EU indices still up this morning | TA focus on Diageo

INDICES

Yesterday, European stocks were higher, with the Stoxx Europe 600 Index adding 0.2%. Both Germany's DAX 30 and the U.K.'s FTSE 100 were up 1.3%, and France's CAC 40 charged 1.8% higher.

EUROPE ADVANCE/DECLINE

62% of STOXX 600 constituents traded higher yesterday.

84% of the shares trade above their 20D MA vs 86% Tuesday (above the 20D moving average).

31% of the shares trade above their 200D MA vs 31% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.36pt to 29.4, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

INTEREST RATE

The 10yr Bund yield rose 7bps to -0.43% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -22bps (below its 20D MA).

ECONOMIC DATA

EC 10:00: May Consumer Confidence final, exp.: -22

EC 10:00: May Industrial Sentiment, exp.: -30.4

EC 10:00: May Services Sentiment, exp.: -35

EC 10:00: May Economic Sentiment, exp.: 67

EC 10:00: May Business Confidence, exp.: -1.81

EC 10:00: May Consumer Inflation expectations, exp.: 29.1

UK 10:45: 30-Year Treasury Gilt auction, exp.: 0.61%

FR 11:00: Apr Jobseekers Total, exp.: 3488.6K

FR 11:00: Apr Unemployment Benefit Claims, exp.: 243K

GE 13:00: May Inflation Rate MoM Prel, exp.: 0.4%

GE 13:00: May Harmonised Inflation Rate YoY Prel, exp.: 0.8%

GE 13:00: May Harmonised Inflation Rate MoM Prel, exp.: 0.4%

GE 13:00: May Inflation Rate YoY Prel, exp.: 0.9%

MORNING TRADING

In Asian trading hours, EUR/USD was firm above 1.1000 level while GBP/USD was little changed at 1.2264. USD/JPY edged up to 107.84.

Spot gold rebounded to $1,713 an ounce.

#UK - IRELAND#

Rolls-Royce's, an engineering group, shareholder AKO Capital offered to sell 96.7 million shares in the company at 318p per share, according to Bloomberg.

Bodycote, a heat treatment services and thermal processes specialist, posted a trading update: "Total Group revenue for the first four months was 12% lower at £216m (down 11% at constant currency and 13% excluding the impact of acquisitions). The month of April experienced constant currency revenues 30% lower than in April last year (35% lower, excluding the impact of acquisitions). By swift and decisive action, we have significantly mitigated the impact of the revenue decline on the Group's profitability, with the Group having positive Headline Operating Profit and generating net cash in each of the first four months of the year, including April."

Stagecoach Group, a bus operators, issued a trading update: "Our available liquidity has increased significantly due to positive cash flow and new borrowing capacity. Available cash and undrawn, committed bank facilities have increased to over £800m. (...) We estimate that our adjusted earnings per share for the year ended 2 May 2020 will be between 12.5p and 14.0p. (...) Plans are in place to increase our regional bus vehicle mileage closer to pre-COVID levels in the near future, versus the current c.40% of pre-COVID levels."

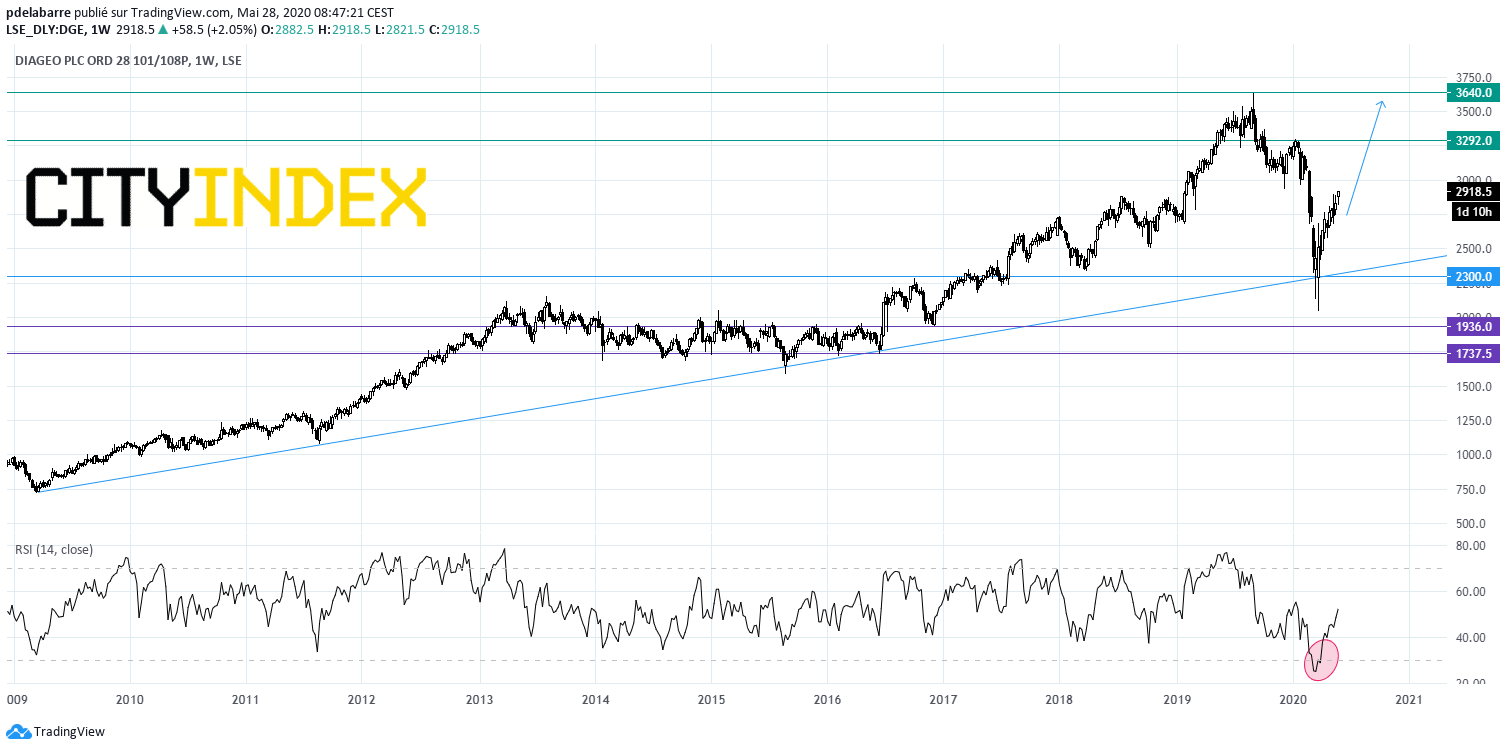

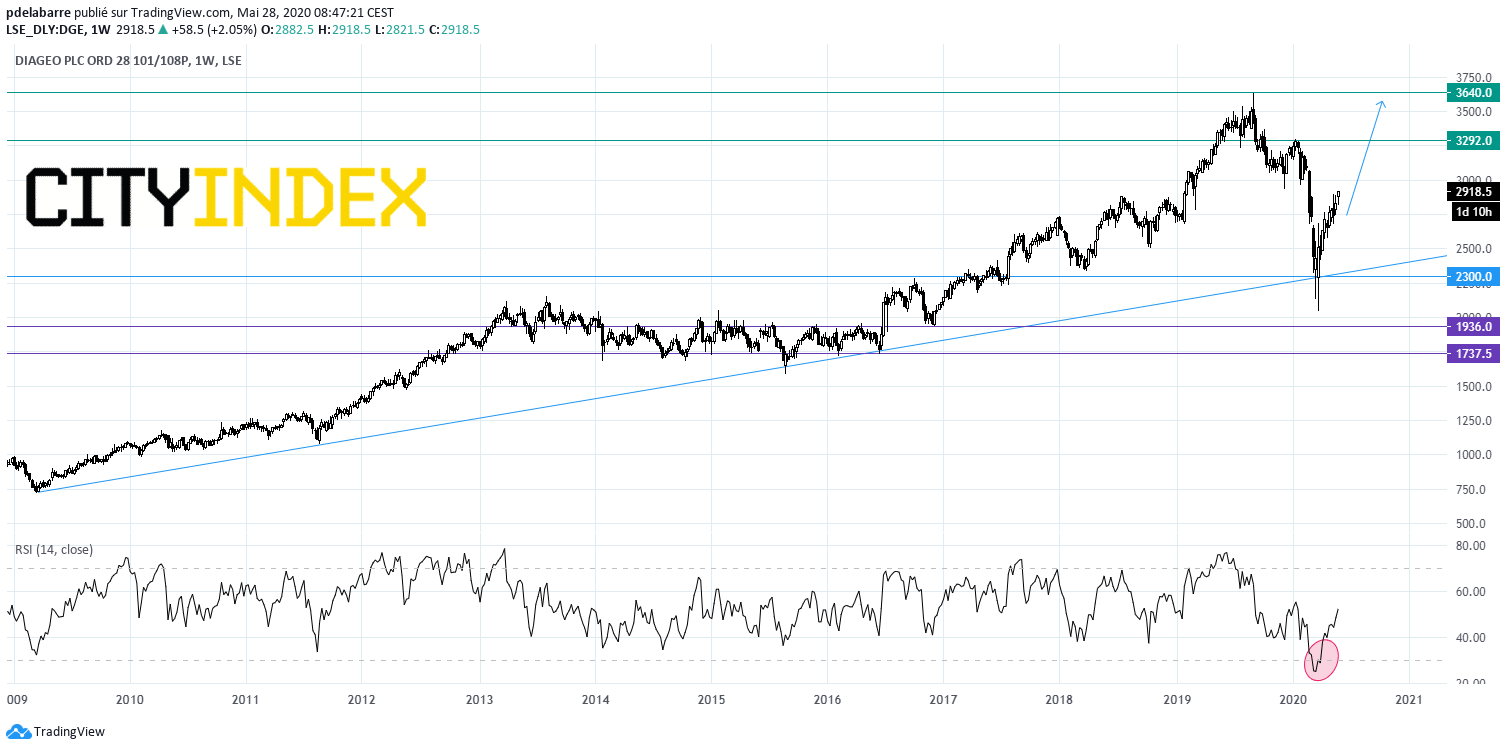

Diageo, an alcoholic beverages group, was downgraded to "neutral" from "buy" at Citigroup. From a chartist point of view, the recovery continues after the share has bounced off a long-term ascending trend line in place since 2009 and a rebound from the RSI indicator within its oversold area. Above 2300, look for 3292 & 3640p.

Source: GAIN Capital, TradingView

#PORTUGAL#

EDP, a Portuguese electric utilities company, was downgraded to "hold" from "buy" at Societe Generale.

EDP Renovaveis, a Portuguese renewable energy company, was upgraded to "buy" from "hold" at Societe Generale.

#ITALY#

Davide Campari-Milano, a branded beverage company, was downgraded to "sell" from "neutral" at Citigroup.

#SWITZERLAND#

Roche, a pharmaceutical group, reported that it has started a global phase 3 trial of Actemra/RoActemra plus remdesivir in hospitalised patients with severe COVID-19 pneumonia, in collaboration with Gilead Sciences.

EX-DIVIDEND

3I Group:17.5p, Dassault Systemes: E0.7

Yesterday, European stocks were higher, with the Stoxx Europe 600 Index adding 0.2%. Both Germany's DAX 30 and the U.K.'s FTSE 100 were up 1.3%, and France's CAC 40 charged 1.8% higher.

EUROPE ADVANCE/DECLINE

62% of STOXX 600 constituents traded higher yesterday.

84% of the shares trade above their 20D MA vs 86% Tuesday (above the 20D moving average).

31% of the shares trade above their 200D MA vs 31% Tuesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 1.36pt to 29.4, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

INTEREST RATE

The 10yr Bund yield rose 7bps to -0.43% (above its 20D MA). The 2yr-10yr yield spread fell 1bp to -22bps (below its 20D MA).

ECONOMIC DATA

EC 10:00: May Consumer Confidence final, exp.: -22

EC 10:00: May Industrial Sentiment, exp.: -30.4

EC 10:00: May Services Sentiment, exp.: -35

EC 10:00: May Economic Sentiment, exp.: 67

EC 10:00: May Business Confidence, exp.: -1.81

EC 10:00: May Consumer Inflation expectations, exp.: 29.1

UK 10:45: 30-Year Treasury Gilt auction, exp.: 0.61%

FR 11:00: Apr Jobseekers Total, exp.: 3488.6K

FR 11:00: Apr Unemployment Benefit Claims, exp.: 243K

GE 13:00: May Inflation Rate MoM Prel, exp.: 0.4%

GE 13:00: May Harmonised Inflation Rate YoY Prel, exp.: 0.8%

GE 13:00: May Harmonised Inflation Rate MoM Prel, exp.: 0.4%

GE 13:00: May Inflation Rate YoY Prel, exp.: 0.9%

MORNING TRADING

In Asian trading hours, EUR/USD was firm above 1.1000 level while GBP/USD was little changed at 1.2264. USD/JPY edged up to 107.84.

Spot gold rebounded to $1,713 an ounce.

#UK - IRELAND#

Rolls-Royce's, an engineering group, shareholder AKO Capital offered to sell 96.7 million shares in the company at 318p per share, according to Bloomberg.

Bodycote, a heat treatment services and thermal processes specialist, posted a trading update: "Total Group revenue for the first four months was 12% lower at £216m (down 11% at constant currency and 13% excluding the impact of acquisitions). The month of April experienced constant currency revenues 30% lower than in April last year (35% lower, excluding the impact of acquisitions). By swift and decisive action, we have significantly mitigated the impact of the revenue decline on the Group's profitability, with the Group having positive Headline Operating Profit and generating net cash in each of the first four months of the year, including April."

Stagecoach Group, a bus operators, issued a trading update: "Our available liquidity has increased significantly due to positive cash flow and new borrowing capacity. Available cash and undrawn, committed bank facilities have increased to over £800m. (...) We estimate that our adjusted earnings per share for the year ended 2 May 2020 will be between 12.5p and 14.0p. (...) Plans are in place to increase our regional bus vehicle mileage closer to pre-COVID levels in the near future, versus the current c.40% of pre-COVID levels."

Diageo, an alcoholic beverages group, was downgraded to "neutral" from "buy" at Citigroup. From a chartist point of view, the recovery continues after the share has bounced off a long-term ascending trend line in place since 2009 and a rebound from the RSI indicator within its oversold area. Above 2300, look for 3292 & 3640p.

Source: GAIN Capital, TradingView

#PORTUGAL#

EDP, a Portuguese electric utilities company, was downgraded to "hold" from "buy" at Societe Generale.

EDP Renovaveis, a Portuguese renewable energy company, was upgraded to "buy" from "hold" at Societe Generale.

#ITALY#

Davide Campari-Milano, a branded beverage company, was downgraded to "sell" from "neutral" at Citigroup.

#SWITZERLAND#

Roche, a pharmaceutical group, reported that it has started a global phase 3 trial of Actemra/RoActemra plus remdesivir in hospitalised patients with severe COVID-19 pneumonia, in collaboration with Gilead Sciences.

EX-DIVIDEND

3I Group:17.5p, Dassault Systemes: E0.7

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM