EU indices strongly positive | TA focus on Ashtead Group

INDICES

Yesterday, European stocks were mostly lower, with the Stoxx Europe 600 Index easing 0.3%. Germany's DAX declined 0.3%, France's CAC dropped 0.5%, and the U.K.'s FTSE 100 was down 0.7%.

EUROPE ADVANCE/DECLINE

55% of STOXX 600 constituents traded lower or unchanged yesterday.

44% of the shares trade above their 20D MA vs 50% Friday (below the 20D moving average).

32% of the shares trade above their 200D MA vs 33% Friday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 3pts to 38.41, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

construction & materials, financial services, health care

Europe worst 3 sectors

basic resources, travel & leisure, banks

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.44% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -21bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: May Harmonised Inflation Rate MoM final, exp.: 0.4%

GE 07:00: May Harmonised Inflation Rate YoY final, exp.: 0.8%

GE 07:00: May Inflation Rate MoM final, exp.: 0.4%

GE 07:00: May Inflation Rate YoY final, exp.: 0.9%

UK 07:00: Apr Average Earnings excl. Bonus, exp.: 2.7%

UK 07:00: Apr Average Earnings incl. Bonus, exp.: 2.4%

UK 07:00: Apr Unemployment Rate, exp.: 3.9%

UK 07:00: May Claimant Count chg, exp.: 856.5K

UK 07:00: Mar Employment chg, exp.: 211K

FR 09:00: IEA Oil Market Report

EC 10:00: Q1 Labour Cost Idx YoY, exp.: 2.4%

EC 10:00: Q1 Wage Growth YoY, exp.: 2.3%

EC 10:00: Jun ZEW Economic Sentiment Idx, exp.: 46

GE 10:00: Jun ZEW Current Conditions, exp.: -93.5

GE 10:00: Jun ZEW Economic Sentiment Idx, exp.: 51

UK 10:45: 10-Year Treasury Gilt auction, exp.: 0.26%

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1329 and GBP/USD advanced further to 1.2635. USD/JPY was broadly flat at 107.33. This morning, the Bank of Japan kept its benchmark rate unchanged at -0.10% as expected, while expanding its special lending program to 110 trillion yen from 75 trillion yen.

Spot gold bounced to $1,729 an ounce.

#UK - IRELAND#

Source: GAIN Capital, TradingView

Telecom Plus, a multi-utility supplier, released full-year results: "Adjusted profit before tax increased by 8.0% to £60.8m (2019: £56.3m) on higher revenues of £875.8m (2019: £804.4m). (...) Adjusted earnings per share increased by 4.7% to 61.8p (2019: 59.0p), with statutory EPS increasing by 8.0% to 45.9p (2019: 42.5p). (...) the Board is proposing to pay a final dividend of 30p per share (2019: 27p), making a total dividend of 57p per share (2019: 52p) for the year."

#GERMANY#

Deutsche Lufthansa, an airline group, said it has informed trade unions that "prospective of personnel surplus at Lufthansa Group companies totals 22,000 full-time positions, with half of them in Germany". The company added that "reduction of overcapacities due to redundancies is to be prevented as far as possible by crisis agreements with trade unions".

Daimler, an automobile group, was upgraded to "buy" from "neutral" at Bank of America Merrill Lynch.

Volkswagen and Porsche, the two vehicle manufacturers, were downgraded to "neutral" from "buy" at Bank of America Merrill Lynch.

#FRANCE#

Remy Cointreau, a spirits company, announced that it entered into exclusive negotiations with the Lhopital family to acquire a majority stake in Champagne de Telmont company, saying: "This acquisition would enrich Remy Cointreau's portfolio of exceptional wines and spirits with a high-end champagne brand that offers significant growth potential overtime, especially on the international market." Financial terms were not disclosed.

#SWEDEN#

Volvo, a vehicle manufacturer, was upgraded to "overweight" from "neutral" at JPMorgan.

EX-DIVIDEND

Repsol: E0.39852

Yesterday, European stocks were mostly lower, with the Stoxx Europe 600 Index easing 0.3%. Germany's DAX declined 0.3%, France's CAC dropped 0.5%, and the U.K.'s FTSE 100 was down 0.7%.

EUROPE ADVANCE/DECLINE

55% of STOXX 600 constituents traded lower or unchanged yesterday.

44% of the shares trade above their 20D MA vs 50% Friday (below the 20D moving average).

32% of the shares trade above their 200D MA vs 33% Friday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 3pts to 38.41, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

construction & materials, financial services, health care

Europe worst 3 sectors

basic resources, travel & leisure, banks

INTEREST RATE

The 10yr Bund yield fell 3bps to -0.44% (below its 20D MA). The 2yr-10yr yield spread rose 2bps to -21bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: May Harmonised Inflation Rate MoM final, exp.: 0.4%

GE 07:00: May Harmonised Inflation Rate YoY final, exp.: 0.8%

GE 07:00: May Inflation Rate MoM final, exp.: 0.4%

GE 07:00: May Inflation Rate YoY final, exp.: 0.9%

UK 07:00: Apr Average Earnings excl. Bonus, exp.: 2.7%

UK 07:00: Apr Average Earnings incl. Bonus, exp.: 2.4%

UK 07:00: Apr Unemployment Rate, exp.: 3.9%

UK 07:00: May Claimant Count chg, exp.: 856.5K

UK 07:00: Mar Employment chg, exp.: 211K

FR 09:00: IEA Oil Market Report

EC 10:00: Q1 Labour Cost Idx YoY, exp.: 2.4%

EC 10:00: Q1 Wage Growth YoY, exp.: 2.3%

EC 10:00: Jun ZEW Economic Sentiment Idx, exp.: 46

GE 10:00: Jun ZEW Current Conditions, exp.: -93.5

GE 10:00: Jun ZEW Economic Sentiment Idx, exp.: 51

UK 10:45: 10-Year Treasury Gilt auction, exp.: 0.26%

MORNING TRADING

In Asian trading hours, EUR/USD held gains at 1.1329 and GBP/USD advanced further to 1.2635. USD/JPY was broadly flat at 107.33. This morning, the Bank of Japan kept its benchmark rate unchanged at -0.10% as expected, while expanding its special lending program to 110 trillion yen from 75 trillion yen.

Spot gold bounced to $1,729 an ounce.

#UK - IRELAND#

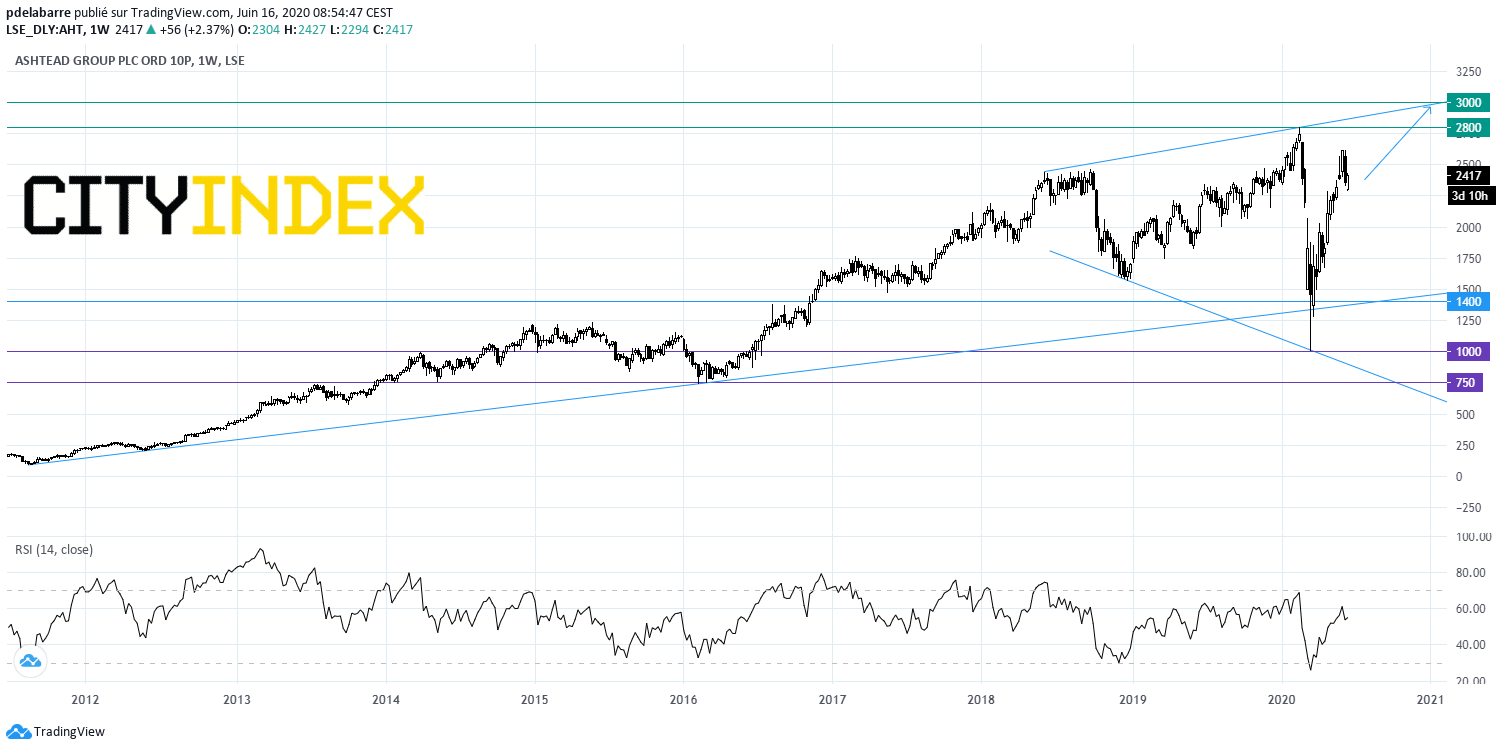

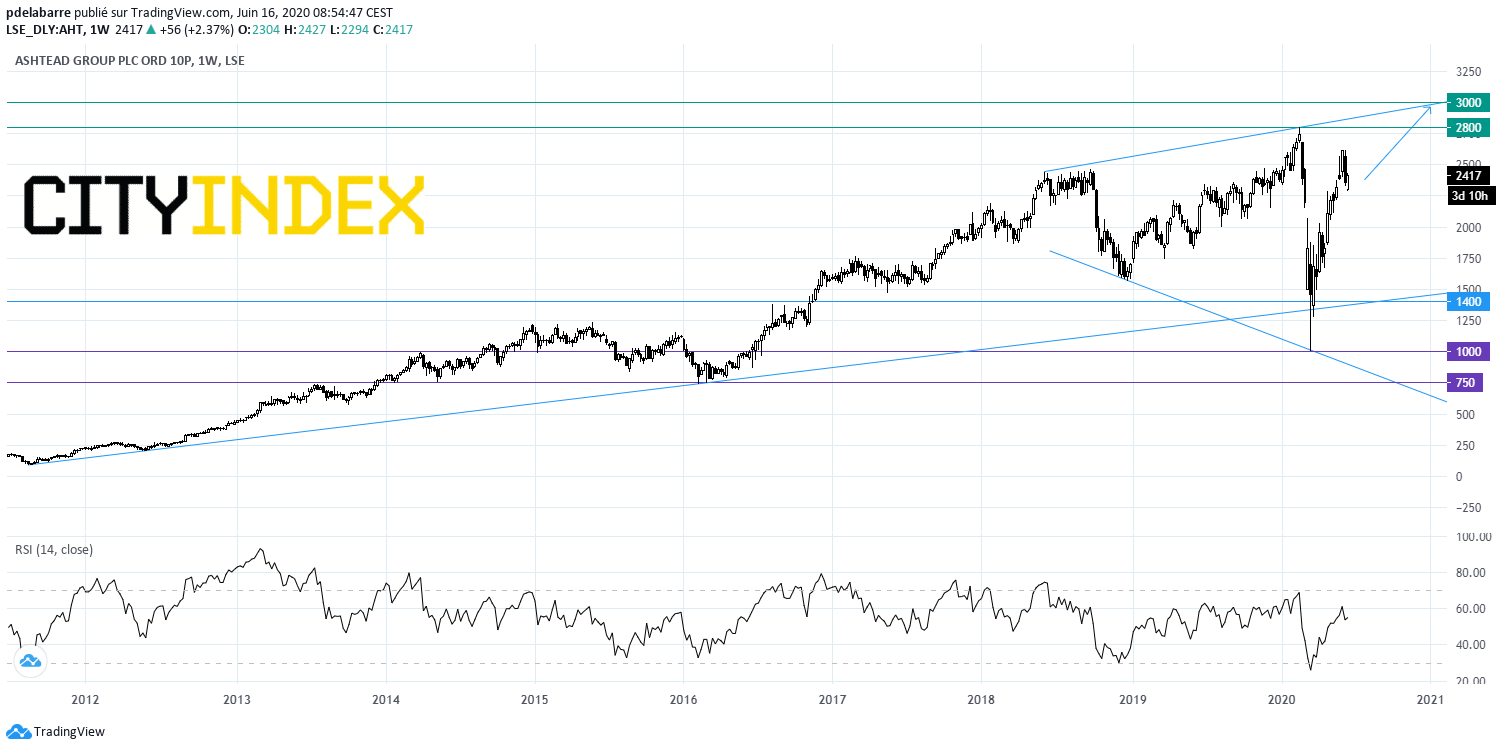

Ashtead Group, an industrial equipment rental company, posted full-year results: "Group revenue for the year increased 12% (9% at constant exchange rates) to £5,054m (2019: £4,500m) with good growth in the US and Canadian markets. (...) As a result, underlying profit before tax for the year was £1,061m (2019: £1,110m) or £1,091m excluding the impact of IFRS 16. (...) underlying earnings per share increased to 175.0p (2019: 174.2p). (...) the Board is recommending a final dividend of 33.5p per share (2019: 33.5p) making 40.65p for the year (2019: 40.0p)." From a chartist point of view, the share is aiming the upper end of a broadening formation after having bounced off a long-term rising trend line in place since 2011. Look for 3000.

Source: GAIN Capital, TradingView

Telecom Plus, a multi-utility supplier, released full-year results: "Adjusted profit before tax increased by 8.0% to £60.8m (2019: £56.3m) on higher revenues of £875.8m (2019: £804.4m). (...) Adjusted earnings per share increased by 4.7% to 61.8p (2019: 59.0p), with statutory EPS increasing by 8.0% to 45.9p (2019: 42.5p). (...) the Board is proposing to pay a final dividend of 30p per share (2019: 27p), making a total dividend of 57p per share (2019: 52p) for the year."

#GERMANY#

Deutsche Lufthansa, an airline group, said it has informed trade unions that "prospective of personnel surplus at Lufthansa Group companies totals 22,000 full-time positions, with half of them in Germany". The company added that "reduction of overcapacities due to redundancies is to be prevented as far as possible by crisis agreements with trade unions".

Daimler, an automobile group, was upgraded to "buy" from "neutral" at Bank of America Merrill Lynch.

Volkswagen and Porsche, the two vehicle manufacturers, were downgraded to "neutral" from "buy" at Bank of America Merrill Lynch.

#FRANCE#

Remy Cointreau, a spirits company, announced that it entered into exclusive negotiations with the Lhopital family to acquire a majority stake in Champagne de Telmont company, saying: "This acquisition would enrich Remy Cointreau's portfolio of exceptional wines and spirits with a high-end champagne brand that offers significant growth potential overtime, especially on the international market." Financial terms were not disclosed.

#SWEDEN#

Volvo, a vehicle manufacturer, was upgraded to "overweight" from "neutral" at JPMorgan.

EX-DIVIDEND

Repsol: E0.39852

Latest market news

Today 08:18 AM

Yesterday 10:40 PM