In our note on the S&P500 yesterday, following a 30% rally that allowed the index to meet the recovery targets set in early April, we took the opportunity to move from a positive bias to a more neutral stance.

A move that appears to have come just in the nick of time, after more dislocation in markets emerged overnight as the price of crude oil for the the expiring West Texas crude futures contract plunged to a low near -$40.32/bbl, before closing at -$37.60/bbl.

This previously unthinkable move is another example of the damage that COVID-19 is inflicting on financial markets and is the result of an oversupply of oil and storage facilities at or near capacity - they are simply unable to accept any more supply. This is likely to hasten a rebalancing between supply and demand in the coming weeks.

There is chatter doing the rounds today that the overnight move in oil will have had dire consequences for hedge funds with May oil futures exposure, and this is presumably one of the reasons why regional equity markets are wobbling today. We think this is unlikely, as most speculators in deliverable markets elect to roll their positions a week or so before expiry to avoid this type of occurrence.

As way of playing both the rebalancing theme in crude oil and the return of a more cautious tone to risk markets, the chart pattern in EURCAD is of interest.

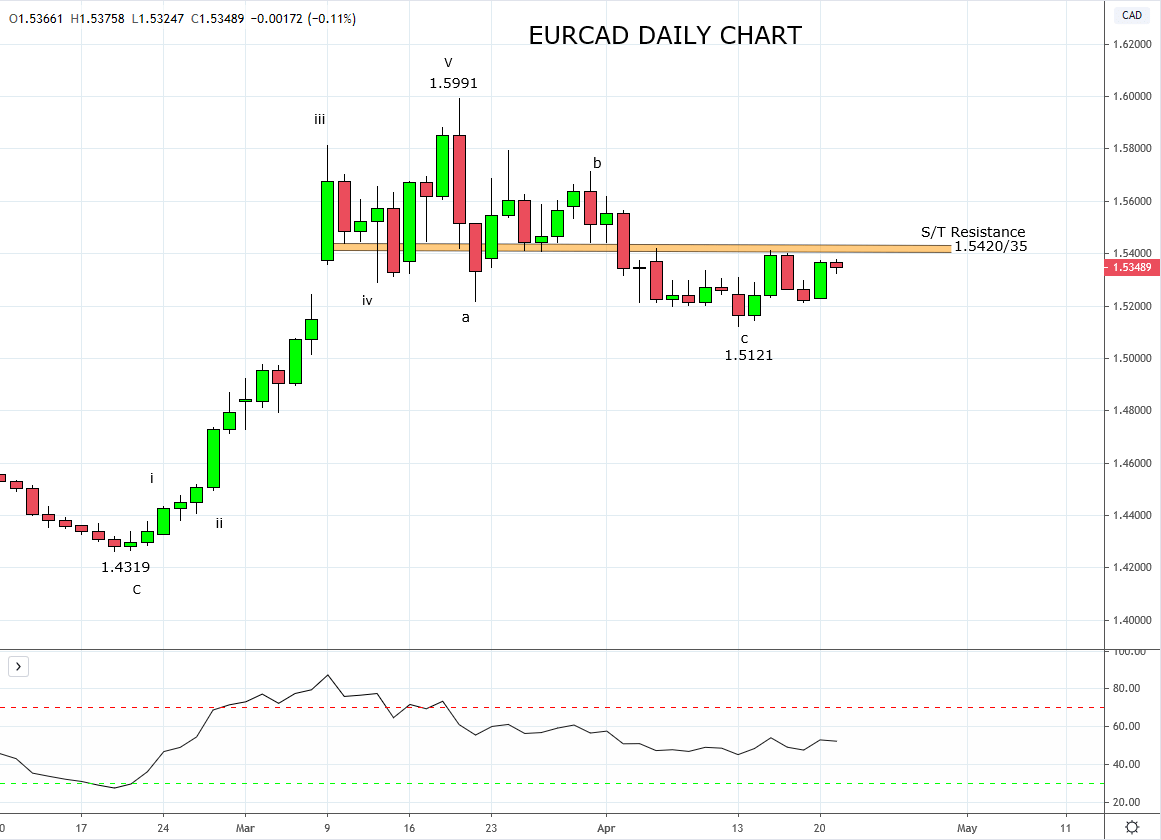

As can be viewed on the chart below, the retracement from the March 1.5991 high to last week’s 1.5121 low appears to be a corrective pullback (Wave iv), following the pairs impulsive run higher in March (Wave iii).

Should EURCAD, now break and close above recent highs and short term resistance 1.5420/35 it would be initial confirmation the uptrend has resumed and the catalyst to open longs.

If the long entry is triggered, the stop loss would be placed just below support at 1.5200 and trailed higher, presuming the pair continues to rally as expected. The target is a retest of March highs 1.5990 area.

Source Tradingview. The figures stated areas of the 21st of April 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation