EU indices strongly up |TA focus on Airbus

INDICES

Friday, European stocks were broadly lower on Friday, with the Stoxx Europe 600 Index falling 1.4%. Germany's DAX 30 lost 1.7%, the U.K.'s FTSE 100 sank 2.3% and France's CAC 40 was down 1.6%.

EUROPE ADVANCE/DECLINE

73% of STOXX 600 constituents traded lower or unchanged Friday.

87% of the shares trade above their 20D MA vs 92% Thursday (above the 20D moving average).

34% of the shares trade above their 200D MA vs 36% Thursday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 2.12pts to 31.13, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

technology, utilities, telecommunications

Europe worst 3 sectors

travel & leisure, banks, automobiles & parts

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.42% (above its 20D MA). The 2yr-10yr yield spread rose 0bp to -21bps (below its 20D MA).

ECONOMIC DATA

FR 08:50: May Markit Manufacturing PMI final, exp.: 31.5

GE 08:55: May Markit Manufacturing PMI final, exp.: 34.5

EC 09:00: May Markit Manufacturing PMI final, exp.: 33.4

UK 09:30: May Markit/CIPS Manufacturing PMI final, exp.: 32.6

FR 14:00: 6-Mth BTF auction, exp.: -0.52%

FR 14:00: 3-Mth BTF auction, exp.: -0.53%

FR 14:00: 12-Mth BTF auction, exp.: -0.52%

MORNING TRADING

In Asian trading hours, EUR/USD advanced to 1.1139 and GBP/USD rose to 1.2408. USD/JPY eased to 107.69. This morning, government data showed that Japan's first quarter capital spending increased 4.3% on year (-5.0% expected).

Spot gold climbed to $1,739 an ounce.

#UK - IRELAND#

AstraZeneca, a pharmaceutical group, said its "Brilinta (ticagrelor) has been approved in the U.S. to reduce the risk of a first heart attack or stroke in high-risk patients with coronary artery disease (CAD), the most common type of heart disease".

Associated British Foods, a food processing and retailing company, post a COVID-19 update: "As at today, Primark is trading in 112 stores which represent 34 percent of our total selling space. Primark is now working to re-open all its stores in England on 15 June, following the recent announcement by the UK Government. At that date we expect to be operating from 281 stores representing 79 percent of total selling space. We await further guidance for the stores in Northern Ireland, Wales and Scotland and anticipate openings in late June."

#GERMANY#

Deutsche Lufthansa, an airline group, would accept the German government's 9 billion euros bailout conditions, which have been agreed by the European Union, reported Bloomberg citing people familiar with the matter.

#FRANCE#

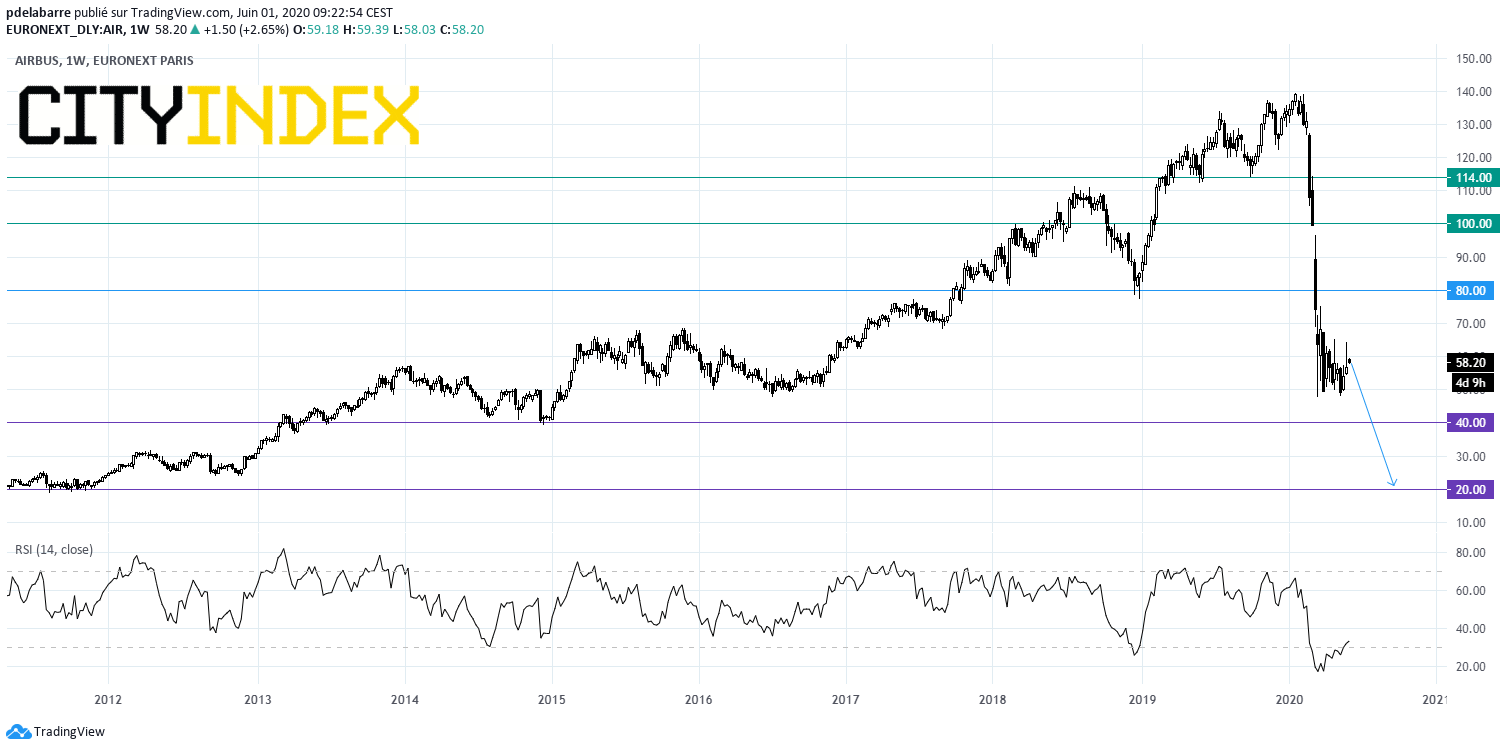

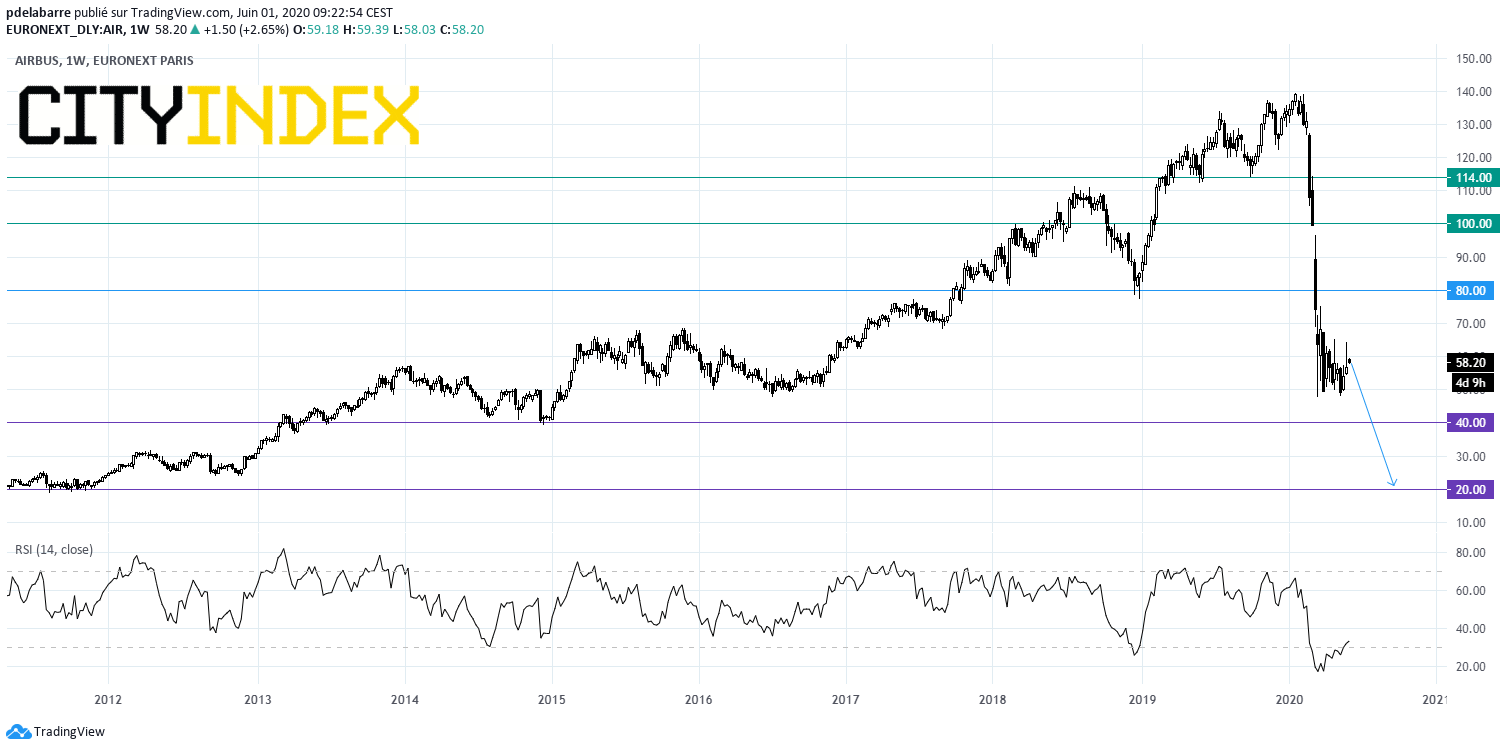

Airbus, an aircraft manufacturer, is considering extra measures to address the COVID-19 impact, including adjusting the production rates for its A320-series jet, reported Bloomberg citing people familiar with the matter. From a chartist point of view, the confirmation of a bump and reversal pattern has reversed the previous long-term bullish trend. A decline towards 40 and even 20 in extension is possible.

Source: GAIN Capital, TradingView

#SPAIN#

Siemens Gamesa, a renewable energy company, said it has received the firm order from Ailes Marines, an affiliate of Iberdrola, to supply and build the 496 MW Bay of Saint Brieuc offshore wind power plant. Financial terms were not disclosed.

#ITALY#

Mediobanca's, an Italian investment bank, shareholder and Italian billionaire Leonardo Del Vecchio has requested authorization from the European Central Bank to raise his stake in the bank to 20% from 10%, reported Bloomberg citing people familiar with the matter.

#SWITZERLAND#

Temenos, an enterprise software company, was downgraded to "hold" from "buy" at Deutsche Bank.

#SCANDINAVIA - DENMARK#

Nokia, a telecommunications group, was upgraded to "overweight" from "neutral" at JPMorgan.

AP Moller Maersk, a Danish integrated shipping company, was upgraded to "overweight" from "neutral" at JPMorgan.

Neste, a Finnish oil refining company, was downgraded to "equalweight" from "overweight" at Barclays.

EX-DIVIDEND

Legrand: E1.34

Friday, European stocks were broadly lower on Friday, with the Stoxx Europe 600 Index falling 1.4%. Germany's DAX 30 lost 1.7%, the U.K.'s FTSE 100 sank 2.3% and France's CAC 40 was down 1.6%.

EUROPE ADVANCE/DECLINE

73% of STOXX 600 constituents traded lower or unchanged Friday.

87% of the shares trade above their 20D MA vs 92% Thursday (above the 20D moving average).

34% of the shares trade above their 200D MA vs 36% Thursday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 2.12pts to 31.13, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

technology, utilities, telecommunications

Europe worst 3 sectors

travel & leisure, banks, automobiles & parts

INTEREST RATE

The 10yr Bund yield fell 1bp to -0.42% (above its 20D MA). The 2yr-10yr yield spread rose 0bp to -21bps (below its 20D MA).

ECONOMIC DATA

FR 08:50: May Markit Manufacturing PMI final, exp.: 31.5

GE 08:55: May Markit Manufacturing PMI final, exp.: 34.5

EC 09:00: May Markit Manufacturing PMI final, exp.: 33.4

UK 09:30: May Markit/CIPS Manufacturing PMI final, exp.: 32.6

FR 14:00: 6-Mth BTF auction, exp.: -0.52%

FR 14:00: 3-Mth BTF auction, exp.: -0.53%

FR 14:00: 12-Mth BTF auction, exp.: -0.52%

MORNING TRADING

In Asian trading hours, EUR/USD advanced to 1.1139 and GBP/USD rose to 1.2408. USD/JPY eased to 107.69. This morning, government data showed that Japan's first quarter capital spending increased 4.3% on year (-5.0% expected).

Spot gold climbed to $1,739 an ounce.

#UK - IRELAND#

AstraZeneca, a pharmaceutical group, said its "Brilinta (ticagrelor) has been approved in the U.S. to reduce the risk of a first heart attack or stroke in high-risk patients with coronary artery disease (CAD), the most common type of heart disease".

Associated British Foods, a food processing and retailing company, post a COVID-19 update: "As at today, Primark is trading in 112 stores which represent 34 percent of our total selling space. Primark is now working to re-open all its stores in England on 15 June, following the recent announcement by the UK Government. At that date we expect to be operating from 281 stores representing 79 percent of total selling space. We await further guidance for the stores in Northern Ireland, Wales and Scotland and anticipate openings in late June."

#GERMANY#

Deutsche Lufthansa, an airline group, would accept the German government's 9 billion euros bailout conditions, which have been agreed by the European Union, reported Bloomberg citing people familiar with the matter.

#FRANCE#

Airbus, an aircraft manufacturer, is considering extra measures to address the COVID-19 impact, including adjusting the production rates for its A320-series jet, reported Bloomberg citing people familiar with the matter. From a chartist point of view, the confirmation of a bump and reversal pattern has reversed the previous long-term bullish trend. A decline towards 40 and even 20 in extension is possible.

Source: GAIN Capital, TradingView

#SPAIN#

Siemens Gamesa, a renewable energy company, said it has received the firm order from Ailes Marines, an affiliate of Iberdrola, to supply and build the 496 MW Bay of Saint Brieuc offshore wind power plant. Financial terms were not disclosed.

#ITALY#

Mediobanca's, an Italian investment bank, shareholder and Italian billionaire Leonardo Del Vecchio has requested authorization from the European Central Bank to raise his stake in the bank to 20% from 10%, reported Bloomberg citing people familiar with the matter.

#SWITZERLAND#

Temenos, an enterprise software company, was downgraded to "hold" from "buy" at Deutsche Bank.

#SCANDINAVIA - DENMARK#

Nokia, a telecommunications group, was upgraded to "overweight" from "neutral" at JPMorgan.

AP Moller Maersk, a Danish integrated shipping company, was upgraded to "overweight" from "neutral" at JPMorgan.

Neste, a Finnish oil refining company, was downgraded to "equalweight" from "overweight" at Barclays.

EX-DIVIDEND

Legrand: E1.34

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM