EU indices strongly negative this morning | TA focus on BP

INDICES

Friday, European stocks closed mixed, with the Stoxx Europe 600 Index climbing 0.3%. Both France's CAC 40 and the U.K.'s FTSE 100 rebounded 0.5%, while Germany's DAX 30 declined 0.2%.

EUROPE ADVANCE/DECLINE

61% of STOXX 600 constituents traded higher Friday.

50% of the shares trade above their 20D MA vs 49% Thursday (below the 20D moving average).

33% of the shares trade above their 200D MA vs 31% Thursday (below the 20D moving average).

The Euro Stoxx 50 Volatility index added 5.39pts to 41.41, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Basic Resources

3mths relative low: none

Europe Best 3 sectors

basic resources, real estate, automobiles & parts

Europe worst 3 sectors

financial services, health care, retail

INTEREST RATE

The 10yr Bund yield fell 8bps to -0.41% (below its 20D MA). The 2yr-10yr yield spread rose 0bp to -23bps (above its 20D MA).

ECONOMIC DATA

EC 10:00: Apr Balance of Trade, exp.: E28.2B

FR 14:00: 6-Mth BTF auction, exp.: -0.51%

FR 14:00: 3-Mth BTF auction, exp.: -0.51%

FR 14:00: 12-Mth BTF auction, exp.: -0.49%

MORNING TRADING

In Asian trading hours, EUR/USD rebounded to 1.1260 and GBP/USD bounced to 1.2520. USD/JPY retreated to 107.20. AUD/USD dropped to 0.6833. This morning, official data showed that China's industrial production grew 4.4% on year in May (+5.0% expected) while retail sales fell 2.8% (-2.3% expected).

Spot gold was flat at $1,729 an ounce.

#UK - IRELAND#

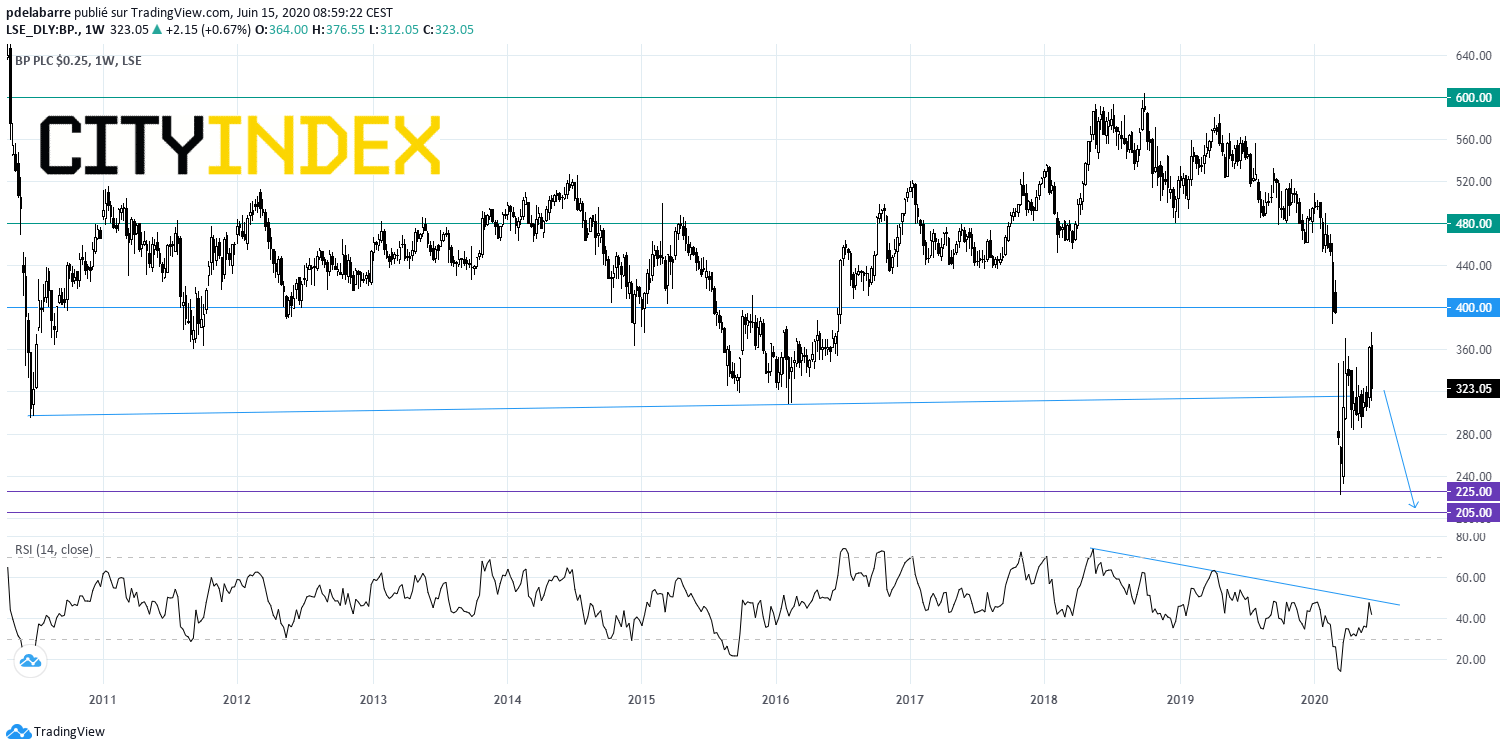

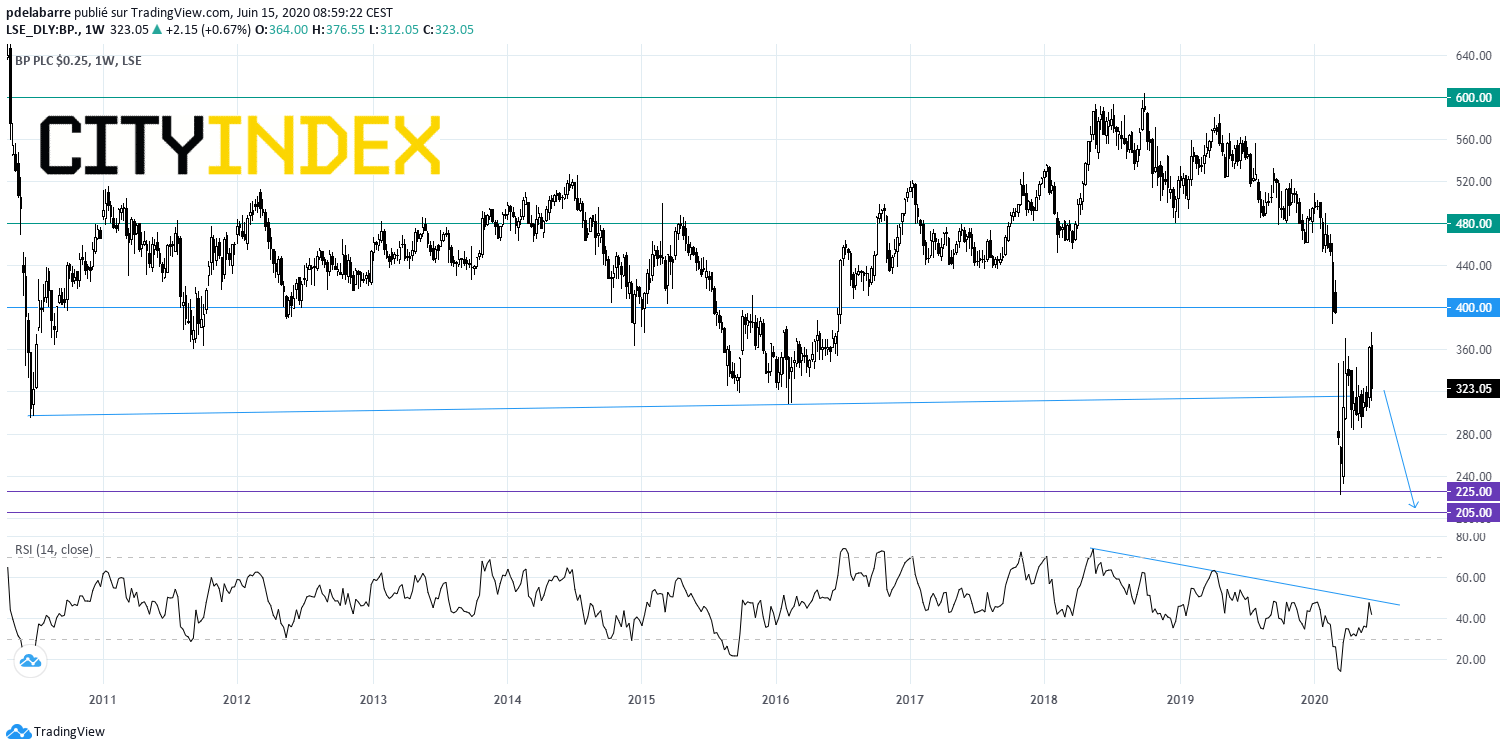

BP, an oil giant, said it now expects non-cash impairment charges and write-offs in the second quarter of 13.0 - 17.5 billion dollars post-tax, citing revision of long-term price assumptions and reviews of intangible assets. From a chartist point of view, two month ago, a long-term bearish signal has been given by breaking down - because of a bearish breakaway gap - a support line from 2010. Below 400, look for 225 and 205.

Source: GAIN Capital, TradingView

Bunzl, a distribution and outsourcing company, posted a 1H trading statement: "Revenue is expected to increase by approximately 6% at both actual and constant exchange rates. After adjusting for the impact of the number of trading days in the period relative to the prior year, at constant exchange rates revenue is expected to rise by approximately 5% (...) The Company remains cautious about the outlook given the risks and uncertainties associated with the emergence of global economies from lockdown and the timing of recovery of the Group's markets in the second half, particularly as the volume of orders for COVID-related products seen during the first half is not expected to be repeated with many customers having already built significant stocks of products for the remainder of the year."

AstraZeneca, a pharmaceutical group, announced that it has reached an agreement with Europe's Inclusive Vaccines Alliance (IVA), spearheaded by Germany, France, Italy and the Netherlands, to supply up to 400 million doses of the University of Oxford's COVID-19 vaccine, with deliveries starting by the end of 2020.

Cineworld, a cinema chain, announced that it has terminated the proposed acquisition of Canadian entertainment company Cineplex, citing certain breaches by Cineplex of the arrangement agreement relating to the acquisition.

Hammerson, a property group, announced that Robert Noel, former CEO of Land Securities Group, will succeed David Tyler as Chairman.

Diageo, an alcoholic beverages company, was downgraded to "neutral" from "outperform" at Credit Suisse.

Wizz Air, a low-cost airline, was upgraded to "buy" from "hold" at HSBC.

#GERMANY#

Commerzbank's, a banking group, Chairman Stefan Schmittmann has rejected private equity firm Cerberus Capital Management's demand for two supervisory board seats, according to Bloomberg.

Fraport, an airport operator, said Frankfurt Airport welcomed 272,826 passengers in May, down 95.6% on year, and the overall shortfall for the first five months of the year amounted to 57.2%. The company added: "This trend continued to be driven by travel restrictions and plummeting demand in connection with the COVID-19 pandemic."

#FRANCE#

BNP Paribas and Societe Generale, the two banking group, were downgraded to "underweight" from "equalweight" at Barclays.

Sodexo, a food services and facilities management company, was downgraded to "sell" from "neutral" at Goldman Sachs.

#BENELUX#

Heineken, a Dutch brewing company, was upgraded to "outperform" from "neutral" at Credit Suisse.

#ITALY#

Intesa Sanpaolo's, an Italian banking group, proposed merger with UBI Banca may be approved by Italian market regulator Consob this week, according to newspaper Il Sole 24 Ore.

#SWITZERLAND#

Novartis, a pharmaceutical group, was upgraded to "buy" from "neutral" at Citigroup.

#NORWAY#

Equinor, a Norwegian energy company, was downgraded to "sell" from "neutral" at Goldman Sachs.

EX-DIVIDEND

Telefonica: E0.162

Friday, European stocks closed mixed, with the Stoxx Europe 600 Index climbing 0.3%. Both France's CAC 40 and the U.K.'s FTSE 100 rebounded 0.5%, while Germany's DAX 30 declined 0.2%.

EUROPE ADVANCE/DECLINE

61% of STOXX 600 constituents traded higher Friday.

50% of the shares trade above their 20D MA vs 49% Thursday (below the 20D moving average).

33% of the shares trade above their 200D MA vs 31% Thursday (below the 20D moving average).

The Euro Stoxx 50 Volatility index added 5.39pts to 41.41, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Basic Resources

3mths relative low: none

Europe Best 3 sectors

basic resources, real estate, automobiles & parts

Europe worst 3 sectors

financial services, health care, retail

INTEREST RATE

The 10yr Bund yield fell 8bps to -0.41% (below its 20D MA). The 2yr-10yr yield spread rose 0bp to -23bps (above its 20D MA).

ECONOMIC DATA

EC 10:00: Apr Balance of Trade, exp.: E28.2B

FR 14:00: 6-Mth BTF auction, exp.: -0.51%

FR 14:00: 3-Mth BTF auction, exp.: -0.51%

FR 14:00: 12-Mth BTF auction, exp.: -0.49%

MORNING TRADING

In Asian trading hours, EUR/USD rebounded to 1.1260 and GBP/USD bounced to 1.2520. USD/JPY retreated to 107.20. AUD/USD dropped to 0.6833. This morning, official data showed that China's industrial production grew 4.4% on year in May (+5.0% expected) while retail sales fell 2.8% (-2.3% expected).

Spot gold was flat at $1,729 an ounce.

#UK - IRELAND#

BP, an oil giant, said it now expects non-cash impairment charges and write-offs in the second quarter of 13.0 - 17.5 billion dollars post-tax, citing revision of long-term price assumptions and reviews of intangible assets. From a chartist point of view, two month ago, a long-term bearish signal has been given by breaking down - because of a bearish breakaway gap - a support line from 2010. Below 400, look for 225 and 205.

Source: GAIN Capital, TradingView

Bunzl, a distribution and outsourcing company, posted a 1H trading statement: "Revenue is expected to increase by approximately 6% at both actual and constant exchange rates. After adjusting for the impact of the number of trading days in the period relative to the prior year, at constant exchange rates revenue is expected to rise by approximately 5% (...) The Company remains cautious about the outlook given the risks and uncertainties associated with the emergence of global economies from lockdown and the timing of recovery of the Group's markets in the second half, particularly as the volume of orders for COVID-related products seen during the first half is not expected to be repeated with many customers having already built significant stocks of products for the remainder of the year."

AstraZeneca, a pharmaceutical group, announced that it has reached an agreement with Europe's Inclusive Vaccines Alliance (IVA), spearheaded by Germany, France, Italy and the Netherlands, to supply up to 400 million doses of the University of Oxford's COVID-19 vaccine, with deliveries starting by the end of 2020.

Cineworld, a cinema chain, announced that it has terminated the proposed acquisition of Canadian entertainment company Cineplex, citing certain breaches by Cineplex of the arrangement agreement relating to the acquisition.

Hammerson, a property group, announced that Robert Noel, former CEO of Land Securities Group, will succeed David Tyler as Chairman.

Diageo, an alcoholic beverages company, was downgraded to "neutral" from "outperform" at Credit Suisse.

Wizz Air, a low-cost airline, was upgraded to "buy" from "hold" at HSBC.

#GERMANY#

Commerzbank's, a banking group, Chairman Stefan Schmittmann has rejected private equity firm Cerberus Capital Management's demand for two supervisory board seats, according to Bloomberg.

Fraport, an airport operator, said Frankfurt Airport welcomed 272,826 passengers in May, down 95.6% on year, and the overall shortfall for the first five months of the year amounted to 57.2%. The company added: "This trend continued to be driven by travel restrictions and plummeting demand in connection with the COVID-19 pandemic."

#FRANCE#

BNP Paribas and Societe Generale, the two banking group, were downgraded to "underweight" from "equalweight" at Barclays.

Sodexo, a food services and facilities management company, was downgraded to "sell" from "neutral" at Goldman Sachs.

#BENELUX#

Heineken, a Dutch brewing company, was upgraded to "outperform" from "neutral" at Credit Suisse.

#ITALY#

Intesa Sanpaolo's, an Italian banking group, proposed merger with UBI Banca may be approved by Italian market regulator Consob this week, according to newspaper Il Sole 24 Ore.

#SWITZERLAND#

Novartis, a pharmaceutical group, was upgraded to "buy" from "neutral" at Citigroup.

#NORWAY#

Equinor, a Norwegian energy company, was downgraded to "sell" from "neutral" at Goldman Sachs.

EX-DIVIDEND

Telefonica: E0.162

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM