EUR JPY Mind the gap

On Wednesday of last week, we published a mostly technical piece on the EUR/JPY. As you may recall, we noted that the rally had stalled […]

On Wednesday of last week, we published a mostly technical piece on the EUR/JPY. As you may recall, we noted that the rally had stalled […]

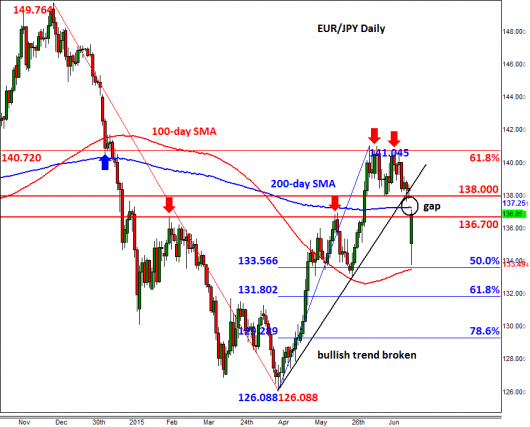

On Wednesday of last week, we published a mostly technical piece on the EUR/JPY. As you may recall, we noted that the rally had stalled around the 61.8% Fibonacci retracement level of the downswing from the December peak at 140.70. The 61.8% Fibonacci level represents a deep retracement, which together with the slowdown in the bullish trend, led us to think that the EUR/JPY would probably break out from its bullish channel and that could lead to a significant drop. As it turned out, this is almost exactly what has happened with price reaching a couple of our targets too.

However like most other financial markets, the EUR/JPY has recovered strongly after creating a massive gap at the open. Gaps often get “filled” before price resumes its move in the same direction. With the case of the EUR/JPY, most of its overnight gap has now been filled, though some still remain above 137.00 and below 138.00. So, there is still the possibility for price to push a further 100 pips or so higher until at least the 138.00 handle. But standing on the way to the 138.00 level is the 200-day moving average at 137.25. Given the importance of this moving average and the fact that most of the gap has been filled already, there is also a good chance that the EUR/JPY may not get to that 138.00 after all.

In any case, as the EUR/JPY has already broken its bullish trend line, the path of least resistance is clearly to downside. A close back below the 136.70 support either today or tomorrow would be a bearish development which could lead to further weakness in the days ahead. There are not many immediate support levels below 136.70. The key support level is around 133.55 where the 100-day moving average meets the 50% retracement level of the upswing from the April low. Thereafter is the 61.8% retracement of the same price swing at 131.80 and then nothing that significant until the April low itself at 126.10. Meanwhile a decisive closing break above 138.00 would invalidate this bearish setup.