EU indices mixed | TA focus on Schneider Electric

INDICES

Yesterday, European stocks closed mixed. The Stoxx Europe 600 Index rebounded 0.42%, the U.K.'s FTSE 100 gained 0.40%, while France's CAC 40 declined 0.22%, and Germany's DAX 30 ended flat for a second day.

EUROPE ADVANCE/DECLINE

54% of STOXX 600 constituents traded higher yesterday.

47% of the shares trade above their 20D MA vs 46% Monday (below the 20D moving average).

49% of the shares trade above their 200D MA vs 49% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.84pt to 24.4, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Utilities

3mths relative low: Telecom., Energy

Europe Best 3 sectors

real estate, food & beverage, travel & leisure

Europe worst 3 sectors

basic resources, financial services, technology

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.49% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -18bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Jun Import Prices MoM, exp.: 0.3%

GE 07:00: Jun Import Prices YoY, exp.: -7%

FR 07:45: Jul Consumer Confidence, exp.: 97

EC 09:00: ECB Non-Monetary Policy Meeting

UK 09:30: Jun Mortgage Lending, exp.: £1.22B

UK 09:30: Jun Net Lending to Individuals MoM, exp.: £-3.4B

UK 09:30: Jun BoE Consumer Credit, exp.: £-4.597B

UK 09:30: Jun Mortgage Approvals, exp.: 9.3K

MORNING TRADING

In Asian trading hours, spot gold traded at $1,953 an ounce lacking momentum for pushing higher. EUR/USD traded higher at 1.1730, while GBP/USD edged lower to 1.2922. USD/JPY kept struggling to keep the 105.00 level. AUD/USD remained elevated at 0.7166.

#UK - IRELAND#

Barclays, a British banking group, issued 1H results: "Despite the impacts of the COVID-19 pandemic, Barclays delivered a H120 Group profit before tax of 1.3 billion pounds (H119: 3.0 billion pounds), resulting in a return on tangible equity (RoTE) of 2.9% (H119: 9.1%) and earnings per share (EPS) of 4.0 pence (H119: 12.1 pence). Pre-provision profits (profit before tax excluding credit impairment charges) increased 27% to 5.0 billion pounds, while credit impairment charges increased to 3.7 billion pounds (H119: 0.9 billion pounds)."

Glaxosmithkline, a global healthcare company, announced that it and Sanofi have reached an agreement with the U.K. government for the supply of up to 60 million doses of a COVID-19 vaccine. The Company added: "The vaccine candidate, developed by Sanofi in partnership with GSK, is based on the recombinant protein-based technology used by Sanofi to produce an influenza vaccine, and GSK's established pandemic adjuvant technology.

Smith & Nephew, an advanced medical devices firm, reported 1H results: "Our first half revenue was 2,035 million dollars (H1 2019: 2,485 million dollars), down 18.1% on a reported growth basis (...) Trading profit was 172 million dollars in the first half (H1 2019: 532 million dollars). The trading profit margin, at 8.5% (H1 2019: 21.4%), was down significantly year-on year as previously guided. (...) Adjusted earnings per share was 13.4 cents (H1 2019: 45.8 cents per share). (...) The interim dividend is 14.4 cents per share, in line with 2019."

#GERMANY#

Deutsche Bank, a German bank, posted a 2Q profit of 61 million euros, compared to a loss of 3.15 billion euros in the prior-year period. The Bank said it set aside 761 million euros in provisions to cover credit losses. The Bank's CEO said: "In a challenging environment we grew revenues and continued to reduce costs, and we're fully on track to meet all our targets."

BASF, a chemical company, said it swung to a 2Q net loss of 878 million euros from a profit of 5.95 billion in the prior-year period which was then boosted by the spin-off of its Wintershall oil-and-gas unit. 2Q sales declined to 12.68 billion euros from 14.48 billion euros last year.

Deutsche Boerse: 2Q results expected

#FRANCE#

Sanofi, a pharmaceutical firm, reported that 2Q Business EPS increased 3.2% to 1.28 euro and Business net income was up 3.6% to 1.60 billion euros on net sales of 8.21 billion euros, down 4.9% (-3.4% at constant exchange rates). On the outlook it said: "Sanofi now expects 2020 business EPS to grow between 6% and 7% at CER."

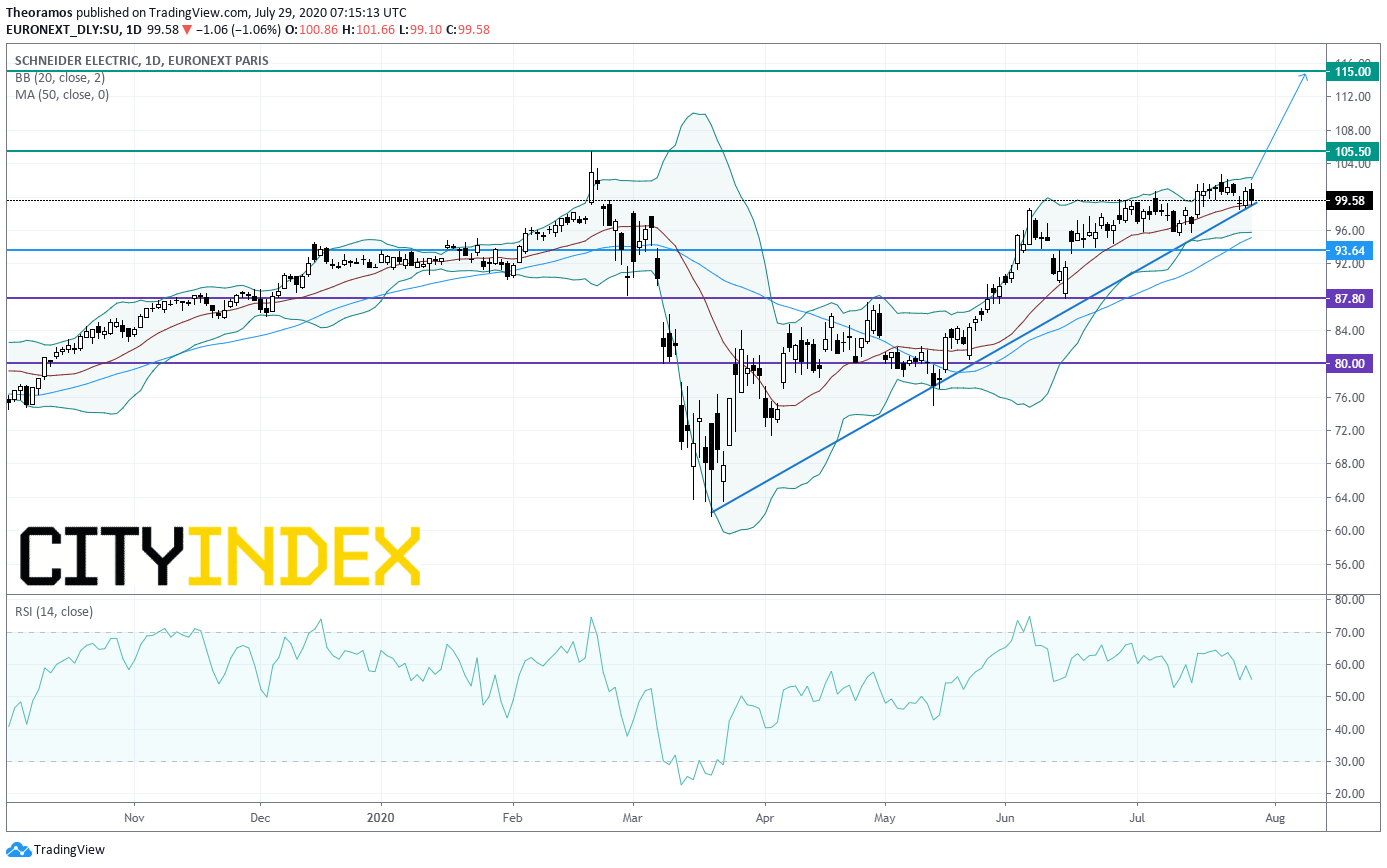

Schneider Electric, which makes electrical power products, announced that 1H net income declined 22% on year to 775 million euros and Adjusted EBITA were down 19.6% to 1.58 billion euros on revenue of 11.58 billion euros, down 12.3% (-10.5% organic decline). The Co said: "The Group sets targets for 2020 as follows: Revenue expected to be between -7% to -10% organic (...) Adjusted EBITA margin between 14.5% to 15.0% (including scope and FX based on current estimation)."

From a chartist point of view, the stock price is supported by a rising trend line drawn since March. The share is trading above of its rising 20 and 50 DMAs. Above 93.64E look for the previous all-time high at 105.5E and 115E in extension.

Source: GAIN Capital, TradingView

Teleperformance, 1H results expected

#SPAIN#

Santander, a Spanish bank, posted a first-half net loss of 10.8 billion euros, compared to a net income of 3.2 billion euros in the prior-year period, citing impairments caused by the coronavirus pandemic.

#BENELUX#

Vopak, a Dutch tank-storage firm, reported that 2Q net income rose to 116 million euros from 106 million euros in the prior-year period on revenue of 292 million euros, down 7.7% on year.

#ITALY#

Salvatore Ferragamo, a clothing and accessories company, reported that 1H revenue plunged 46.9% on year (at constant exchange rates) to 377 million euros.

Snam: 2Q results expected.

