EUR JPY channelling focus on 138

Today we are looking at the technical outlook for the EUR/JPY, which has been climbing higher inside a bullish channel since bottoming out around 126.00 […]

Today we are looking at the technical outlook for the EUR/JPY, which has been climbing higher inside a bullish channel since bottoming out around 126.00 […]

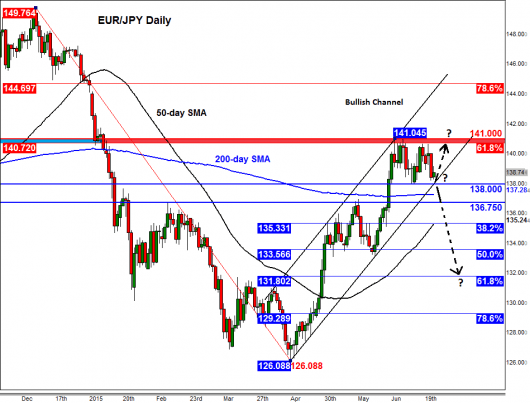

Today we are looking at the technical outlook for the EUR/JPY, which has been climbing higher inside a bullish channel since bottoming out around 126.00 in early April. But the rally has now stalled with the pair finding strong resistance around the area between 140.75 and 141.00. As can be seen on the chart, as well as this area being a previous support/resistance it also corresponds with the 61.8% Fibonacci retracement level of the last major downswing – i.e. from the December peak of 149.75. Given this deep retracement and the slow-down in the bullish trend, we wouldn’t be surprised if the EUR/JPY were to form a top here. Indeed, a potential break out from the bullish channel could lead to a significant withdrawal of bids and potentially an increase in selling activity.

The key support level that the bears will need to take out is at 138.00 – the low from earlier this month. Below here we have the 200-day moving average at 137.30 and the previous resistance at 136.75; these levels could offer some short term support. A potential break below 136.75 could be a very bearish outcome which could lead to an eventual drop to the 38.2% or even the 61.8% retracement levels of the upswing from April, at 135.35 and 131.80 respectively.

Meanwhile if support at 138.00 holds once more then we wouldn’t rule out the possibility for a bounce back to the abovementioned resistance area of 140.75-141.00. And if price were to climb back all the way there then there is no reason why it shouldn’t be able to rally beyond that point. Indeed a decisive break above 140.75/141.00 would signal that a major upward continuation is underway.

In short, the EUR/JPY is dropping towards a key technical juncture, namely 138.00. What happens here could determine at least the near-term direction. Given the extent of the recent rally, we suspect price may break below here and lead to a sharp sell-off.