Medium-term technical outlook on EUR/CHF

click to enlarge charts

Key Levels (1 to 3 weeks)

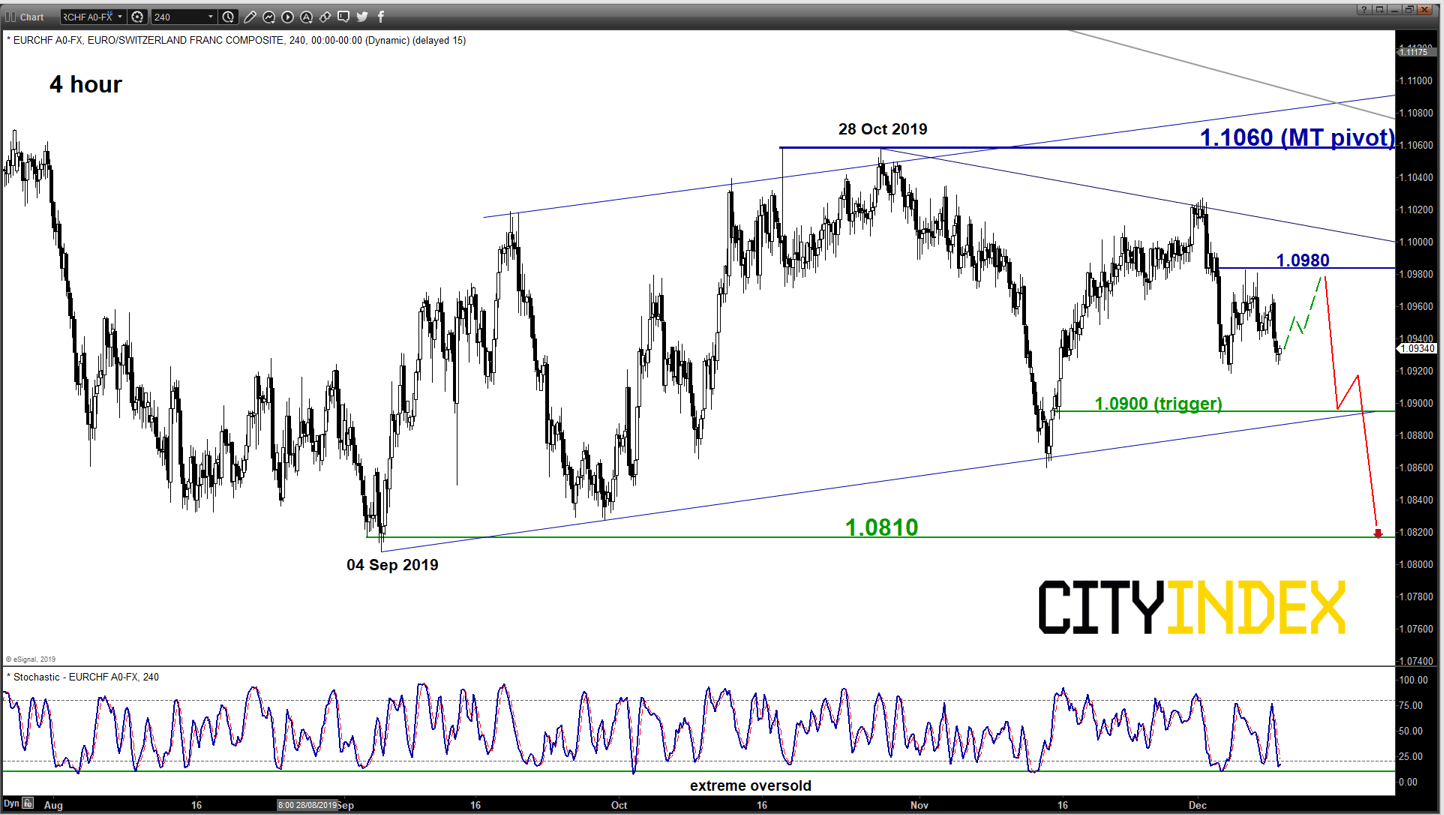

Intermediate resistance: 1.0980

Pivot (key resistance): 1.1060

Supports: 1.0900, 1.0810 & 1.0650

Next resistance: 1.1195

Directional Bias (1 to 3 weeks)

