In yesterday’s article, we outlined a roadmap for the ASX200 to continue its recovery from its March low, albeit in a manner that would prove to be at times both violent and choppy due to a series of aftershocks stemming from COVID-19 crisis. This morning, aftershocks have been felt.

Firstly global credit rating agency Fitch downgraded the big four Australian banks' credit rating to A+ with a “negative” outlook, due to risks of rising bad debts and lower profits. This follows Australia’s banking watchdog APRA, warning yesterday that banks should cut dividend payments until there is clearer economic certainty.

Not to be outdone by a rival rating agency, S&P has this morning cut Australia’s AAA credit rating outlook to “negative” from “stable”. The cut is in response to a stalling domestic economy and the big increase in federal government spending designed to help insulate the economy and support workers during the slowdown.

While these developments are not entirely unexpected, it has translated into selling of the Australian banking sector this morning as viewed by the share price of Westpac falling over -3.6% at the time of writing. Negative sentiment has also flowed through into the currency and the Australian dollar is trading lower against both the U.S. dollar and the Euro.

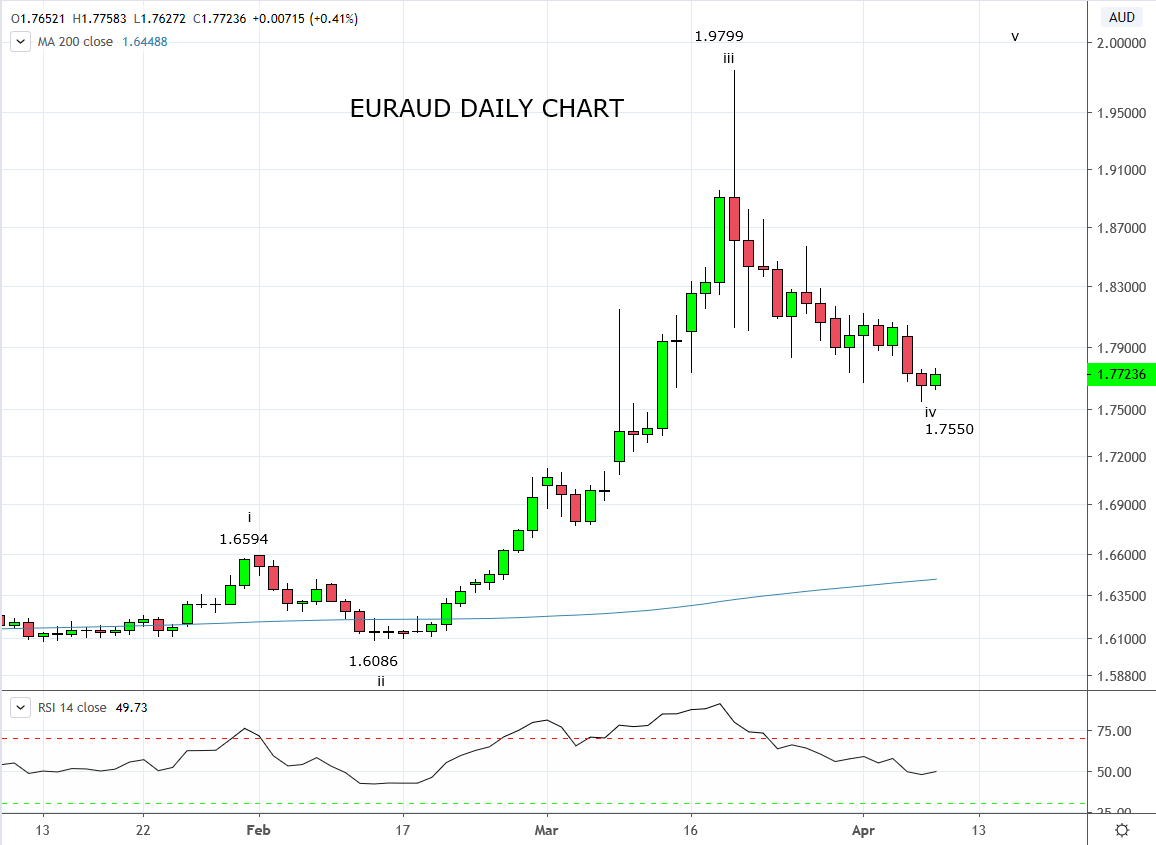

In this light, EURAUD is a currency pair that warrants further investigation. The 22 big figure retracement from its March 1.9799 high to the overnight 1.7550 low is viewed as a correction (Wave iv) following the pairs impulsive run higher from 1.6100 to 1.9799 (Wave iii).

The formation of a loss of momentum candle at the 1.7550 overnight low warns the corrective pullback is close to completion. Should EURAUD hold above 1.7550 and then push/close above short term resistance at 1.7760/90 it would be initial confirmation that the uptrend has resumed with scope to upside targets at 1.8030/50 and then 1.8550.

From a risk-reward perspective, this an attractive trade, although we would like to remind in the current volatility to reduce position size accordingly.

Source Tradingview. The figures stated areas of the 8th of April 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation