EUR/USD initially fell Thursday morning as European Central Bank (ECB) President Mario Draghi delivered remarks that continued to indicate the ECB’s willingness to “ensure that an appropriate degree of monetary accommodation is maintained.” This essentially refers to the readiness of the ECB to extend its stimulus measures in the form of further quantitative easing.

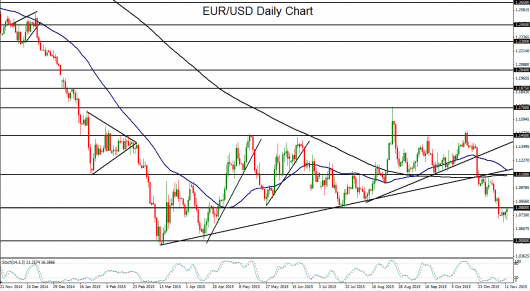

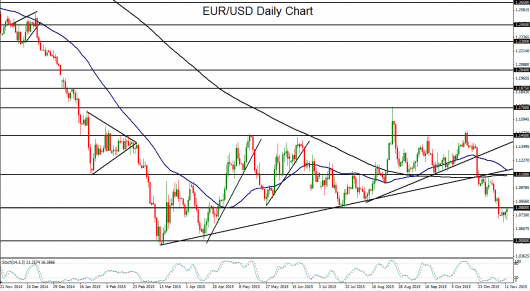

Coupled with a strong dollar early on Thursday, these dovish remarks helped push EUR/USD down to a low of 1.0690, just above Tuesday’s half-year low of 1.0673, before rebounding later in the day.

For the past month, since mid-October, EUR/USD has made a steep decline that has been prompted by both an increasingly hawkish-leaning Fed along with a dovish-leaning ECB. This divergence in monetary policy continues to weigh on the currency pair.

Late last week, the exchange rate broke down below major support at the key 1.0800 level after a surprisingly strong US non-farm payrolls employment report led to a sharp surge for the US dollar as the data further supported the case for a Fed rate hike in December.

Since last week, price action has remained mired under 1.0800, now as a tentative resistance level, though Thursday’s EUR/USD rebound has retested this resistance.

Despite this rebound, if the currency pair manages to continue trading under 1.0800, the outlook remains significantly bearish, especially in light of the noted divergence in monetary policy between the ECB and the Fed.

In the run-up to December’s Fed meeting, further Fed-driven dollar-support and the likelihood of more stimulus measures from the ECB could place EUR/USD on a track towards 1.0500 support, near March’s long-term lows. Any further downside momentum below 1.0500 could move the currency pair towards its long-term target at parity (1.0000).