Enel: 1H results expected.

#SWITZERLAND#

Roche, a Swiss drug maker, reported that a Phase 3 study on Actemra/RoActemra (tocilizumab) did not meet its primary endpoint of improved clinical status in hospitalized adult patients with severe Covid-19 associated pneumonia.

Yesterday, European stocks closed mixed. The Stoxx Europe 600 Index rebounded 0.42%, the U.K.'s FTSE 100 gained 0.40%, while France's CAC 40 declined 0.22%, and Germany's DAX 30 ended flat for a second day.

EUROPE ADVANCE/DECLINE

54% of STOXX 600 constituents traded higher yesterday.

47% of the shares trade above their 20D MA vs 46% Monday (below the 20D moving average).

49% of the shares trade above their 200D MA vs 49% Monday (above the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.84pt to 24.4, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Utilities

3mths relative low: Telecom., Energy

Europe Best 3 sectors

real estate, food & beverage, travel & leisure

Europe worst 3 sectors

basic resources, financial services, technology

INTEREST RATE

The 10yr Bund yield fell 4bps to -0.49% (below its 20D MA). The 2yr-10yr yield spread fell 0bp to -18bps (above its 20D MA).

ECONOMIC DATA

GE 07:00: Jun Import Prices MoM, exp.: 0.3%

GE 07:00: Jun Import Prices YoY, exp.: -7%

FR 07:45: Jul Consumer Confidence, exp.: 97

EC 09:00: ECB Non-Monetary Policy Meeting

UK 09:30: Jun Mortgage Lending, exp.: £1.22B

UK 09:30: Jun Net Lending to Individuals MoM, exp.: £-3.4B

UK 09:30: Jun BoE Consumer Credit, exp.: £-4.597B

UK 09:30: Jun Mortgage Approvals, exp.: 9.3K

MORNING TRADING

In Asian trading hours, spot gold traded at $1,953 an ounce lacking momentum for pushing higher. EUR/USD traded higher at 1.1730, while GBP/USD edged lower to 1.2922. USD/JPY kept struggling to keep the 105.00 level. AUD/USD remained elevated at 0.7166.

#UK - IRELAND#

Barclays, a British banking group, issued 1H results: "Despite the impacts of the COVID-19 pandemic, Barclays delivered a H120 Group profit before tax of 1.3 billion pounds (H119: 3.0 billion pounds), resulting in a return on tangible equity (RoTE) of 2.9% (H119: 9.1%) and earnings per share (EPS) of 4.0 pence (H119: 12.1 pence). Pre-provision profits (profit before tax excluding credit impairment charges) increased 27% to 5.0 billion pounds, while credit impairment charges increased to 3.7 billion pounds (H119: 0.9 billion pounds)."

Glaxosmithkline, a global healthcare company, announced that it and Sanofi have reached an agreement with the U.K. government for the supply of up to 60 million doses of a COVID-19 vaccine. The Company added: "The vaccine candidate, developed by Sanofi in partnership with GSK, is based on the recombinant protein-based technology used by Sanofi to produce an influenza vaccine, and GSK's established pandemic adjuvant technology.

Smith & Nephew, an advanced medical devices firm, reported 1H results: "Our first half revenue was 2,035 million dollars (H1 2019: 2,485 million dollars), down 18.1% on a reported growth basis (...) Trading profit was 172 million dollars in the first half (H1 2019: 532 million dollars). The trading profit margin, at 8.5% (H1 2019: 21.4%), was down significantly year-on year as previously guided. (...) Adjusted earnings per share was 13.4 cents (H1 2019: 45.8 cents per share). (...) The interim dividend is 14.4 cents per share, in line with 2019."

#GERMANY#

Deutsche Bank, a German bank, posted a 2Q profit of 61 million euros, compared to a loss of 3.15 billion euros in the prior-year period. The Bank said it set aside 761 million euros in provisions to cover credit losses. The Bank's CEO said: "In a challenging environment we grew revenues and continued to reduce costs, and we're fully on track to meet all our targets."

BASF, a chemical company, said it swung to a 2Q net loss of 878 million euros from a profit of 5.95 billion in the prior-year period which was then boosted by the spin-off of its Wintershall oil-and-gas unit. 2Q sales declined to 12.68 billion euros from 14.48 billion euros last year.

Deutsche Boerse: 2Q results expected

#FRANCE#

Sanofi, a pharmaceutical firm, reported that 2Q Business EPS increased 3.2% to 1.28 euro and Business net income was up 3.6% to 1.60 billion euros on net sales of 8.21 billion euros, down 4.9% (-3.4% at constant exchange rates). On the outlook it said: "Sanofi now expects 2020 business EPS to grow between 6% and 7% at CER."

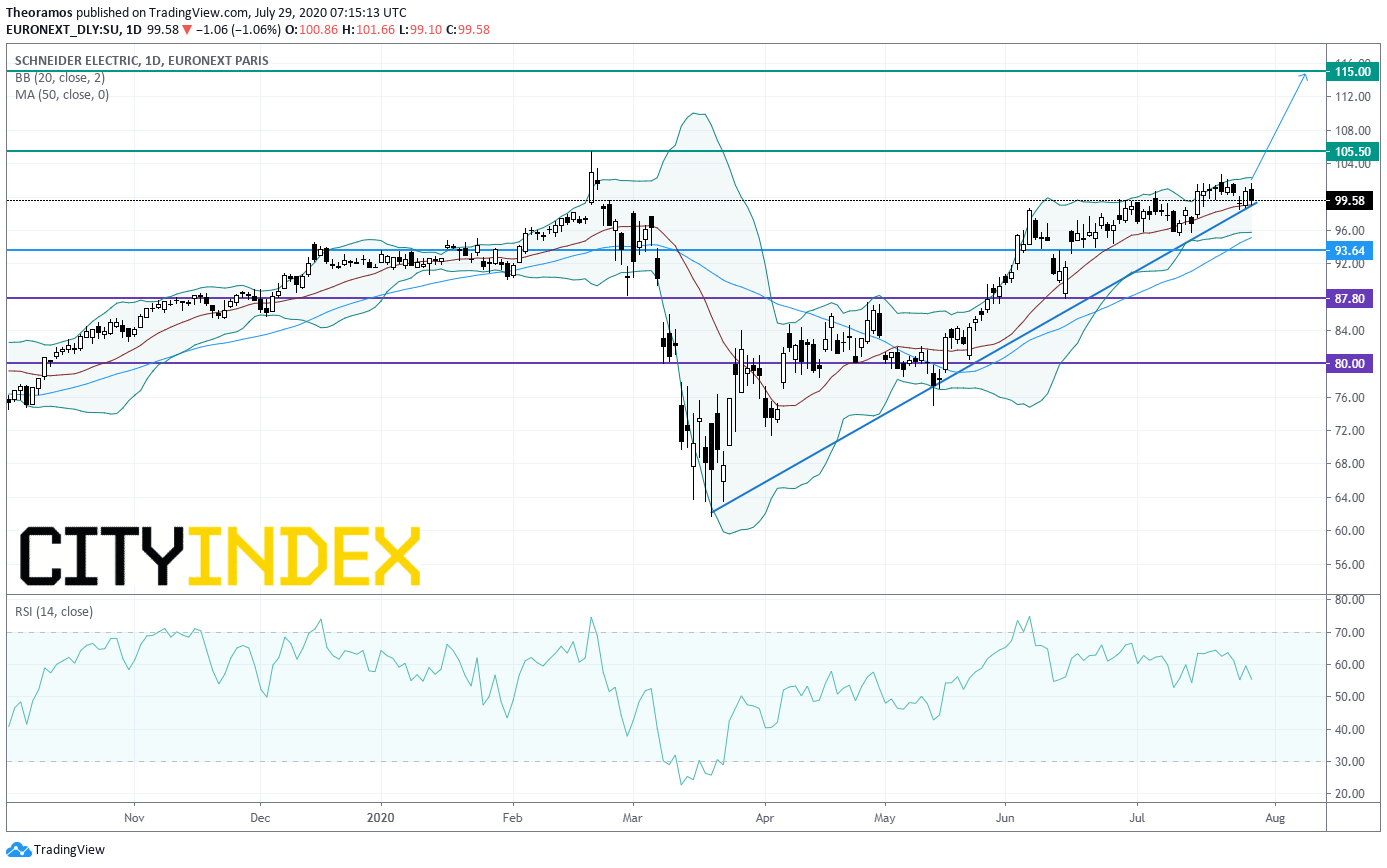

Schneider Electric, which makes electrical power products, announced that 1H net income declined 22% on year to 775 million euros and Adjusted EBITA were down 19.6% to 1.58 billion euros on revenue of 11.58 billion euros, down 12.3% (-10.5% organic decline). The Co said: "The Group sets targets for 2020 as follows: Revenue expected to be between -7% to -10% organic (...) Adjusted EBITA margin between 14.5% to 15.0% (including scope and FX based on current estimation)."

From a chartist point of view, the stock price is supported by a rising trend line drawn since March. The share is trading above of its rising 20 and 50 DMAs. Above 93.64E look for the previous all-time high at 105.5E and 115E in extension.

Source: GAIN Capital, TradingView

Teleperformance, 1H results expected

#SPAIN#

Santander, a Spanish bank, posted a first-half net loss of 10.8 billion euros, compared to a net income of 3.2 billion euros in the prior-year period, citing impairments caused by the coronavirus pandemic.

#BENELUX#

Vopak, a Dutch tank-storage firm, reported that 2Q net income rose to 116 million euros from 106 million euros in the prior-year period on revenue of 292 million euros, down 7.7% on year.

#ITALY#

Salvatore Ferragamo, a clothing and accessories company, reported that 1H revenue plunged 46.9% on year (at constant exchange rates) to 377 million euros.

Snam: 2Q results expected.

Enel: 1H results expected.

#SWITZERLAND#

Roche, a Swiss drug maker, reported that a Phase 3 study on Actemra/RoActemra (tocilizumab) did not meet its primary endpoint of improved clinical status in hospitalized adult patients with severe Covid-19 associated pneumonia.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM