Short-term technical outlook on EUR/CAD

click to enlarge charts

Key Levels (1 to 3 days)

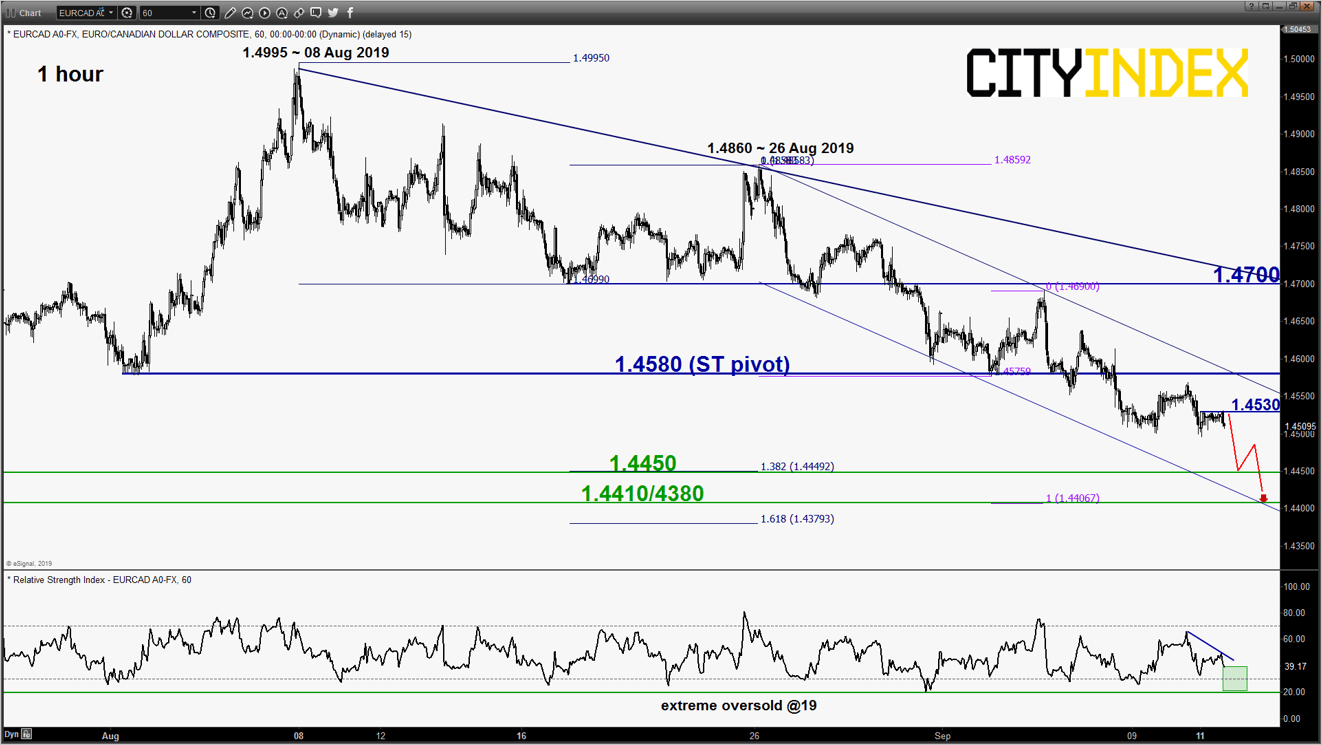

Intermediate resistance: 1.4530

Pivot (key resistance): 1.4580

Supports: 1.4450 & 1.4410/4380

Next resistance: 1.4700

Directional Bias (1 to 3 days)

Bearish bias below 1.4580 key short-term pivotal resistance for a further potential downleg to target the next near-term supports at 1.4450 and 1.4410/4380

On the other hand, a clearance with an hourly close above 1.4580 kickstarts a corrective rebound towards the key medium-term resistance at 1.4700,

Key elements

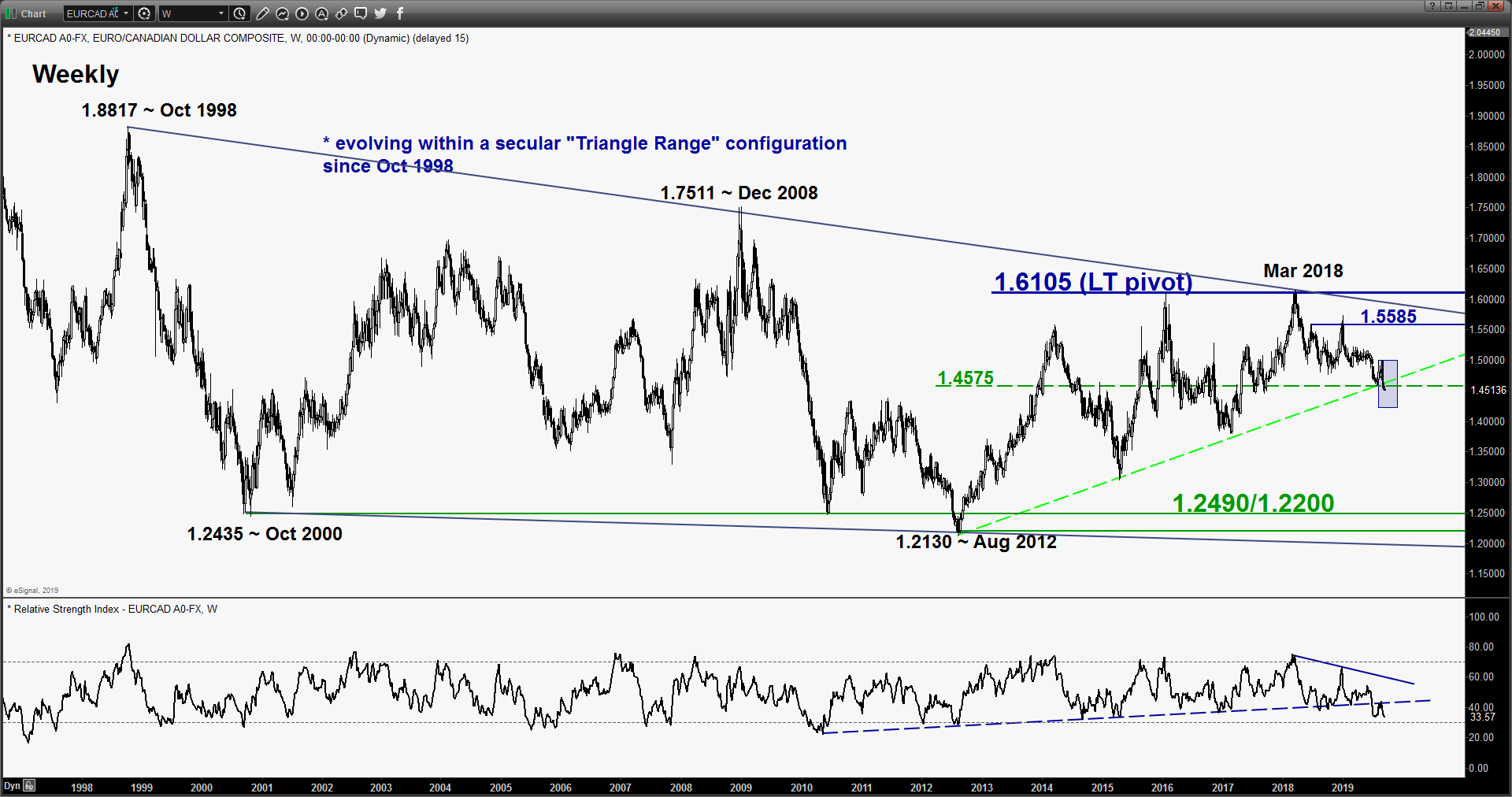

- The EUR/CAD cross pair has staged a bearish breakdown below a former major ascending support in place since Aug 2012 low now turns pull-back resistance t 1.4580 (see weekly chart).

- In the short to medium-term, the EUR/CAD is evolving within a minor descending channel in place since 26 Aug 2019 high with the upper boundary of the descending channel acting as at resistance at 1.4580 that confluences with the 23.6% Fibonacci retracement of the recent decline from 26 Aug 2019 high to yesterday, 10 Sep 2019 low of 1.4500.

- The next significant near-term support rests at 1.4410/4380 which is defined by the lower boundary of the minor descending channel and a Fibonacci projection cluster.

- Short-term downside momentum of price action remains intact as indicated by the 1-hour RSI oscillator where it still has room to manoeuvre to the downside before it reaches an extreme oversold level of 19.

Charts are from eSignal

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM