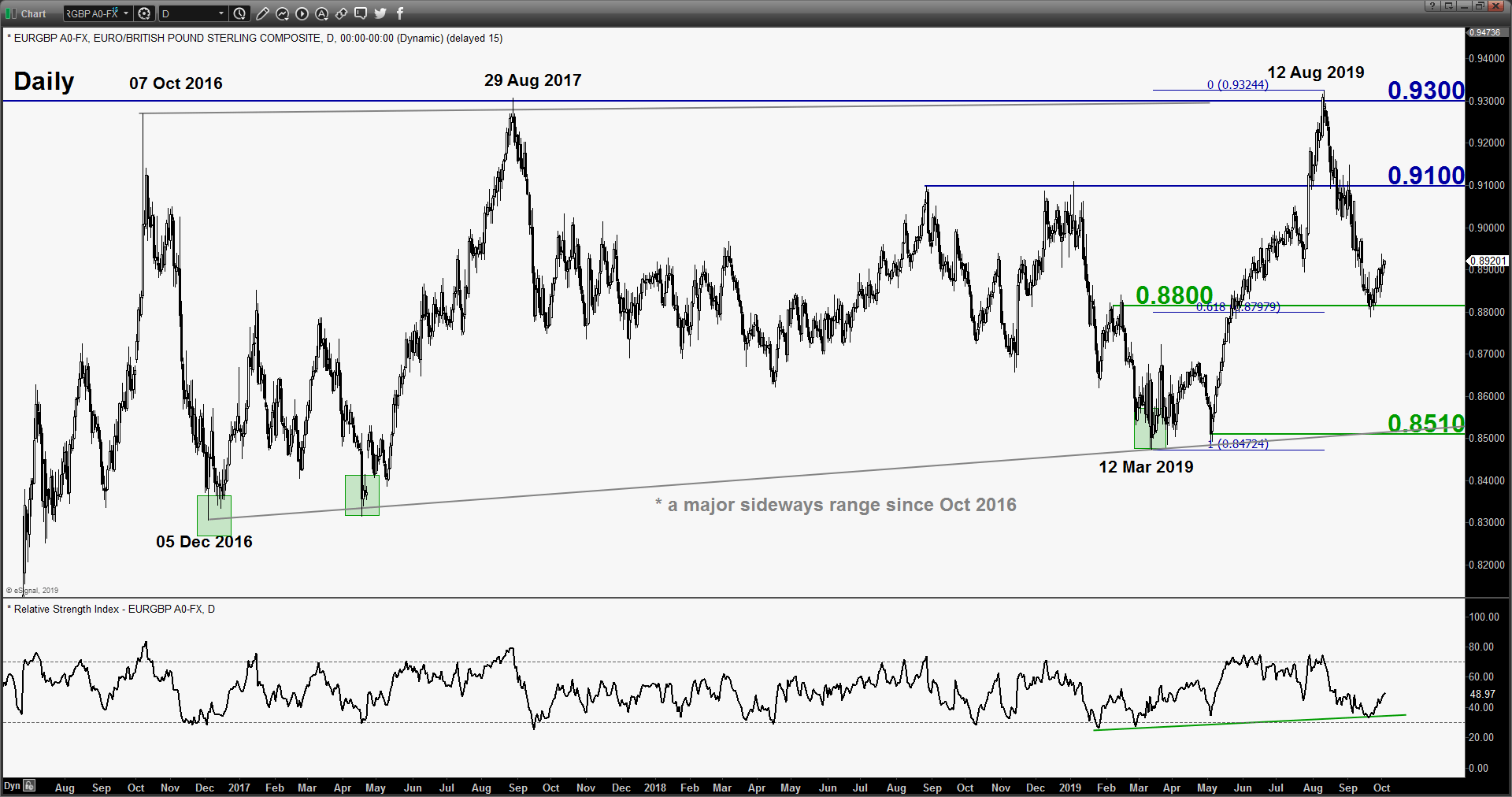

- The recent 6-weeks of 540 pips decline from its major range resistance of 0.9100 has stalled at former swing high area of 0.8800 seen in 14 Feb 2019 which also confluences with the 61.8% Fibonacci retracement of the prior multi-month of up move from 12 Mar to 12 Aug 2019 high.

- The daily RSI oscillator has also staged a rebound right at the significant corresponding ascending support in place since 12 May 2019 and close to its oversold region. These observations suggest that the decline from 12 Aug 2019 is overstretched with the probability of at least a multi-week mean reversion rebound increases at this juncture.

- In the shorter-term, the EUR/GBP cross pair has staged a bullish exit from a minor descending channel in place since 12 Aug 2019 high with former minor descending channel resistance now acting as a pull-back support at 0.8870.

- After the recent bullish breakout on 01 Oct 2019, the EUR/GBP has started to consolidate within a minor bullish range continuation “pennant” configuration from is recent minor swing high of 0.8937. In conjunction, the shorter-term hourly RSI oscillator has staged a bullish breakout above a corresponding resistance which indicates a pre-signal for a potential bullish breakout from the “pennant”.

- The next significant intermediate resistance of 0.9060/9100 is defined by the former swing high areas of 28 Aug 2018/03 Jan 2019 and a Fibonacci retracement/expansion cluster

Charts are from eSignal

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM