The heavily-shorted pound has come back to life in the past three trading days. It has been lent buoyancy first and foremost by profit-taking from those who had sold the currency at much higher levels when the risks associated with the possibility of Britain leaving the EU were still under-priced. While the so-called “Brexit” risks haven’t exactly diminished as the polls are still very tight, it is possible that this potential scenario may be mostly priced in. In addition, today’s stronger UK inflation figures have raised a few eyebrows and possibly a few bullish bets on the Cable, too. According to the ONS, the Consumer Price Index (CPI) in March stood at a good +0.5% year-over-year, versus +0.3% the month before. More significantly, the core CPI measure of inflation has now risen to a 15-month high of +1.5%. Obviously one month’s worth of data is insignificant, but definitely not unnoticeable for the Bank of England’s Monetary Policy Committee. Consider this: if oil prices continue their sharp recovery, inflation in the UK, and indeed many other countries, could soon overshoot expectations. All of a sudden, the MPC could awaken from its long slumber and start raising interest rates, perhaps at a faster pace than anticipated.

But make no mistake – it won’t be a “Super Thursday” this week; the on-going Brexit saga means the MPC will almost certainly hold off fire and that’s indeed what everyone in the market is expecting. However, if the BoE does start to talk up the prospects of rising inflation then the market may interpret this as a sign that UK interest rates may start to rise once the EU referendum is out of the way. In any event, the potential gains for the pound will likely remain limited until the June 23 vote.

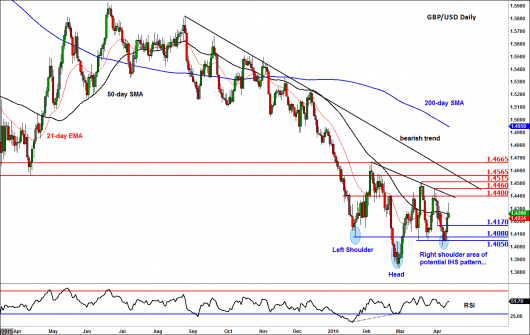

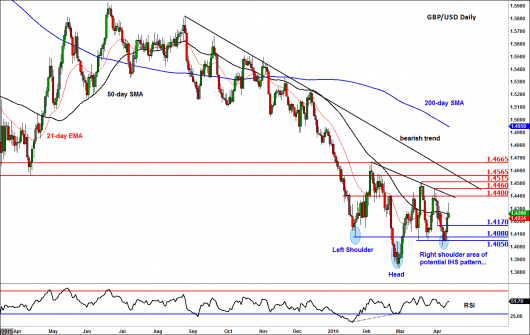

Last week, we highlighted the possibility for a sharp rebound in the GBP/USD pair as it dropped to test some significant support levels. As a reminder, the monthly chart, which shows repeated bounces from around the 1.4 handle, formed an inside bar formation in March. This is a potentially bullish scenario. However so far this month, there has been no follow-through in buying momentum on this time frame. But this could change because the Cable has rallied quite strongly in recent days off of the noted right shoulder area of a potential Inverse Head and Shoulders (IHS) pattern around the 1.40 level – see the shaded area on the daily chart, below.

The GBP/USD has already broken down several resistances such as 1.4080 and 1.4170, levels which could turn into support upon re-test. On the upside, the next potential resistance levels to watch include the short-term bearish trend around 1.4400 area, which also represents the neckline of the IHS pattern. The previous highs at 1.4460 and 1.4515 are also among the levels that should be watched. But the pivotal area is between 1.4565 and 1.4665 which was previously support and resistance. A more significant bearish trend also cuts through this region. So, there are lots of hurdles for the Cable to tackle before one can become more confident about the prospects of a much larger recovery.

Indeed, this is not the first time the GBP/USD has staged this kind of a bounce before the sellers have re-emerged. It could be another such occasions, so proceed with extra care – especially while the bearish trends are intact.