EU indices still down this morning | TA focus on Heineken

INDICES

Yesterday, European stocks declined, with the Stoxx Europe 600 Index dropping 0.8%. Germany's DAX 30 lost 1.4%, the U.K.'s FTSE 100 declined 0.9% and France's CAC 40 was down 1.2%.

EUROPE ADVANCE/DECLINE

77% of STOXX 600 constituents traded lower or unchanged yesterday.

60% of the shares trade above their 20D MA vs 68% Wednesday (above the 20D moving average).

25% of the shares trade above their 200D MA vs 28% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 3.21pts to 32.32, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

telecommunications, retail, utilities

Europe worst 3 sectors

banks, technology, energy

INTEREST RATE

The 10yr Bund yield was unchanged to -0.47% (above its 20D MA). The 2yr-10yr yield spread rose 1bp to -20bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Apr Public Sector Net Borrowing, exp.: £-2.33B

UK 07:00: Apr Retail Sales ex Fuel MoM, exp.: -3.7%

UK 07:00: Apr Retail Sales ex Fuel YoY, exp.: -4.1%

UK 07:00: Apr Retail Sales YoY, exp.: -5.8%

UK 07:00: Apr Retail Sales MoM, exp.: -5.1%

EC 12:30: ECB Monetary Policy Meeting Accounts

EC 15:30: ECB Lane speech

MORNING TRADING

In Asian trading hours, EUR/USD fell further to 1.0941 and GBP/USD edged down to 1.2218. USD/JPY was little changed at 107.60. This morning, the Bank of Japan announced plans to start a new 75 trillion yen lending program in June, to support coronavirus-hit businesses, while keeping its benchmark rate at -0.1% and 10-year government bond yield target at about 0% unchanged. Also, official data showed that Japan's core CPI dipped 0.2% on year in April (-0.1% expected), the fist decline in more than three years.

Spot gold rebounded slightly to $1,726 an ounce.

#UK - IRELAND#

United Utilities, a water company, reported full-year results: "Revenue was up £41 million, at £1,859 million, largely reflecting our allowed regulatory revenue changes. (...) Underlying operating profit was up £59 million, at £744 million. (...) Underlying profit after tax was up by £22 million, at £430 million, (...) the board has proposed a final dividend of 28.40 pence per ordinary share (taking the total dividend for 2019/20 to 42.60 pence), an increase of 3.2 per cent, (...) The economic implications of COVID-19 will provide a challenging backdrop to the AMP7 regulatory period. (...) It is, however, too early to predict the full impact of COVID-19 on inflation, the economy more generally and on our business."

Vodafone Group, a technology communications provider, announced that Jean-Francois Van Boxmeer, currently CEO of Heineken, will succeed Gerard Kleisterlee as Chairman on November 3.

Hikma Pharmaceuticals, a drug maker, said it has received approval from the U.S. Food and Drug Administration for its Icosapent Ethyl Capsules, the generic equivalent to Vascepa.

AstraZeneca, a drug maker, and Daiichi Sankyo Co said their antibody drug conjugate Enhertu (trastuzumab deruxtecan) has been granted Orphan Drug Designation (ODD) in the U.S. for the treatment of patients with gastric cancer.

Spectris, a supplier of precision instrumentation and controls, posted a trading update: "While sales in China recovered strongly in April, activity in Europe and North America slowed sharply, resulting in a 12% like-for-like sales decline (-20% in reported terms) for the Group in the first four months of the year."

ITV, a media group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#BENELUX#

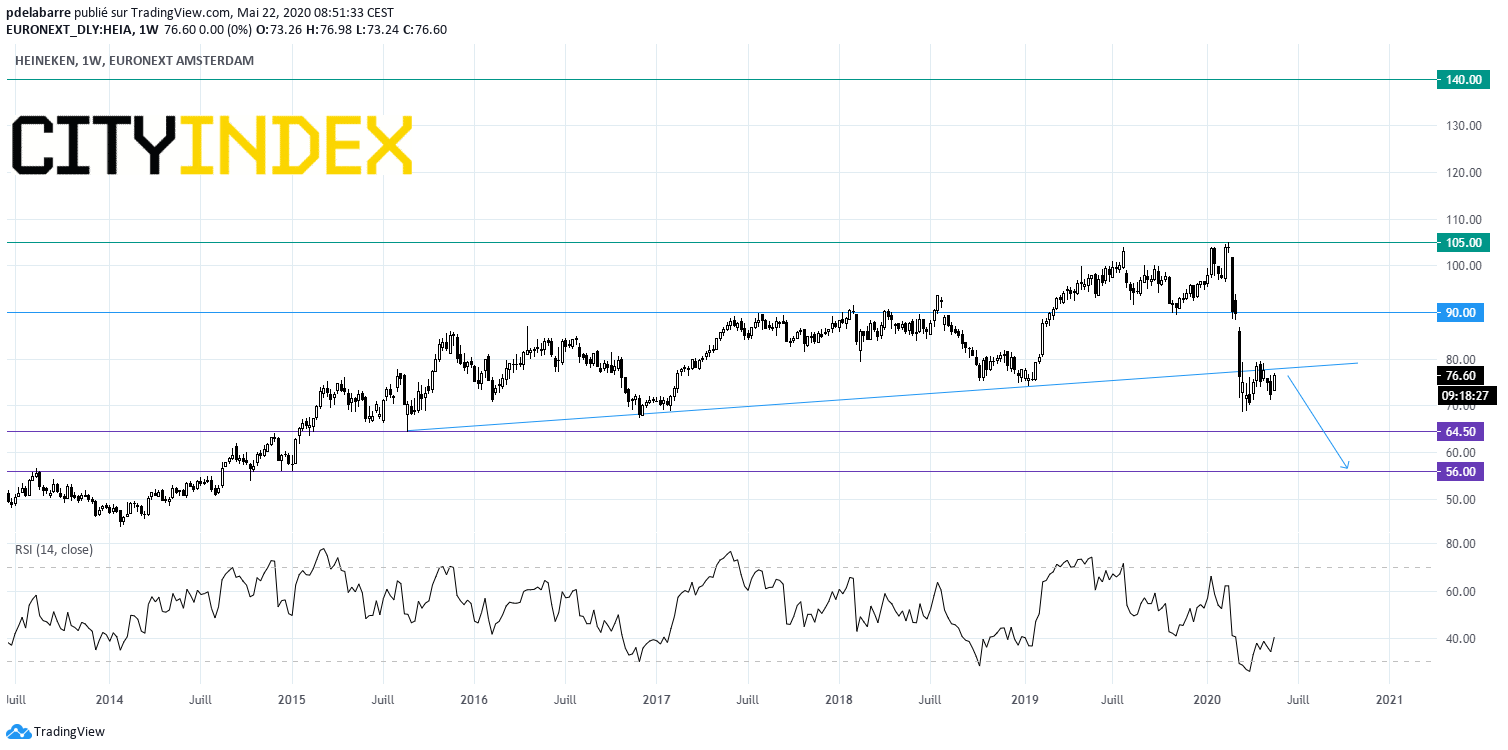

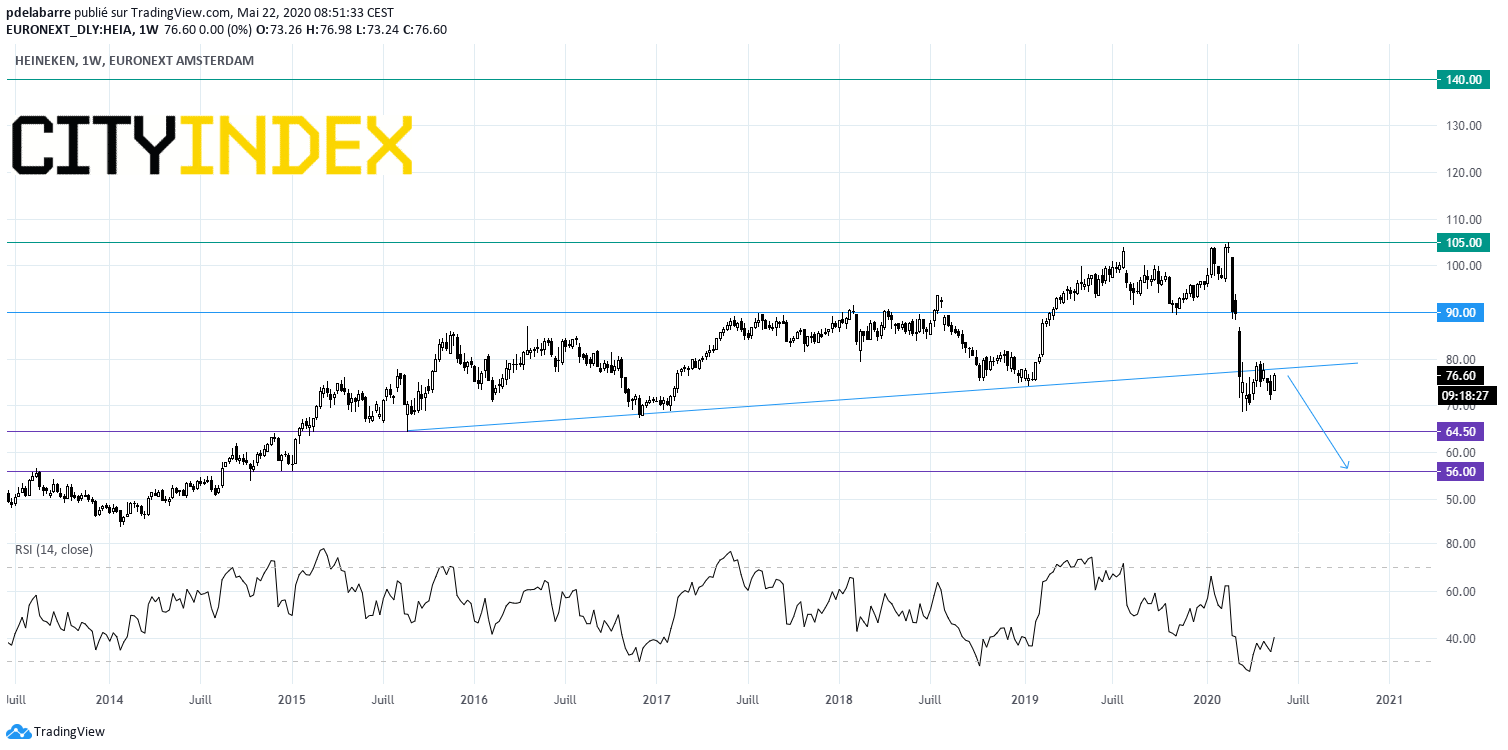

Heineken's, one of the world largest brewer, CEO Jean-Francois Van Boxmeer will leave his position in June to join British telecommunications group Vodafone, according to a statement released by the latter. From a chartist point of view, the share has broken down a support ascending trend line in place since mid 2015 and therefore now aims 64.5 and then 56 euros.

Source: GAIN Capital, TradingView

Altice Europe, a telecommunications group, was upgraded to "buy" from "hold" at HSBC.

#SWEDEN#

Securitas, a Swedish security company, was upgraded to "overweight" from "underweight" at JPMorgan.

Yesterday, European stocks declined, with the Stoxx Europe 600 Index dropping 0.8%. Germany's DAX 30 lost 1.4%, the U.K.'s FTSE 100 declined 0.9% and France's CAC 40 was down 1.2%.

EUROPE ADVANCE/DECLINE

77% of STOXX 600 constituents traded lower or unchanged yesterday.

60% of the shares trade above their 20D MA vs 68% Wednesday (above the 20D moving average).

25% of the shares trade above their 200D MA vs 28% Wednesday (above the 20D moving average).

The Euro Stoxx 50 Volatility index added 3.21pts to 32.32, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: none

3mths relative low: none

Europe Best 3 sectors

telecommunications, retail, utilities

Europe worst 3 sectors

banks, technology, energy

INTEREST RATE

The 10yr Bund yield was unchanged to -0.47% (above its 20D MA). The 2yr-10yr yield spread rose 1bp to -20bps (above its 20D MA).

ECONOMIC DATA

UK 07:00: Apr Public Sector Net Borrowing, exp.: £-2.33B

UK 07:00: Apr Retail Sales ex Fuel MoM, exp.: -3.7%

UK 07:00: Apr Retail Sales ex Fuel YoY, exp.: -4.1%

UK 07:00: Apr Retail Sales YoY, exp.: -5.8%

UK 07:00: Apr Retail Sales MoM, exp.: -5.1%

EC 12:30: ECB Monetary Policy Meeting Accounts

EC 15:30: ECB Lane speech

MORNING TRADING

In Asian trading hours, EUR/USD fell further to 1.0941 and GBP/USD edged down to 1.2218. USD/JPY was little changed at 107.60. This morning, the Bank of Japan announced plans to start a new 75 trillion yen lending program in June, to support coronavirus-hit businesses, while keeping its benchmark rate at -0.1% and 10-year government bond yield target at about 0% unchanged. Also, official data showed that Japan's core CPI dipped 0.2% on year in April (-0.1% expected), the fist decline in more than three years.

Spot gold rebounded slightly to $1,726 an ounce.

#UK - IRELAND#

United Utilities, a water company, reported full-year results: "Revenue was up £41 million, at £1,859 million, largely reflecting our allowed regulatory revenue changes. (...) Underlying operating profit was up £59 million, at £744 million. (...) Underlying profit after tax was up by £22 million, at £430 million, (...) the board has proposed a final dividend of 28.40 pence per ordinary share (taking the total dividend for 2019/20 to 42.60 pence), an increase of 3.2 per cent, (...) The economic implications of COVID-19 will provide a challenging backdrop to the AMP7 regulatory period. (...) It is, however, too early to predict the full impact of COVID-19 on inflation, the economy more generally and on our business."

Vodafone Group, a technology communications provider, announced that Jean-Francois Van Boxmeer, currently CEO of Heineken, will succeed Gerard Kleisterlee as Chairman on November 3.

Hikma Pharmaceuticals, a drug maker, said it has received approval from the U.S. Food and Drug Administration for its Icosapent Ethyl Capsules, the generic equivalent to Vascepa.

AstraZeneca, a drug maker, and Daiichi Sankyo Co said their antibody drug conjugate Enhertu (trastuzumab deruxtecan) has been granted Orphan Drug Designation (ODD) in the U.S. for the treatment of patients with gastric cancer.

Spectris, a supplier of precision instrumentation and controls, posted a trading update: "While sales in China recovered strongly in April, activity in Europe and North America slowed sharply, resulting in a 12% like-for-like sales decline (-20% in reported terms) for the Group in the first four months of the year."

ITV, a media group, was upgraded to "buy" from "neutral" at Goldman Sachs.

#BENELUX#

Heineken's, one of the world largest brewer, CEO Jean-Francois Van Boxmeer will leave his position in June to join British telecommunications group Vodafone, according to a statement released by the latter. From a chartist point of view, the share has broken down a support ascending trend line in place since mid 2015 and therefore now aims 64.5 and then 56 euros.

Source: GAIN Capital, TradingView

Altice Europe, a telecommunications group, was upgraded to "buy" from "hold" at HSBC.

#SWEDEN#

Securitas, a Swedish security company, was upgraded to "overweight" from "underweight" at JPMorgan.

Latest market news

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM