EU indices up this morning | TA focus on Randstad

INDICES

Yesterday, European stocks were mixed, with the Stoxx Europe 600 Index easing 0.4%. Germany's DAX 30 dropped 1.2%, France's CAC 40 declined 1.1%, while the U.K.'s FTSE 100 edged up less than 0.1%.

EUROPE ADVANCE/DECLINE

62% of STOXX 600 constituents traded lower or unchanged yesterday.

59% of the shares trade above their 20D MA vs 69% Tuesday (below the 20D moving average).

22% of the shares trade above their 200D MA vs 22% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.3pt to 34.81, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

health care, food & beverage, financial services

Europe worst 3 sectors

energy, travel & leisure, banks

INTEREST RATE

The 10yr Bund yield fell 2bps to -0.58% (below its 20D MA). The 2yr-10yr yield spread fell 2bps to -24bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Mar Industrial Production MoM, exp.: 0.3%

FR 07:45: Mar Current Account, exp.: E-3.8B

FR 07:45: Mar Balance of Trade, exp.: E-5.2B

FR 07:45: Mar Industrial Production MoM, exp.: 0.9%

FR 07:45: Q1 Private Non Farm Payrolls QoQ Prel, exp.: 0.5%

EC 08:00: ECB Annual Report 2019

EC 08:30: Apr Construction PMI, exp.: 33.5

FR 08:30: Apr Construction PMI, exp.: 35.2

GE 08:30: Apr Construction PMI, exp.: 42

UK 08:30: Apr Halifax House Price Idx YoY, exp.: 3%

UK 08:30: Apr Halifax House Price Idx MoM, exp.: 0%

FR 10:00: 10-Year OAT auction, exp.: 0.04%

UK 12:00: BoE Inflation Report

UK 12:00: BoE Interest Rate Decision, exp.: 0.1%

UK 12:00: BoE Quantitative Easing, exp.: £645B

UK 12:00: MPC Meeting Minutes

UK 12:00: BoE MPC Vote Hike, exp.: 0/9

UK 12:00: BoE MPC Vote Unchanged, exp.: 44083

UK 12:00: BoE MPC Vote Cut, exp.: 0/9

UK 00:01: May Gfk Consumer Confidence Flash, exp.: -34

MORNING TRADING

In Asian trading hours, EUR/USD was flat at 1.0800 while GBP/USD slipped further to 1.2327. USD/JPY held above the 106.00 level. AUD/USD bounced to 0.6418. This morning, government data showed that China's exports grew 3.5% on year in April (-11.0% expected), while imports dropped 14.2% (-10.0% expected). Also, China's Caixin Services PMI rose to 44.4 in April (50.1 expected) from 43.0 in March.

Spot gold held rebounded to $1,692 an ounce.

#UK - IRELAND#

InterContinental Hotels Group, a global hotel group, provided a 1Q trading update: "Following a solid performance in the first two months of 2020, occupancy levels dropped to historic lows in March and April, as social distancing measures and travel restrictions came into effect around the world. Global RevPAR in the first quarter declined by 25%, including a 55% decline in March, and we anticipate April to be down by around 80%. (...) In the US, RevPAR was down 19.6% for the quarter and 49% in March, (...) First quarter RevPAR in Greater China was down 65.3%. (...) Our previously announced measures are expected to result in a reduction of up to 150 million dollars in our Fee Business costs; (...) we anticipate gross capital expenditure of ~150 million dollars for 2020, a saving of ~100 million dollars versus 2019."

Rolls-Royce, a major aerospace engine maker, said: "We now expect to deliver up to 1.0 billion pounds of cash savings in 2020. The cancellation of the final 2019 shareholder payment has also conserved an incremental 137 million pounds of cash flow. An additional revolving credit facility of 1.5 billion pounds was secured to bolster the Group's liquidity position and a successful syndication process with a larger group of banks has increased this to 1.9 billion pounds. (...) Due to the unprecedented reduction in air traffic caused by COVID-19, we are anticipating a significant net cash outflow during the second quarter and it remains too early to guide on the likely outcome for the full year."

RSA Insurance Group, an international general insurer, posted a 1Q trading update: "Insurance market conditions were largely unchanged in Q1 with little time for a COVID-19 effect. (...) Group net written premiums of 1,521 million pounds were down 1% ex. exits vs Q1 2019 (down 2% inc. exits) and in line with our plans (...) The Group business operating profit for Q1 was up by double digit percentages, both including and excluding exit portfolios, with an improved combined ratio and slightly lower investment income (as guided). (...) The Group's estimated Solvency II coverage ratio was 151% at 31 March 2020 (31 December 2019: 168%), reflecting COVID-19 driven market impacts and planned pension contributions, (...) Specific COVID-19 related claims are arising in travel insurance (which benefit from substantial reinsurance protection), wedding cancellation insurance (UK impacts) and for commercial lines business interruption and related policies."

IAG, an airline group, posted 1Q results: "In quarter 1 we're reporting a substantial operating loss of E535 million before exceptional items compared to an operating profit of E135 million last year. Total operating losses including exceptional items relating to fuel and foreign currency hedges came to E1,860 million. (...) We are planning for a meaningful return to service in July 2020 at the earliest, (...) However, we do not expect passenger demand to recover to the level of 2019 before 2023 at the earliest." At the same time, the company announced that Luis Gallego will succeed Willie Walsh as CEO on September 24.

Melrose Industries, an industrial conglomerate, posted a trading update for the four months from January 1 to April 30: "The Group traded in line with expectations from 1 January 2020 until mid-March 2020, at which point the worldwide impact from COVID-19 caused significant disruption, resulting in many factories being shut or remaining only partially open. As a result of the effects from COVID-19, Group sales in the Period were down approximately 20% versus the same period last year."

Burberry, a luxury fashion house, was upgraded to "buy" from "hold" at HSBC.

#GERMANY#

Puma, a sportswear company, announced that 1Q net income plunged 61.6% on year to 36 million euros and EBIT declined 50.1% to 71 million euros on revenue of 1.30 billion euros, down 1.5% (-1.3% currency adjusted). The company added: "In May 2020, PUMA secured a new revolving credit facility of E 900 million through a banking consortium of twelve banks, (...) we expect the financial per-formance in the second quarter to be worse than in the first quarter. The development over the coming weeks and months is so unpredictable that we cannot provide a reliable financial outlook for the full year 2020."

HeidelbergCement, a building materials supplier, posted 1Q results from current operation rose 5% on year to 59 million euros while revenue dropped 7% (-8% like-for-like) to 3.93 billion euros. Regarding 2020 outlook, the company stated: "Because of the significant decline in construction activity in many countries from mid-March due to stipulated production downtimes, the company expects a negative impact on revenue and results."

Uniper, an energy company, was upgraded to "overweight" from "neutral" at JPMorgan.

#FRANCE#

Air France-KLM, an airline group, announced that 1Q net loss widened to 1.80 billion euros from 0.32 billion euros in the prior-year period, citing "Covid-19 related over hedging -455 million euros, release of deferred tax assets -173 million euros and impairment of Boeing 747 aircraft -21 million euros". Also, EBITDA loss amounted to 61 million euros, compared with an EBITDA of 443 million euros last year, and revenue was down 15.5% to 5.02 billion euros. Regarding the outlook, the company said: "The Group now anticipates: (...) A prolonged negative impact on passenger demand, not expected to recover to pre-crisis levels before several years. (...) The Group foresees significantly negative EBITDA in full year 2020 and a significantly higher current operating income loss in the second quarter than in the first quarter 2020.

Legrand, an industrial group, reported that 1Q net income fell 12.2% on year to 167 million euros and operating profit slid 9.1% to 260 million euros on revenue of 1.52 billion euros, down 2.2% (-7.3% organic growth). The company added: "Sales continued their organic fall in April 2020, with a retreat of -41% for the month alone that confirmed trends observed in the second half of March in several countries. On this basis, Legrand anticipates a marked decline in sales in the second quarter of 2020, reflecting the adoption of many lockdown measures. Compared to the second quarter of 2020, and subject to a favorable trend in the global health situation, the second half of the year should see a sequential improvement."

EssilorLuxottica, an eyewear conglomerate, was downgraded to "sell" from "hold" at Societe Generale.

