EU indices under pressure | TA focus on Thales

INDICES

Yesterday, European stocks were little changed. The Stoxx Europe 600 Index, Germany's DAX 30, France's CAC 40 and the U.K.'s FTSE 100 were all broadly flat at close.

EUROPE ADVANCE/DECLINE

41% of STOXX 600 constituents traded higher yesterday.

66% of the shares trade above their 20D MA vs 72% Wednesday (above the 20D moving average).

51% of the shares trade above their 200D MA vs 51% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.9pt to 23.31, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Industrial

3mths relative low: Media, Travel & Leisure

Europe Best 3 sectors

financial services, real estate, construction & materials

Europe worst 3 sectors

energy, media, travel & leisure

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.49% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -19bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Jun Retail Sales YoY, exp.: -13.1%

UK 07:00: Jun Retail Sales MoM, exp.: 12%

UK 07:00: Jun Retail Sales ex Fuel MoM, exp.: 10.2%

UK 07:00: Jun Retail Sales ex Fuel YoY, exp.: -9.8%

FR 08:15: Jul Markit Composite PMI Flash, exp.: 51.7

FR 08:15: Jul Markit Services PMI Flash, exp.: 50.7

FR 08:15: Jul Markit Manufacturing PMI Flash, exp.: 52.3

GE 08:30: Jul Markit Composite PMI Flash, exp.: 47

GE 08:30: Jul Markit Services PMI Flash, exp.: 47.3

GE 08:30: Jul Markit Manufacturing PMI Flash, exp.: 45.2

EC 09:00: Jul Markit Composite PMI Flash, exp.: 48.5

EC 09:00: Jul Markit Manufacturing PMI Flash, exp.: 47.4

EC 09:00: Jul Markit Services PMI Flash, exp.: 48.3

UK 09:30: Jul Markit/CIPS Manufacturing PMI Flash, exp.: 50.1

UK 09:30: Jul Markit/CIPS UK Services PMI Flash, exp.: 47.1

UK 09:30: Jul Markit/CIPS Composite PMI Flash, exp.: 47.7

MORNING TRADING

In Asian trading hours, EUR/USD advanced to 1.1614 and GBP/USD bounced to 1.2752. USD/JPY dropped further to 106.53.

Spot gold was flat at $1,887 an ounce.

#UK - IRELAND#

Pearson, a publishing and education company, reported 1H results: "Pearson's sales decreased by 18% in headline terms to £1,492m (H1 2019: £1,829m). (...) Adjusted operating profit declined to a loss of £(23)m (H1 2019: £144m) with a profit impact of c.£140m from COVID-19 trading pressures after cost mitigations. (...) Our statutory operating profit of £107m in H1 2020 compares to a profit of £37m in H1 2019, the increase was largely due to the gain on sale of Penguin Random House. (...) The Board is declaring an interim dividend of 6.0p (2019: 6.0p)."

Ferguson, a distributor of plumbing and heating products, reported that revenue from continuing operations fell 3.6% on year in the period from May 1 to July 21, compared with a 15.3% decline in April.

AstraZeneca, a pharmaceutical group, said its "Breztri Aerosphere (budesonide/glycopyrrolate/formoterol fumarate) has been approved in the US for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD)".

#GERMANY#

Hapag-Lloyd, a shipping and container transportation company, was upgraded to "buy" from "neutral" at Citigroup.

#FRANCE#

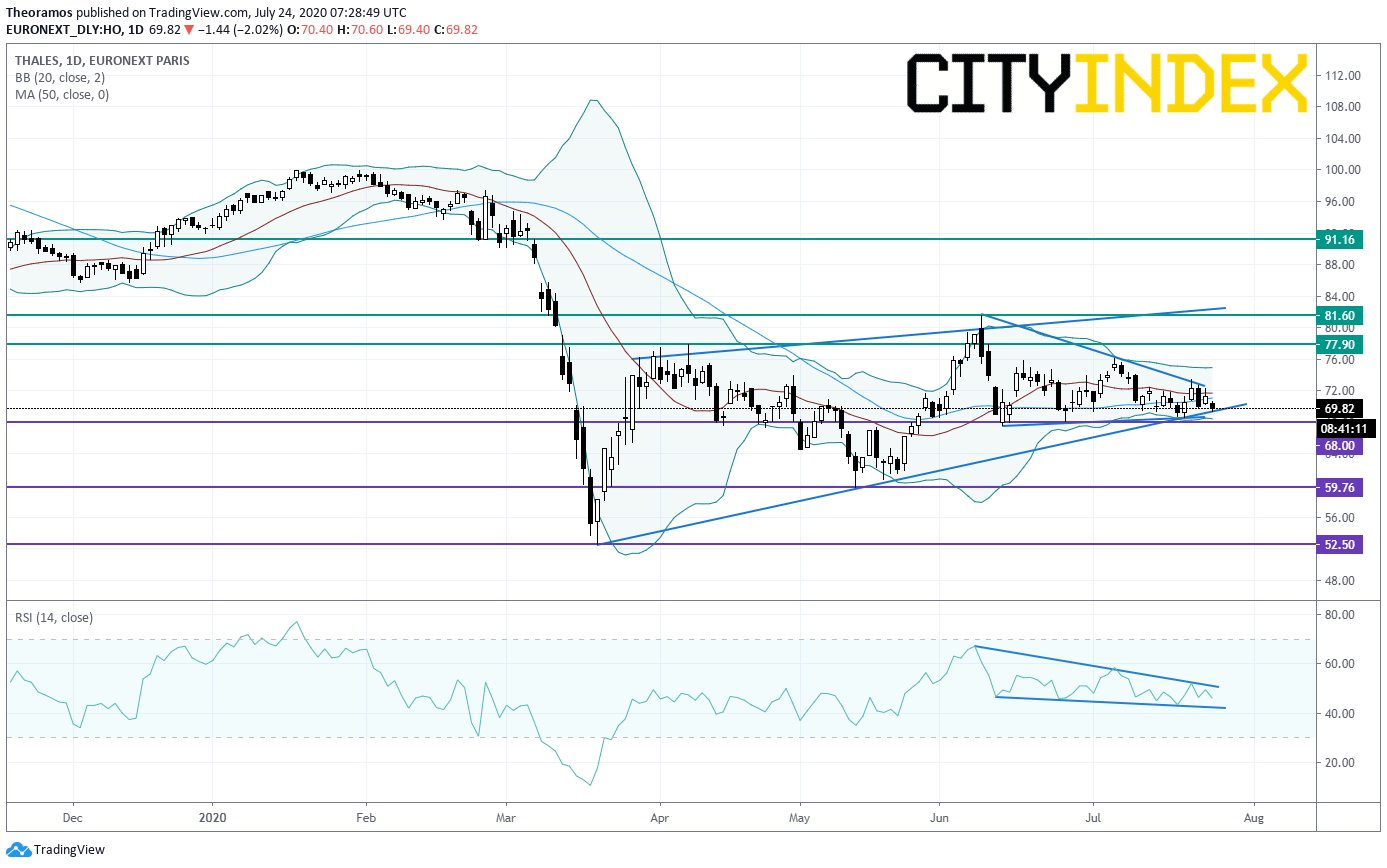

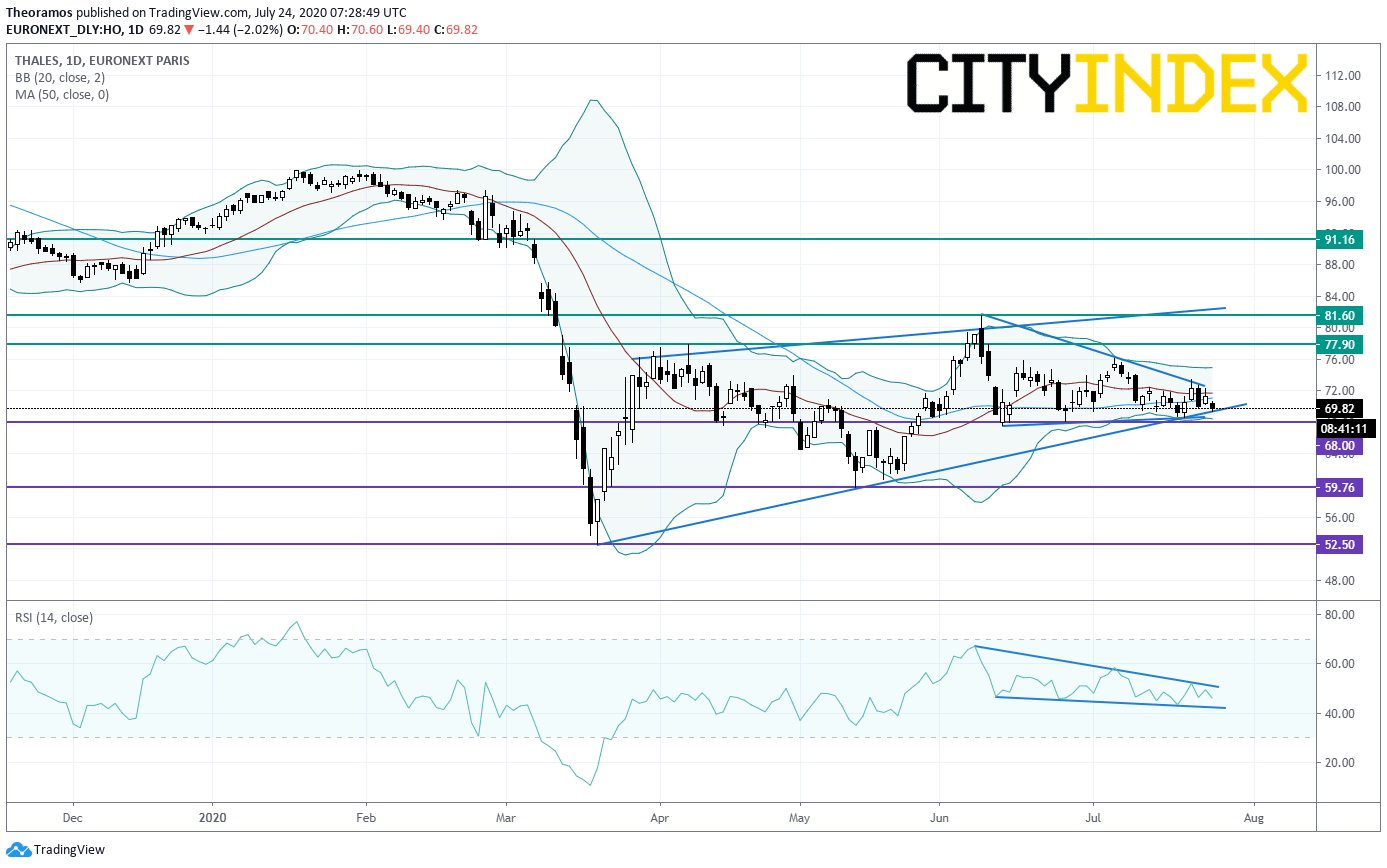

Thales, an aerospace and defence company, announced that 1H adjusted net income dropped 60% on year to 232 million euros and EBIT declined 57% to 348 million euros on revenue of 7.75 billion euros, down 5.4% (-13.6% organic growth). The company said it now expects full-year EBIT of 1.3 - 1.4 billion euros and revenue of 16.5 - 17.2 billion euros.

From a technical point of view, the share price remains within a rising rising wedge since March. In addition, the stock price is stuck within a symmetrical triangle pattern since June. Prices are nearing the key support at 68E (trend line support + overlap). Caution is warranted as a break below 68E would trigger a bearish acceleration towards 59.76E and March low at 52.5E. As long as 68E is support, a rebound is possible towards the intermediary resistance at 77.9E.

Source: GAIN Capital, TradingView

Dassault Aviation, an aircraft manufacturer of military and business jets, announced that 1H adjusted net income declined 69.6% on year to 87 million euros and adjusted operating income sank 78.0% to 55 million euros on adjusted net sales of 16.19 billion euros, down 9.0%.

#SPAIN#

Mapfre, a Spanish insurance company, is expected to release 2Q results.

#SWITZERLAND#

Lonza Group, a chemicals and biotechnology company, posted 1H net income jumped 59.5% on year to 477 million Swiss franc and EBIT grew 21.4% to 618 million Swiss franc on revenue of 3.07 billion Swiss franc, up 3.3% (+7.7% in constant exchange rate). The company added: "The Board of Directors decided to divest the LSI segment via a sale process, which will be initiated in H2 2020. (...) Lonza Group confirms its Outlook for full-year 2020 at above mid-single digit-sales growth and a stable level of CORE EBITDA margin."

#SCANDINAVIA#

Equinor, an Norwegian energy company, announced that it swung to a 2Q net loss of 251 million dollars from a net profit of 1.48 billion dollars in the prior-year period, but narrowed from a 1Q net loss of 705 million dollars. Adjusted earnings after tax sank 43% on year to 646 million dollars on total revenue of 7.60 billion dollars, down 56%.

Hexagon, a global technology group, is expected to report 2Q results.

Yesterday, European stocks were little changed. The Stoxx Europe 600 Index, Germany's DAX 30, France's CAC 40 and the U.K.'s FTSE 100 were all broadly flat at close.

EUROPE ADVANCE/DECLINE

41% of STOXX 600 constituents traded higher yesterday.

66% of the shares trade above their 20D MA vs 72% Wednesday (above the 20D moving average).

51% of the shares trade above their 200D MA vs 51% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.9pt to 23.31, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Chemicals, Industrial

3mths relative low: Media, Travel & Leisure

Europe Best 3 sectors

financial services, real estate, construction & materials

Europe worst 3 sectors

energy, media, travel & leisure

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.49% (below its 20D MA). The 2yr-10yr yield spread rose 1bp to -19bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Jun Retail Sales YoY, exp.: -13.1%

UK 07:00: Jun Retail Sales MoM, exp.: 12%

UK 07:00: Jun Retail Sales ex Fuel MoM, exp.: 10.2%

UK 07:00: Jun Retail Sales ex Fuel YoY, exp.: -9.8%

FR 08:15: Jul Markit Composite PMI Flash, exp.: 51.7

FR 08:15: Jul Markit Services PMI Flash, exp.: 50.7

FR 08:15: Jul Markit Manufacturing PMI Flash, exp.: 52.3

GE 08:30: Jul Markit Composite PMI Flash, exp.: 47

GE 08:30: Jul Markit Services PMI Flash, exp.: 47.3

GE 08:30: Jul Markit Manufacturing PMI Flash, exp.: 45.2

EC 09:00: Jul Markit Composite PMI Flash, exp.: 48.5

EC 09:00: Jul Markit Manufacturing PMI Flash, exp.: 47.4

EC 09:00: Jul Markit Services PMI Flash, exp.: 48.3

UK 09:30: Jul Markit/CIPS Manufacturing PMI Flash, exp.: 50.1

UK 09:30: Jul Markit/CIPS UK Services PMI Flash, exp.: 47.1

UK 09:30: Jul Markit/CIPS Composite PMI Flash, exp.: 47.7

MORNING TRADING

In Asian trading hours, EUR/USD advanced to 1.1614 and GBP/USD bounced to 1.2752. USD/JPY dropped further to 106.53.

Spot gold was flat at $1,887 an ounce.

#UK - IRELAND#

Pearson, a publishing and education company, reported 1H results: "Pearson's sales decreased by 18% in headline terms to £1,492m (H1 2019: £1,829m). (...) Adjusted operating profit declined to a loss of £(23)m (H1 2019: £144m) with a profit impact of c.£140m from COVID-19 trading pressures after cost mitigations. (...) Our statutory operating profit of £107m in H1 2020 compares to a profit of £37m in H1 2019, the increase was largely due to the gain on sale of Penguin Random House. (...) The Board is declaring an interim dividend of 6.0p (2019: 6.0p)."

Ferguson, a distributor of plumbing and heating products, reported that revenue from continuing operations fell 3.6% on year in the period from May 1 to July 21, compared with a 15.3% decline in April.

AstraZeneca, a pharmaceutical group, said its "Breztri Aerosphere (budesonide/glycopyrrolate/formoterol fumarate) has been approved in the US for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD)".

#GERMANY#

Hapag-Lloyd, a shipping and container transportation company, was upgraded to "buy" from "neutral" at Citigroup.

#FRANCE#

Thales, an aerospace and defence company, announced that 1H adjusted net income dropped 60% on year to 232 million euros and EBIT declined 57% to 348 million euros on revenue of 7.75 billion euros, down 5.4% (-13.6% organic growth). The company said it now expects full-year EBIT of 1.3 - 1.4 billion euros and revenue of 16.5 - 17.2 billion euros.

From a technical point of view, the share price remains within a rising rising wedge since March. In addition, the stock price is stuck within a symmetrical triangle pattern since June. Prices are nearing the key support at 68E (trend line support + overlap). Caution is warranted as a break below 68E would trigger a bearish acceleration towards 59.76E and March low at 52.5E. As long as 68E is support, a rebound is possible towards the intermediary resistance at 77.9E.

Source: GAIN Capital, TradingView

Dassault Aviation, an aircraft manufacturer of military and business jets, announced that 1H adjusted net income declined 69.6% on year to 87 million euros and adjusted operating income sank 78.0% to 55 million euros on adjusted net sales of 16.19 billion euros, down 9.0%.

#SPAIN#

Mapfre, a Spanish insurance company, is expected to release 2Q results.

#SWITZERLAND#

Lonza Group, a chemicals and biotechnology company, posted 1H net income jumped 59.5% on year to 477 million Swiss franc and EBIT grew 21.4% to 618 million Swiss franc on revenue of 3.07 billion Swiss franc, up 3.3% (+7.7% in constant exchange rate). The company added: "The Board of Directors decided to divest the LSI segment via a sale process, which will be initiated in H2 2020. (...) Lonza Group confirms its Outlook for full-year 2020 at above mid-single digit-sales growth and a stable level of CORE EBITDA margin."

#SCANDINAVIA#

Equinor, an Norwegian energy company, announced that it swung to a 2Q net loss of 251 million dollars from a net profit of 1.48 billion dollars in the prior-year period, but narrowed from a 1Q net loss of 705 million dollars. Adjusted earnings after tax sank 43% on year to 646 million dollars on total revenue of 7.60 billion dollars, down 56%.

Hexagon, a global technology group, is expected to report 2Q results.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM