EU indices: tentative rebound | TA focus on SAP

Yesterday, European stocks remained under pressure. The Stoxx Europe 600 Index fell 0.67%. Germany's DAX 30 dropped 0.97%, France's CAC 40 lost 1.24%, and the U.K.'s FTSE 100 was down 0.55%.

EUROPE ADVANCE/DECLINE

70% of STOXX 600 constituents traded lower or unchanged yesterday.

61% of the shares trade above their 20D MA vs 70% Tuesday (above the 20D moving average).

45% of the shares trade above their 200D MA vs 45% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.64pt to 29.57, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Financial Services, Utilities

3mths relative low: Retail, Media, Energy

Europe Best 3 sectors

technology, retail, financial services

Europe worst 3 sectors

utilities, food & beverage, banks

INTEREST RATE

The 10yr Bund yield was unchanged to -0.43% (above its 20D MA). The 2yr-10yr yield spread rose 1bp to -23bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: May Current Account, exp.: E7.7B

GE 07:00: May Balance of Trade s.a, exp.: E3.2B

GE 07:00: May Exports MoM s.a, exp.: -24%

GE 07:00: May Imports MoM s.a, exp.: -16.5%

GE 07:00: May Balance of Trade, exp.: E3.5B

EC 09:00: Eurogroup Meeting

GE 13:00: Bundesbank Buch speech

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1341 while GBP/USD firmed above the 1.2600 level. USD/JPY was broadly flat at 107.31. This morning, official data showed that Japan's core machine orders grew 1.7% on month in May (-5.0% expected). AUD/USD eased to 0.6979. Earlier today, government data showed that China's CPI grew 2.5% on year in June (as expected) while PPI dropped 3.0% (-3.2% expected).

Spot gold edged up to $1,809 an ounce.

#UK - IRELAND#

Persimmon, a housebuilding company, released a 1H trading update: "Persimmon's total revenues for the first six months of 2020 were £1.19bn (2019: £1.75bn). (...) As at 30 June 2020, the value of the Group's forward sales of new homes was c. 15% ahead of the prior year at £1.86bn (2019: £1.62bn)."

Grafton Group, a building materials distributor, published a 1H trading update: "Group revenue in continuing operations for the six months to 30 June 2020 was £1.06 billion, down 19.4 per cent from £1.31 billion in the same period last year due to the impact on trading of the Covid-19 pandemic. (...) Trading in the month of June was more resilient than anticipated with Group revenue in continuing operations of £247.8 million. (...) Average daily like-for-like revenue in June was down by 1.1 per cent on the prior year. (...) While we have made further progress in June following the reopening of our businesses in the UK and Ireland in May, financial guidance for the year ending 31 December 2020 will remain suspended at this stage given the continuing uncertainty in our principal markets."

Dechra Pharmaceuticals, a veterinary pharmaceuticals company, issued a full-year update: "Reported Group revenue for the Period increased by c.7% at constant exchange rate (CER) (c.7% at actual exchange rate (AER))."

#GERMANY - AUSTRIA#

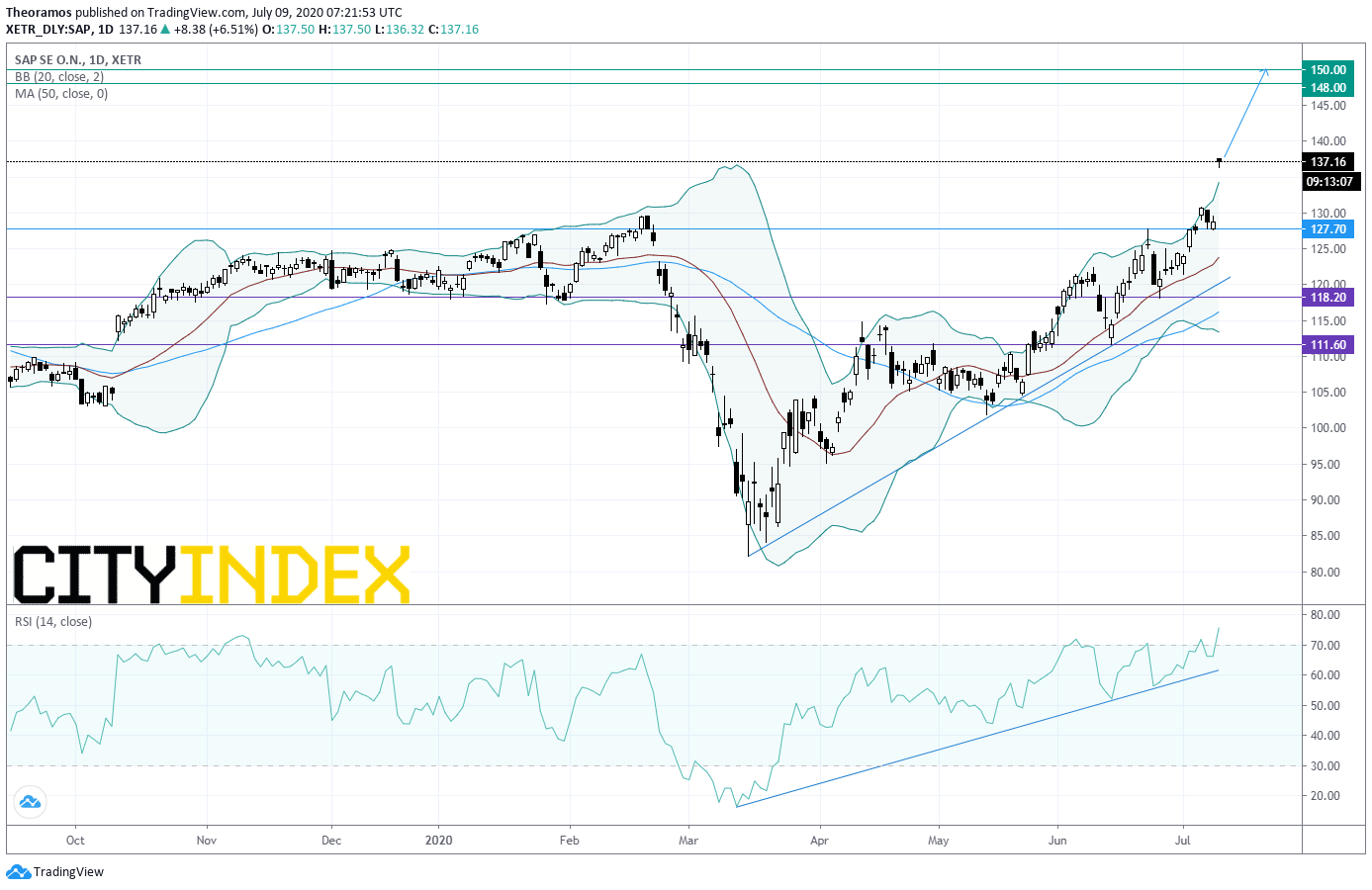

SAP, an enterprise software company, announced that 2Q preliminary adjusted total revenue grew 1% on year (+1% at constant currencies) to 6.74 billion euros, where adjusted cloud revenue rose 19% (+18% at constant currencies) to 2.04 billion euros. Also, adjusted operating profit increased 8% to 1.96 billion euros. The company added: "Non-IFRS cloud revenue is still expected to be in a range of E8.3 billion to E8.7 billion at constant currencies (2019: E7.01 billion), up 18% to 24% at constant currencies. (...) Non-IFRS operating profit is still expected to be in a range of E8.1 to E8.7 billion at constant currencies (2019: E8.21 billion), down 1% to up 6% at constant currencies." From a chartist point of view, the stock price is making a new historical high thanks to the bullish gap opened this morning. Prices remain supported by a rising trendline in place since march. The volatility breakout on Bollinger bands is a bullish signal. However, the daily RSI is highly overbought. Above 127.7E expect a further advance with 148 euros and 155 euros as next bullish targets (Fibonacci projection levels).

Source: GAIN Capital, TradingView

Verbund, an Austria electricity company, was upgraded to "equalweight" from "underweight" at Barclays.

#FRANCE#

BioMerieux, a biotechnology company, reported that 2Q revenue rose 9.9% on year (+10.7% organic growth) to 707 million euros.

Airbus, an aircraft manufacturer, said it registered no new orders in June, with net orders before cancellations of 298 aircraft, compared with 299 aircraft in May.

Engie, was downgraded to "neutral" from "buy" at Citigroup.

#SWITZERLAND#

Barry Callebaut, a chocolate manufacturer, reported that 9-month revenue dropped 4.4% on year (+0.4% in local currencies) to 5.24 billion Swiss franc. The company said: "The COVID-19 pandemic is a major unforeseen event which will have a negative impact on fiscal year 2019/20. This is why we update our mid-term guidance, excluding fiscal year 2019/20 and introducing increased metrics of, on average for the 3-year period 2020/21 to 2022/23, +5-7% volume growth and EBIT above volume growth in local currencies, barring any major unforeseeable events. The updated mid-term guidance starts in September 2020."

#SCANDINAVIA - DENMARK#

Tryg, a Scandinavian insurance company, announced that 2Q profit before tax rose 57.2% on year to 1.54 billion Danish krone on gross premium income of 5.60 billion Danish krone, up 2.6%.

EX-DIVIDEND

BAT:52.6p, Daimler: E0.9