From here things don’t appear to be so clear cut. One near term catalyst, the European Union summit held in Brussels this past weekend ended in a stalemate as the “frugal five” (Austria, Sweden, Denmark, Finland, and the Netherlands) dug their heels in over the size and shape of the coronavirus recovery fund.

Specifically, the “frugal five” want to reduce the proportion of the EUR 750bn fund that will be grants rather than loans. They also want tighter conditions and controls in place to govern how the money is spent. Not an unreasonable request from this writer's point of view.

While no agreement was expected from the summit, the extent of the divide, creates some modest pullback risks in the EURUSD, EURCHF as well as the DAX, the German stock index we wrote a bullish article on in early July here.

“A break/daily close above the downtrend resistance at 12400 would be a positive development and the trigger to consider opening longs in the DAX. The positive bias would then be magnified on a break above the 12591 high which would then open up a retest and break of the 12867 high.”

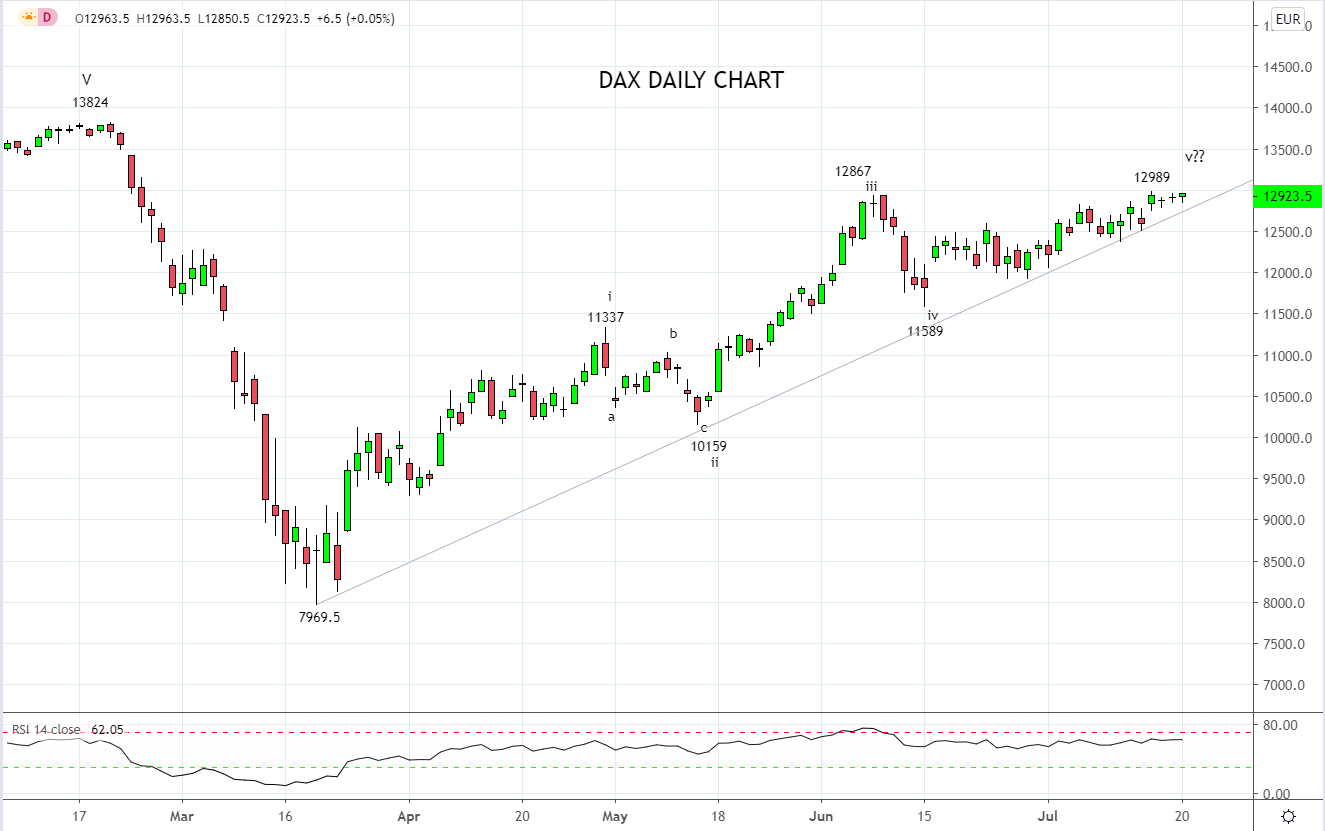

This call worked out well as the DAX made fresh cycle highs last week. However, in light of the macro reasons outlined above and because of the Elliott Wave count below that indicates that the DAX is in the terminal stages of a 5-wave advance, we now move to a more cautious stance.

While we don’t want to pre-empt the end of what has been a robust recovery, we would suggest using a break and daily close below uptrend support at 12700ish as an initial sign the DAX has commenced a pullback towards the mid-June 11589 low.

Source Tradingview. The figures stated areas of the 20th of July 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation