EU indices up this morning | TA focus on Chr Hansen

INDICES

Yesterday, European stocks were broadly lower. Germany's DAX 30 declined 0.4%, while both France's CAC 40 and the U.K.'s FTSE 100 were down 0.2% each.

EUROPE ADVANCE/DECLINE

55% of STOXX 600 constituents traded higher yesterday.

42% of the shares trade above their 20D MA vs 39% Tuesday (below the 20D moving average).

43% of the shares trade above their 200D MA vs 42% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.59pt to 30.13, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

travel & leisure, energy, health care

Europe worst 3 sectors

automobiles & parts, basic resources, banks

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.45% (below its 20D MA). The 2yr-10yr yield spread fell 3bps to -26bps (below its 20D MA).

ECONOMIC DATA

EC 10:00: May Unemployment Rate, exp.: 7.3%

EC 10:00: May PPI YoY, exp.: -4.5%

EC 10:00: May PPI MoM, exp.: -2%

FR 10:00: 10-Year OAT auction, exp.: 0.02%

UK 10:45: 5-Year Treasury Gilt auction, exp.: 0.04%

GE 13:00: Bundesbank Wuermeling speech

EC 14:00: ECB Mersch speech

UK 17:00: BoE Financial Stability Report

UK 17:00: BoE FPC Record

EC 18:00: ECB Schnabel speech

UK 00:01: Jun Gfk Consumer Confidence final, exp.: -36

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1258 and GBP/USD advanced further to 1.2483. USD/JPY edged up to 107.52. AUD/USD was little changed at 0.6916. This morning, official data showed that Australia recorded a trade surplus of 80.25 billion Australian dollars in May (90 billion Australian dollars surplus expected).

Spot gold remained subdued at $1,768 an ounce.

#UK-IRELAND#

Associated British Foods, a food processing and retailing company, posted a 3Q trading update: "Group revenue from continuing businesses for the 40 weeks ended 20 June 2020 was 13% lower than the same period last year at constant currency and 14% lower at actual exchange rates. (...) For the full year we continue to expect strong progress in the aggregate adjusted operating profit of our Sugar, Grocery, Agriculture and Ingredients businesses. (...) Nearly all Primark stores are now trading again and we estimate that, absent a significant number of further store closures, adjusted operating profit for Primark, excluding exceptional charges, will be in the range £300-350m for the full year compared to £913m reported for the last financial year."

Meggitt, an aerospace and defence company, issued a 2Q trading update: "Overall, we expect Group organic revenue to be c.30% lower in the second quarter. (...) Group revenue in the first half is expected to be c.15% lower than in H1 2019 on an organic basis, with growth in Defence more than offset by lower revenues in both civil aerospace and Energy."

Wizz Air, a low-cost airline company, reported that passenger number dropped 86.1% on year to 502,253 in June and the load factor fell to 52.2% from 95.0% in the prior-year period.

BHP Group, a giant metals miner, was downgraded to "hold" from "buy" at Deutsche Bank, while its peers Rio Tinto was upgraded to "buy" from "hold".

National Grid, an electricity and gas utility company, was downgraded to "hold" from "buy" at HSBC.

#GERMANY#

BMW, a vehicle manufacturer, announced that U.S. auto sales (including Mini) declined 38.3% on year to 56,245 units in 2Q.

Daimler, an automobile group, reported that U.S. vehicle sales dropped 16.4% on year to 71,130 units in 2Q.

Porsche, a sports cars maker, posted U.S. auto sales slid 20.0% on year to 12,192 units in 2Q.

Deutsche Bank, a banking group, was downgraded to "sell" from "hold" at Societe Generale.

#BENELUX#

Heineken, a Dutch brewing giant, was downgraded to "neutral" from "overweight" at JPMorgan.

#SCANDINAVIA - DENMARK#

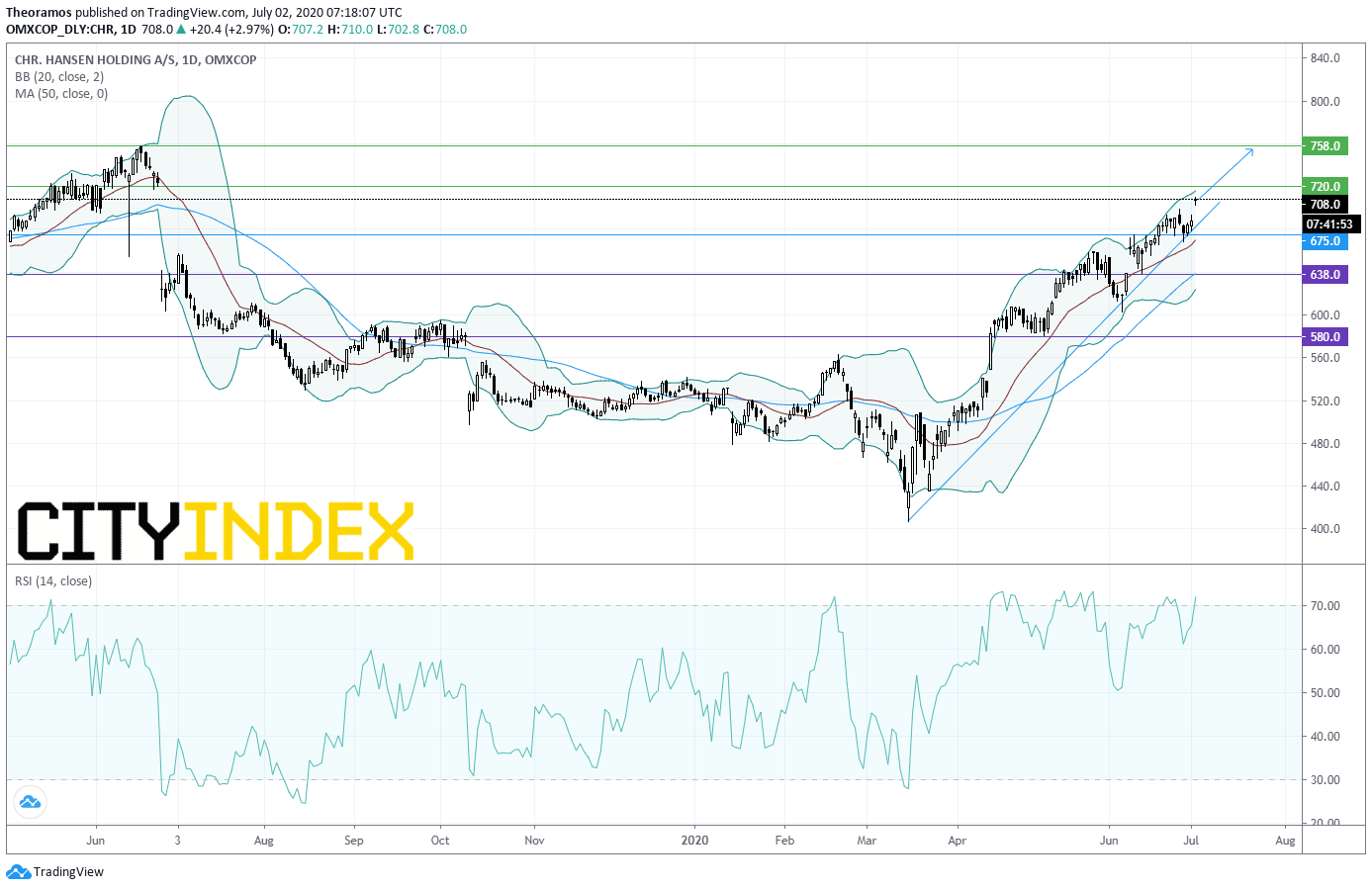

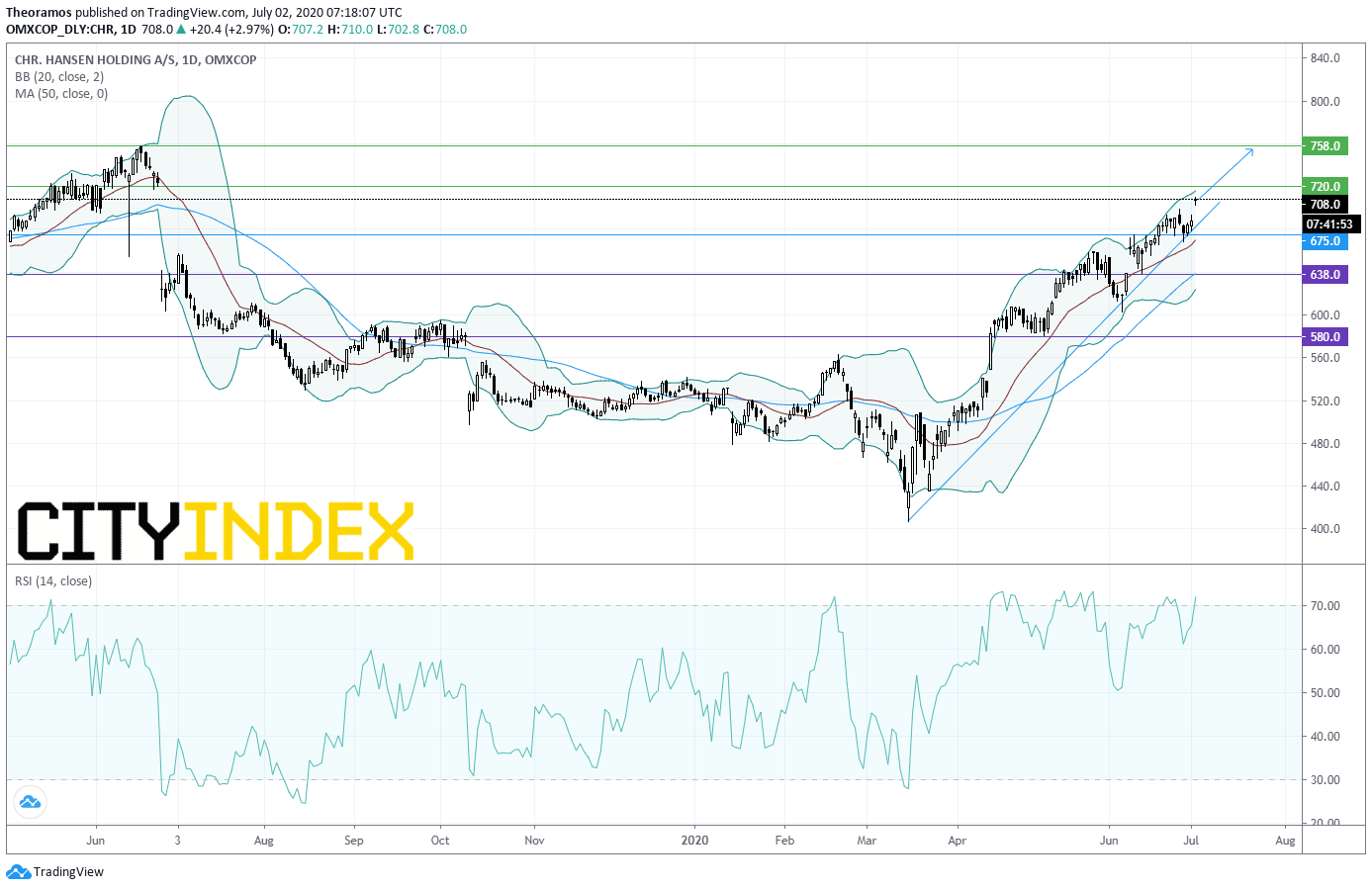

Chr Hansen, a bioscience group, announced that 3Q net income grew 5% on year to 70 million euros and adjusted EBIT rose 5% to 97 million euros on revenue of 314 million euros, up 4% (+7% organic growth). From a chartist point of view, the stock is supported by a rising trendline drawn since March the 16th and its 20 and 50-period moving averages. Furthermore, the share is aiming the previous all-time high at 758DKK.

Source: GAIN Capital, TradingView

Assa Abloy, an access solutions provider, was upgraded to "buy" from "hold" at Deutsche Bank.

EX-DIVIDEND

National Grid:32p, Teleperformance: E2.4, Unibail-Rodamco-Westfield: E5.4

Yesterday, European stocks were broadly lower. Germany's DAX 30 declined 0.4%, while both France's CAC 40 and the U.K.'s FTSE 100 were down 0.2% each.

EUROPE ADVANCE/DECLINE

55% of STOXX 600 constituents traded higher yesterday.

42% of the shares trade above their 20D MA vs 39% Tuesday (below the 20D moving average).

43% of the shares trade above their 200D MA vs 42% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 1.59pt to 30.13, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

travel & leisure, energy, health care

Europe worst 3 sectors

automobiles & parts, basic resources, banks

INTEREST RATE

The 10yr Bund yield rose 2bps to -0.45% (below its 20D MA). The 2yr-10yr yield spread fell 3bps to -26bps (below its 20D MA).

ECONOMIC DATA

EC 10:00: May Unemployment Rate, exp.: 7.3%

EC 10:00: May PPI YoY, exp.: -4.5%

EC 10:00: May PPI MoM, exp.: -2%

FR 10:00: 10-Year OAT auction, exp.: 0.02%

UK 10:45: 5-Year Treasury Gilt auction, exp.: 0.04%

GE 13:00: Bundesbank Wuermeling speech

EC 14:00: ECB Mersch speech

UK 17:00: BoE Financial Stability Report

UK 17:00: BoE FPC Record

EC 18:00: ECB Schnabel speech

UK 00:01: Jun Gfk Consumer Confidence final, exp.: -36

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1258 and GBP/USD advanced further to 1.2483. USD/JPY edged up to 107.52. AUD/USD was little changed at 0.6916. This morning, official data showed that Australia recorded a trade surplus of 80.25 billion Australian dollars in May (90 billion Australian dollars surplus expected).

Spot gold remained subdued at $1,768 an ounce.

#UK-IRELAND#

Associated British Foods, a food processing and retailing company, posted a 3Q trading update: "Group revenue from continuing businesses for the 40 weeks ended 20 June 2020 was 13% lower than the same period last year at constant currency and 14% lower at actual exchange rates. (...) For the full year we continue to expect strong progress in the aggregate adjusted operating profit of our Sugar, Grocery, Agriculture and Ingredients businesses. (...) Nearly all Primark stores are now trading again and we estimate that, absent a significant number of further store closures, adjusted operating profit for Primark, excluding exceptional charges, will be in the range £300-350m for the full year compared to £913m reported for the last financial year."

Meggitt, an aerospace and defence company, issued a 2Q trading update: "Overall, we expect Group organic revenue to be c.30% lower in the second quarter. (...) Group revenue in the first half is expected to be c.15% lower than in H1 2019 on an organic basis, with growth in Defence more than offset by lower revenues in both civil aerospace and Energy."

Wizz Air, a low-cost airline company, reported that passenger number dropped 86.1% on year to 502,253 in June and the load factor fell to 52.2% from 95.0% in the prior-year period.

BHP Group, a giant metals miner, was downgraded to "hold" from "buy" at Deutsche Bank, while its peers Rio Tinto was upgraded to "buy" from "hold".

National Grid, an electricity and gas utility company, was downgraded to "hold" from "buy" at HSBC.

#GERMANY#

BMW, a vehicle manufacturer, announced that U.S. auto sales (including Mini) declined 38.3% on year to 56,245 units in 2Q.

Daimler, an automobile group, reported that U.S. vehicle sales dropped 16.4% on year to 71,130 units in 2Q.

Porsche, a sports cars maker, posted U.S. auto sales slid 20.0% on year to 12,192 units in 2Q.

Deutsche Bank, a banking group, was downgraded to "sell" from "hold" at Societe Generale.

#BENELUX#

Heineken, a Dutch brewing giant, was downgraded to "neutral" from "overweight" at JPMorgan.

#SCANDINAVIA - DENMARK#

Chr Hansen, a bioscience group, announced that 3Q net income grew 5% on year to 70 million euros and adjusted EBIT rose 5% to 97 million euros on revenue of 314 million euros, up 4% (+7% organic growth). From a chartist point of view, the stock is supported by a rising trendline drawn since March the 16th and its 20 and 50-period moving averages. Furthermore, the share is aiming the previous all-time high at 758DKK.

Source: GAIN Capital, TradingView

Assa Abloy, an access solutions provider, was upgraded to "buy" from "hold" at Deutsche Bank.

EX-DIVIDEND

National Grid:32p, Teleperformance: E2.4, Unibail-Rodamco-Westfield: E5.4

Latest market news

Today 08:15 AM