#SPAIN#

Telefonica, a telecommunications group, announced that 1Q OIBDA dropped 11.8% on year to 3.76 billion euros on revenue of 11.37 billion euros, down 5.1% (-1.3% organic growth). The company said it has withdrawn its 2020 financial guidance "due to the significant changes in the guidance scenario and context". At the same time, the company reported that it has reached an agreement with Liberty Global to form a 50-50 joint venture, combining their U.K. businesses Virgin Media and O2. Regarding the deal, the company stated: "Both parties expect to receive net cash proceeds at closing following a series of recapitalizations that will generate £5.7 billion in proceeds for Telefonica and £1.4 billion for Liberty Global."

BBVA, a Spanish bank, was downgraded to "neutral" from "overweight" at JPMorgan.

#BENELUX#

AB InBev, a drink and brewing company, announced that it swung to a 1Q normalized net loss of 845 million dollars from a normalized net profit of 2.40 billion dollars in the prior-year period. Normalized EBITDA dropped 13.7% to 3.95 billion dollars on revenue of 11.00 billion dollars, down 5.8%. Regarding the outlook, the company stated: "We expect that the impact on our 2Q20 results will be materially worse than in 1Q20. This has already become evident in our April 2020 global volumes, which declined by approximately 32%, primarily driven by the closure of the on-premise channel in most markets and government restrictions imposed on certain operations of ours in connection with the COVID-19 pandemic."

ArcelorMittal, a steel producer, reported that it swung to a 1Q net loss of 1.12 billion dollars from a net profit of 414 million dollars in the prior-year period. EBITDA declined 41.5% on year to 0.97 billion dollars on revenue of 14.84 billion dollars, down 22.6%. The company expects 2Q EBITDA of 0.40 - 0.60 billion dollars and said it has decided to suspend dividend payments, citing "significant cost savings measures being taken across the business" due to the COVID-19.

DSM, a global science-based company, posted 1Q net income slid 14% on year to 168 million euros and adjusted EBIT fell 3% to 272 million euros on revenue of 2.29 billion euros, broadly flat.

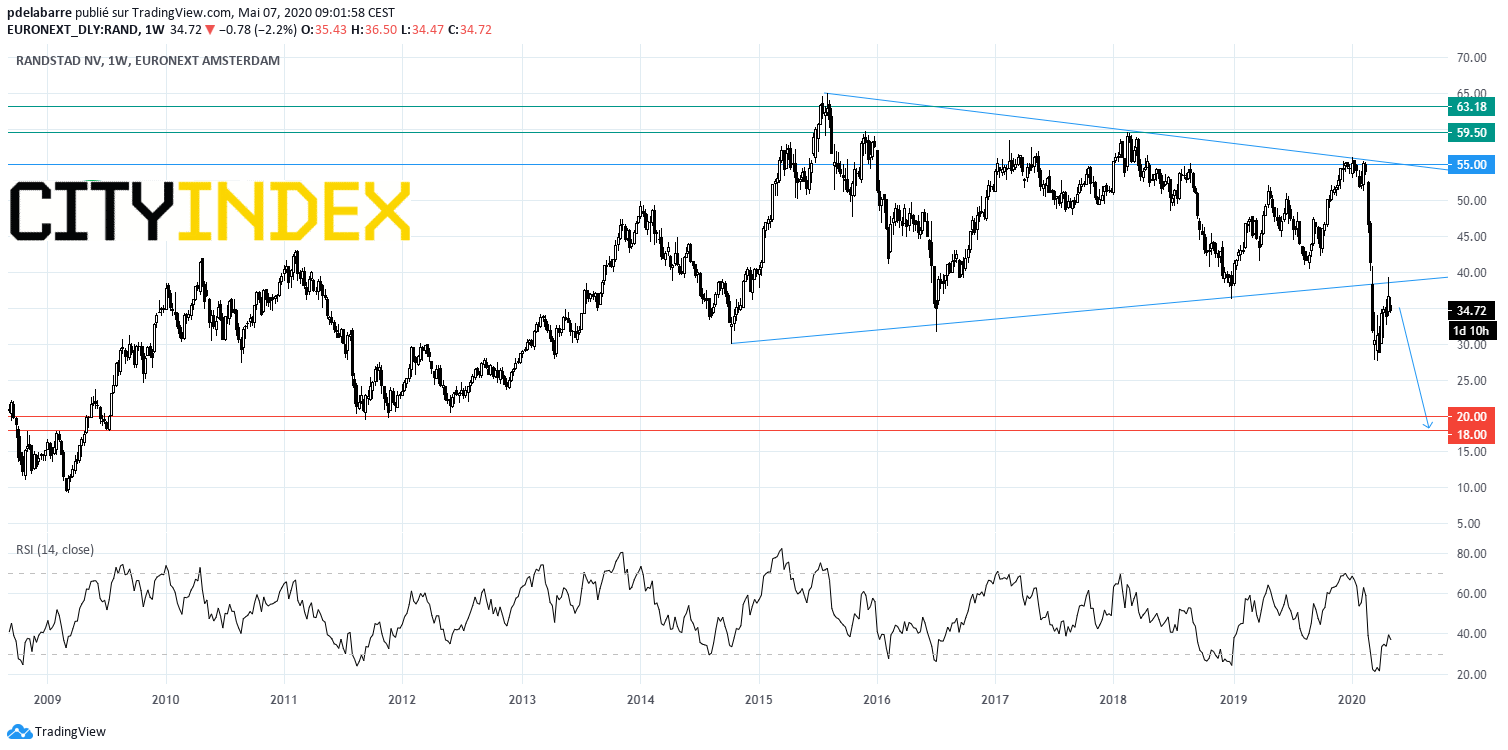

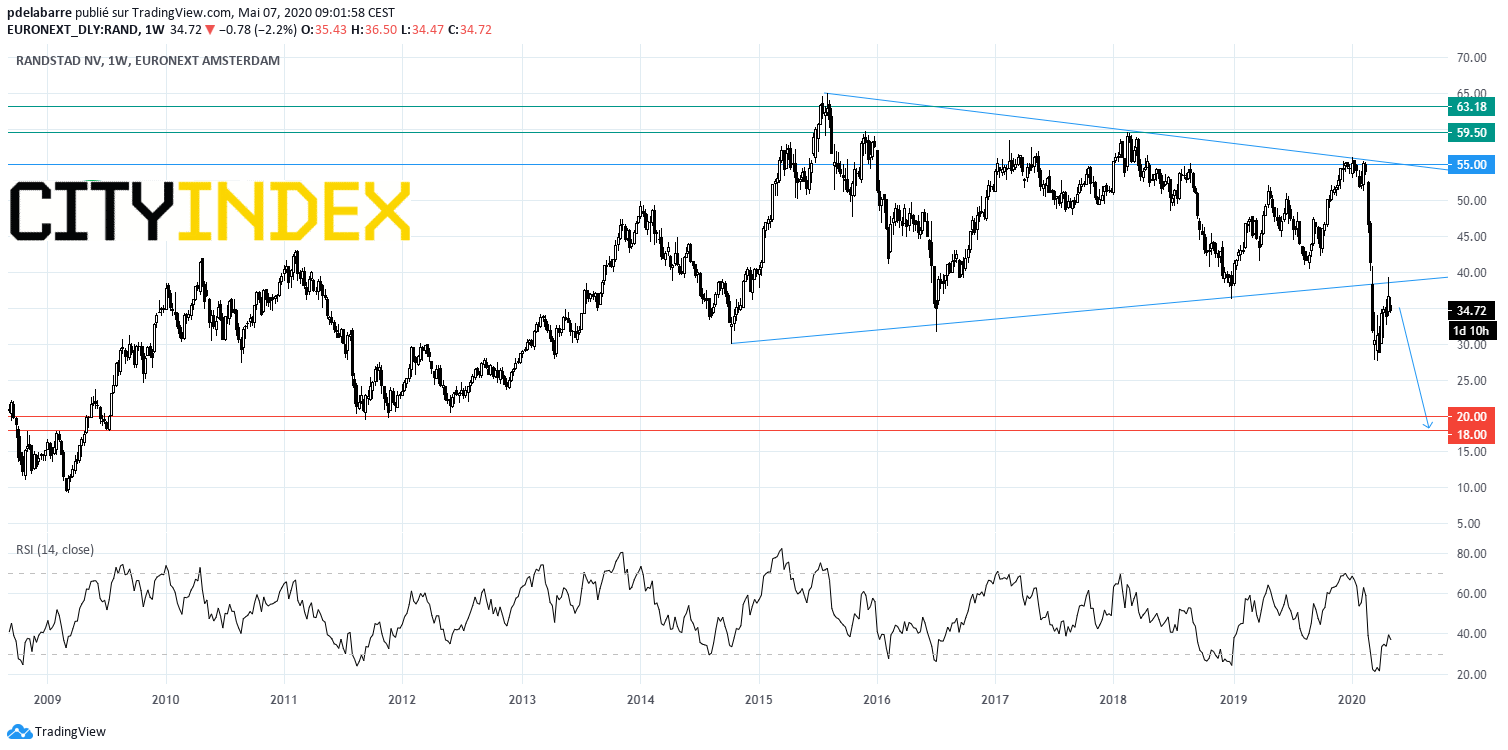

Randstad, a human resource consulting firm, was upgraded to "neutral" from "sell" at Goldman Sachs.

Source: GAIN Capital, TradingView

#ITALY#

Enel, an energy group, announced that 1Q net income slipped 0.7% on year to 1.25 billion euros while EBITDA increased 3.5% to 4.71 billion euros on revenue of 19.99 billion euros, down 12.2%.

#SWITZERLAND#

Adecco, a human resources company, was upgraded to "neutral" from "sell" at Goldman Sachs.

#SCANDINAVIA#

Equinor, a Norwegian energy group, announced that 1Q adjusted net income sank 63% on year to 561 million dollars, citing 2.45 billion dollars net impairments. Operating income slumped 99% to 58 million dollars on total revenue of 15.13 billion dollars, down 8%. The company declared a quarterly dividend of 0.09 dollar per share, down 67% on quarter.

EX-DIVIDEND

Allianz: E9.6, BP: $0.105, Credit Suisse: SF0.0694

Yesterday, European stocks were mixed, with the Stoxx Europe 600 Index easing 0.4%. Germany's DAX 30 dropped 1.2%, France's CAC 40 declined 1.1%, while the U.K.'s FTSE 100 edged up less than 0.1%.

EUROPE ADVANCE/DECLINE

62% of STOXX 600 constituents traded lower or unchanged yesterday.

59% of the shares trade above their 20D MA vs 69% Tuesday (below the 20D moving average).

22% of the shares trade above their 200D MA vs 22% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 0.3pt to 34.81, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

health care, food & beverage, financial services

Europe worst 3 sectors

energy, travel & leisure, banks

INTEREST RATE

The 10yr Bund yield fell 2bps to -0.58% (below its 20D MA). The 2yr-10yr yield spread fell 2bps to -24bps (below its 20D MA).

ECONOMIC DATA

GE 07:00: Mar Industrial Production MoM, exp.: 0.3%

FR 07:45: Mar Current Account, exp.: E-3.8B

FR 07:45: Mar Balance of Trade, exp.: E-5.2B

FR 07:45: Mar Industrial Production MoM, exp.: 0.9%

FR 07:45: Q1 Private Non Farm Payrolls QoQ Prel, exp.: 0.5%

EC 08:00: ECB Annual Report 2019

EC 08:30: Apr Construction PMI, exp.: 33.5

FR 08:30: Apr Construction PMI, exp.: 35.2

GE 08:30: Apr Construction PMI, exp.: 42

UK 08:30: Apr Halifax House Price Idx YoY, exp.: 3%

UK 08:30: Apr Halifax House Price Idx MoM, exp.: 0%

FR 10:00: 10-Year OAT auction, exp.: 0.04%

UK 12:00: BoE Inflation Report

UK 12:00: BoE Interest Rate Decision, exp.: 0.1%

UK 12:00: BoE Quantitative Easing, exp.: £645B

UK 12:00: MPC Meeting Minutes

UK 12:00: BoE MPC Vote Hike, exp.: 0/9

UK 12:00: BoE MPC Vote Unchanged, exp.: 44083

UK 12:00: BoE MPC Vote Cut, exp.: 0/9

UK 00:01: May Gfk Consumer Confidence Flash, exp.: -34

MORNING TRADING

In Asian trading hours, EUR/USD was flat at 1.0800 while GBP/USD slipped further to 1.2327. USD/JPY held above the 106.00 level. AUD/USD bounced to 0.6418. This morning, government data showed that China's exports grew 3.5% on year in April (-11.0% expected), while imports dropped 14.2% (-10.0% expected). Also, China's Caixin Services PMI rose to 44.4 in April (50.1 expected) from 43.0 in March.

Spot gold held rebounded to $1,692 an ounce.