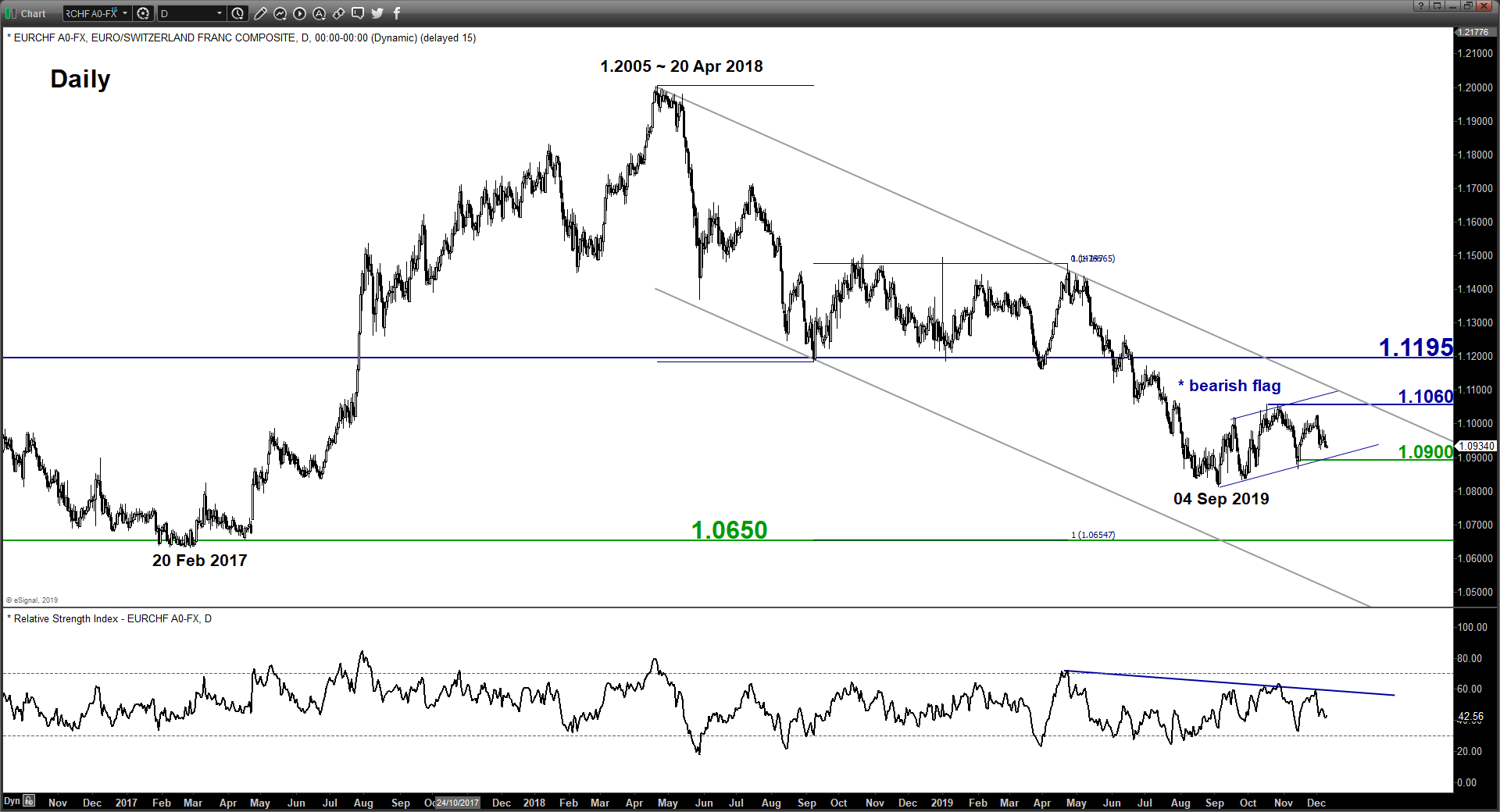

Bearish bias in any bounces below 1.1060 key medium-term pivotal resistance and a break below 1.0900 reinforces a bearish breakdown below the “bearish flag” ascending range configuration to target the 04 Sep 2019 swing low area of 1.0810 in the first step. Below 1.0810 sees a further slide towards 1.0650 (major range support from 24 Jun 2016/20 Feb 2017 & 1.00 Fibonacci projection of the down move from 20 Apr 2018 high to 07 Sep 2018 low projected from 23 Apr 2019 high)

However, a clearance with a daily close above 1.1060 invalidates the bearish scenario for a squeeze up to retest its major resistance at 1.1195 (former major range support from 07 Sep 2018/01 Apr 2019).

Key elements

- Since its 1.2005 high of 20 Apr 2018, the EUR/CHF cross pair has been evolving within a major descending channel with its upper boundary now acting as a resistance at 1.1060 that also confluences with a Fibonacci retracement/expansion cluster.

- The recent 2-month 250 pips rebound from its 04 Sep 2019 swing low area of 1.0810 has taken the form of a medium-term “bearish flag” ascending range configuration within a major downtrend phase in place since 20 Apr 2018 high.

- A “bearish flag” configuration tends to indicate a “dead cat” rebound before the bearish movement resumes, right now the support of the “bearish flag” rests at 1.0900.

- The shorter-term 4-hour Stochastic oscillator has reached an extreme oversold level which indicates that the EUR/CHF may see a bounce back to retest it minor range resistance at 1.0980 first before another potential downleg resumes.