Ahead of the publication of UK and US inflation figures on Tuesday, the pound had hit a 2.5-week high against the euro and climbed noticeably against the US dollar. This was in response to receding Brexit concerns after fresh polls had shown the “In” camp was well in the lead, ahead of Britain’s June 23 referendum on the European Union membership. So, when the UK CPI measure of inflation came out weaker than expected, the response in the FX markets was fairly muted. Indeed, the pound even managed to extend its earlier advance against some of the weaker currencies such as the Canadian dollar, which fell as oil prices retreated after hitting fresh 2016 highs, apparently on profit-taking. In the afternoon, the GBP/USD made another attempt to break lower after the latest US inflation figures came out mixed. But as we go to press, the Cable was still managing to hold its own relatively well, which is a bullish sign given the unfavourable data for the bulls.

Clearly, traders are putting more weight towards changes in the probably of Brexit than those in domestic economic data, at least when it comes to trading the pound. We think that this behaviour of the market is likely to remain in place until after the outcome of the vote becomes clear. As such, Wednesday’s UK wage and jobs figures, for example, may not be able to hold down the currency sustainably in the event the data comes out weaker than anticipated.

The latest polls in the Telegraph and Guardian showed the “In” camp’s lead over “Out” stood at 15 and 8 points, respectively. According to Betfair, the implied probability of a vote for Britain to stay in the EU rose to 73% on Tuesday. Should the probability of Brexit falls further then the pound may be able to sharply extend its recent recovery.

But it will struggle to do so if UK data continues to disappoint expectations. The 0.3% year-over-year rise in April CPI means inflation is well below the Bank of England’s 2% target, so a rate rise later this year is looking almost impossible at this stage. The only inflation in the UK is in the housing market, which may be a reason why interest rates should go up once the UK-EU referendum is out of the way. However, the growth in UK wages has also slowed down sharply in recent months. This will need to pick up steam once more if we are to see inflation get closer to the BoE’s target any time soon.

The ONS will release the April wage and labour market data on Wednesday morning. The now closely-watched three-month moving average of wages including bonuses is expected to have moderated to 1.7% from 1.8% previously. The unemployment rate is seen steady at 5.1%, while jobless claims are expected to have risen by 4 thousand applications in April. The April retail sales data will be released on Thursday.

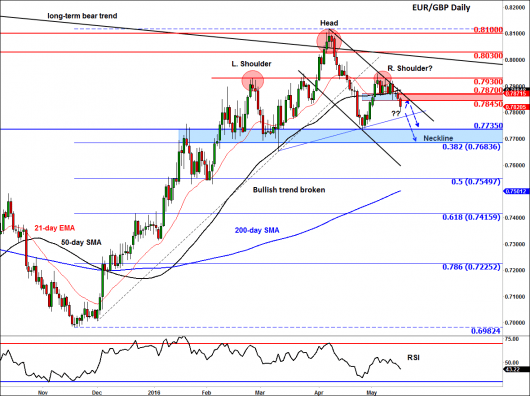

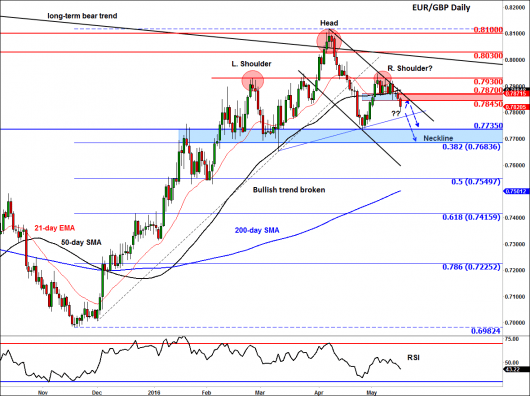

EUR/GBP: Pound head and shoulders above euro

As I reported in our previous Brexit piece, the recent recovery in this pair seems to be stalling once again which is good news for those who think that Brexit odds are still overstated. The cross has turned around at a level that makes technical sense: 0.7930. This area had been a key resistance-turned-support level in the past. Now that the EUR/GBP has pulled away from this level it has formed the right shoulder of a potential ‘Head and Shoulders’ reversal pattern. This pattern will be completed if the neckline, around the 0.7680-0.7735 area, breaks. Encouragingly for the sellers, price has now pushed below short-term support and the 50-day moving average around the 0.7845/70 region. This area had offered decent support in recent days.

As things stance, the bearish outlook would only become invalid upon a rally above the right shoulder area of 0.7930. But in this scenario, price will then face further key resistance levels ahead which means the potential gains could still be limited. In our view, the most import area of resistance is around 0.8030-0.8100 where previous highs meet a long-term bearish trend line and a couple of Fibonacci levels. In the very short-term outlook, a retest of the now-broken 0.7845-0.7870 region could lead to renewed selling-pressure.