#UK - IRELAND#

InterContinental Hotels Group, a global hotel group, provided a 1Q trading update: "Following a solid performance in the first two months of 2020, occupancy levels dropped to historic lows in March and April, as social distancing measures and travel restrictions came into effect around the world. Global RevPAR in the first quarter declined by 25%, including a 55% decline in March, and we anticipate April to be down by around 80%. (...) In the US, RevPAR was down 19.6% for the quarter and 49% in March, (...) First quarter RevPAR in Greater China was down 65.3%. (...) Our previously announced measures are expected to result in a reduction of up to 150 million dollars in our Fee Business costs; (...) we anticipate gross capital expenditure of ~150 million dollars for 2020, a saving of ~100 million dollars versus 2019."

Rolls-Royce, a major aerospace engine maker, said: "We now expect to deliver up to 1.0 billion pounds of cash savings in 2020. The cancellation of the final 2019 shareholder payment has also conserved an incremental 137 million pounds of cash flow. An additional revolving credit facility of 1.5 billion pounds was secured to bolster the Group's liquidity position and a successful syndication process with a larger group of banks has increased this to 1.9 billion pounds. (...) Due to the unprecedented reduction in air traffic caused by COVID-19, we are anticipating a significant net cash outflow during the second quarter and it remains too early to guide on the likely outcome for the full year."

RSA Insurance Group, an international general insurer, posted a 1Q trading update: "Insurance market conditions were largely unchanged in Q1 with little time for a COVID-19 effect. (...) Group net written premiums of 1,521 million pounds were down 1% ex. exits vs Q1 2019 (down 2% inc. exits) and in line with our plans (...) The Group business operating profit for Q1 was up by double digit percentages, both including and excluding exit portfolios, with an improved combined ratio and slightly lower investment income (as guided). (...) The Group's estimated Solvency II coverage ratio was 151% at 31 March 2020 (31 December 2019: 168%), reflecting COVID-19 driven market impacts and planned pension contributions, (...) Specific COVID-19 related claims are arising in travel insurance (which benefit from substantial reinsurance protection), wedding cancellation insurance (UK impacts) and for commercial lines business interruption and related policies."

IAG, an airline group, posted 1Q results: "In quarter 1 we're reporting a substantial operating loss of E535 million before exceptional items compared to an operating profit of E135 million last year. Total operating losses including exceptional items relating to fuel and foreign currency hedges came to E1,860 million. (...) We are planning for a meaningful return to service in July 2020 at the earliest, (...) However, we do not expect passenger demand to recover to the level of 2019 before 2023 at the earliest." At the same time, the company announced that Luis Gallego will succeed Willie Walsh as CEO on September 24.

Melrose Industries, an industrial conglomerate, posted a trading update for the four months from January 1 to April 30: "The Group traded in line with expectations from 1 January 2020 until mid-March 2020, at which point the worldwide impact from COVID-19 caused significant disruption, resulting in many factories being shut or remaining only partially open. As a result of the effects from COVID-19, Group sales in the Period were down approximately 20% versus the same period last year."

Burberry, a luxury fashion house, was upgraded to "buy" from "hold" at HSBC.

#GERMANY#

Puma, a sportswear company, announced that 1Q net income plunged 61.6% on year to 36 million euros and EBIT declined 50.1% to 71 million euros on revenue of 1.30 billion euros, down 1.5% (-1.3% currency adjusted). The company added: "In May 2020, PUMA secured a new revolving credit facility of E 900 million through a banking consortium of twelve banks, (...) we expect the financial per-formance in the second quarter to be worse than in the first quarter. The development over the coming weeks and months is so unpredictable that we cannot provide a reliable financial outlook for the full year 2020."

HeidelbergCement, a building materials supplier, posted 1Q results from current operation rose 5% on year to 59 million euros while revenue dropped 7% (-8% like-for-like) to 3.93 billion euros. Regarding 2020 outlook, the company stated: "Because of the significant decline in construction activity in many countries from mid-March due to stipulated production downtimes, the company expects a negative impact on revenue and results."

Uniper, an energy company, was upgraded to "overweight" from "neutral" at JPMorgan.

#FRANCE#

Air France-KLM, an airline group, announced that 1Q net loss widened to 1.80 billion euros from 0.32 billion euros in the prior-year period, citing "Covid-19 related over hedging -455 million euros, release of deferred tax assets -173 million euros and impairment of Boeing 747 aircraft -21 million euros". Also, EBITDA loss amounted to 61 million euros, compared with an EBITDA of 443 million euros last year, and revenue was down 15.5% to 5.02 billion euros. Regarding the outlook, the company said: "The Group now anticipates: (...) A prolonged negative impact on passenger demand, not expected to recover to pre-crisis levels before several years. (...) The Group foresees significantly negative EBITDA in full year 2020 and a significantly higher current operating income loss in the second quarter than in the first quarter 2020.

Legrand, an industrial group, reported that 1Q net income fell 12.2% on year to 167 million euros and operating profit slid 9.1% to 260 million euros on revenue of 1.52 billion euros, down 2.2% (-7.3% organic growth). The company added: "Sales continued their organic fall in April 2020, with a retreat of -41% for the month alone that confirmed trends observed in the second half of March in several countries. On this basis, Legrand anticipates a marked decline in sales in the second quarter of 2020, reflecting the adoption of many lockdown measures. Compared to the second quarter of 2020, and subject to a favorable trend in the global health situation, the second half of the year should see a sequential improvement."

EssilorLuxottica, an eyewear conglomerate, was downgraded to "sell" from "hold" at Societe Generale.

#SPAIN#

Telefonica, a telecommunications group, announced that 1Q OIBDA dropped 11.8% on year to 3.76 billion euros on revenue of 11.37 billion euros, down 5.1% (-1.3% organic growth). The company said it has withdrawn its 2020 financial guidance "due to the significant changes in the guidance scenario and context". At the same time, the company reported that it has reached an agreement with Liberty Global to form a 50-50 joint venture, combining their U.K. businesses Virgin Media and O2. Regarding the deal, the company stated: "Both parties expect to receive net cash proceeds at closing following a series of recapitalizations that will generate £5.7 billion in proceeds for Telefonica and £1.4 billion for Liberty Global."

BBVA, a Spanish bank, was downgraded to "neutral" from "overweight" at JPMorgan.

#BENELUX#

AB InBev, a drink and brewing company, announced that it swung to a 1Q normalized net loss of 845 million dollars from a normalized net profit of 2.40 billion dollars in the prior-year period. Normalized EBITDA dropped 13.7% to 3.95 billion dollars on revenue of 11.00 billion dollars, down 5.8%. Regarding the outlook, the company stated: "We expect that the impact on our 2Q20 results will be materially worse than in 1Q20. This has already become evident in our April 2020 global volumes, which declined by approximately 32%, primarily driven by the closure of the on-premise channel in most markets and government restrictions imposed on certain operations of ours in connection with the COVID-19 pandemic."

ArcelorMittal, a steel producer, reported that it swung to a 1Q net loss of 1.12 billion dollars from a net profit of 414 million dollars in the prior-year period. EBITDA declined 41.5% on year to 0.97 billion dollars on revenue of 14.84 billion dollars, down 22.6%. The company expects 2Q EBITDA of 0.40 - 0.60 billion dollars and said it has decided to suspend dividend payments, citing "significant cost savings measures being taken across the business" due to the COVID-19.

DSM, a global science-based company, posted 1Q net income slid 14% on year to 168 million euros and adjusted EBIT fell 3% to 272 million euros on revenue of 2.29 billion euros, broadly flat.

Randstad, a human resource consulting firm, was upgraded to "neutral" from "sell" at Goldman Sachs.

Source: GAIN Capital, TradingView

#ITALY#

Enel, an energy group, announced that 1Q net income slipped 0.7% on year to 1.25 billion euros while EBITDA increased 3.5% to 4.71 billion euros on revenue of 19.99 billion euros, down 12.2%.

#SWITZERLAND#

Adecco, a human resources company, was upgraded to "neutral" from "sell" at Goldman Sachs.

#SCANDINAVIA#

Equinor, a Norwegian energy group, announced that 1Q adjusted net income sank 63% on year to 561 million dollars, citing 2.45 billion dollars net impairments. Operating income slumped 99% to 58 million dollars on total revenue of 15.13 billion dollars, down 8%. The company declared a quarterly dividend of 0.09 dollar per share, down 67% on quarter.

EX-DIVIDEND

Allianz: E9.6, BP: $0.105, Credit Suisse: SF0.0694

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM